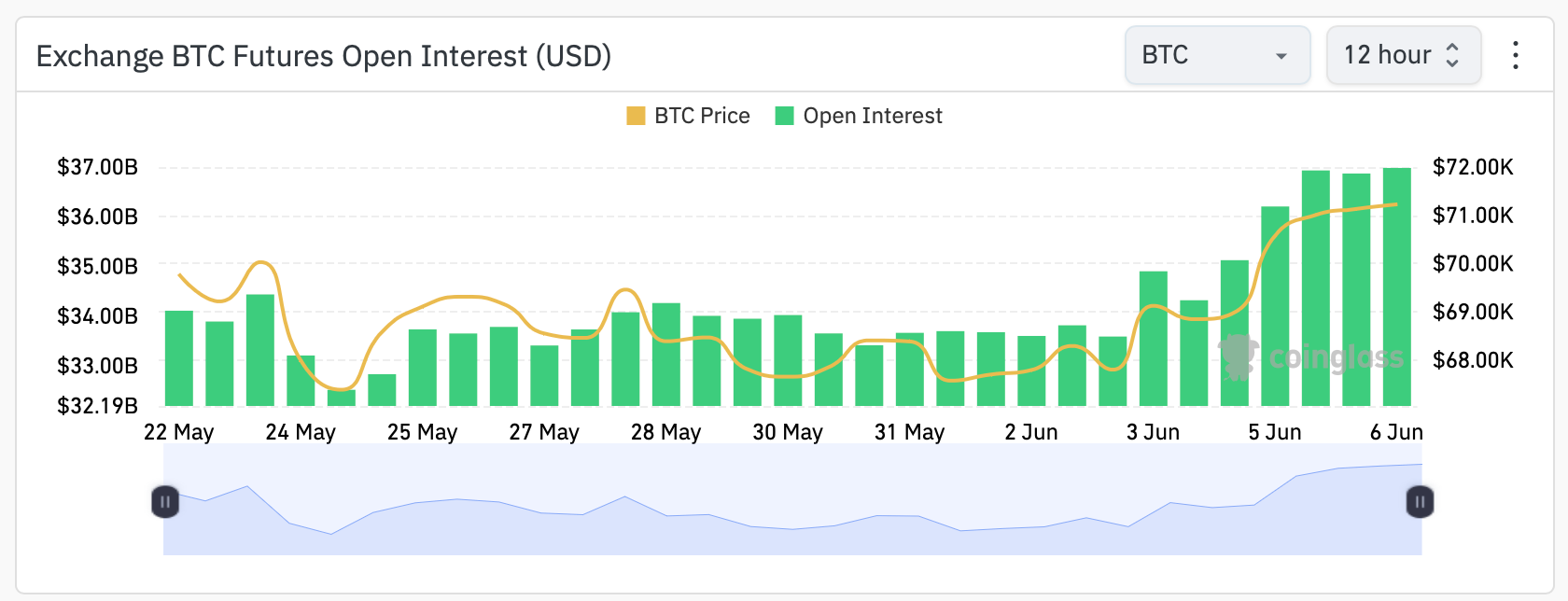

The recent increase in Bitcoin‘s open interest (OI) has caught the attention of cryptocurrency traders. This situation has significant implications for the market. According to CoinGlass data, Bitcoin’s OI increased by $2.02 billion in just three days. As of June 6, it reached $36.92 billion. This rapid rise indicates a phase where a sudden price increase contrary to the current trend could occur, leading to quick losses.

Warning About a Sudden Price Correction

One cryptocurrency trader, Daan Crypto Trades, highlighted this notable increase in a recent post, emphasizing the importance of understanding OI. Open Interest represents the total number of outstanding derivative contracts, such as options or futures, that have not yet been settled. An increase in OI indicates that more investors are speculating on Bitcoin’s price movements, which can lead to increased market volatility.

Kelly Kellam, director of BitLab Academy, provided more insights into the potential consequences of this OI increase. Kellam pointed out that the combination of rising OI and positive funding rates suggests a higher likelihood of a whipsaw effect. This phenomenon could lead to a sudden price correction as investors with leveraged long positions may need to quickly adjust their strategies.

The Meaning of Open Interest

The rise of OI to $36.92 billion is not just a numerical milestone. It also signifies increased market activity and speculation. This situation can amplify price fluctuations, especially if traders decide to change their positions simultaneously. Such shifts can have a cascading effect, impacting overall market sentiment and potentially triggering significant price movements.

Despite the positive market sentiment evidenced by Bitcoin’s price climbing to $70,890 and a 4.23% increase over the past week, there are concerns about the stability of these gains. Bitcoin also increased by 10.42% in the past month, but traders remain cautious.

Analyst Jelle warned that a sharp drop of around 4% in Bitcoin’s price to $68,000 could lead to the liquidation of approximately $1.96 billion in short long positions.

The potential for significant losses is a critical concern for traders. Such an event could lead to sudden and substantial price fluctuations and challenge the strategies of those using high leverage. Although there is confidence that Bitcoin may soon enter a price discovery phase, this path is expected to be marked by significant volatility.

Türkçe

Türkçe Español

Español