According to a report published by the cryptocurrency exchange Bybit, institutional investments in meme coins have seen a significant increase this year. This trend was reflected in the institutional investment figures for these cryptocurrencies. The amount, which was $63 million at the beginning of the year, peaked at approximately $300 million in April. The nearly 4.5x growth indicated a growing interest in the meme coin sector among professional investors.

Which Meme Coins Received Investments?

Dogecoin (DOGE) and Shiba Inu (SHIB) were the primary beneficiaries of this institutional capital influx. Their popularity among institutional investors largely stemmed from their high liquidity in the spot market. This liquidity made these coins more attractive for significant investments as they could be bought and sold in large quantities without significantly affecting market prices.

The assets tracked by Bybit were based on their own exchange figures, so they did not account for meme coin assets on other platforms.

One of the altcoins that institutional investors turned to in the meme coin market was BONK. BONK attracted over $75 million in institutional investment, positioning itself as the most preferred new meme coin this year. This indicated an increasing diversity in meme coin investments as new tokens continued to emerge and attract interest among investors.

Decrease in May

However, in May, this trend saw a slight reversal as institutional holdings in meme coins almost halved to $125 million. This decrease was attributed to profit-taking activities by the institutional investors. Despite this drop, the significant growth at the beginning of the year showed that the overall interest in meme coins remained strong.

Interestingly, during this period, there was a noticeable shift in institutional orientation towards other cryptocurrencies. Stablecoin holdings among institutions fell from $1.7 billion to $1.4 billion. In contrast, there was an increase in investments in Bitcoin (BTC), Ethereum (ETH), and meme coins. This indicated that institutional investors were strategically readjusting their crypto portfolios.

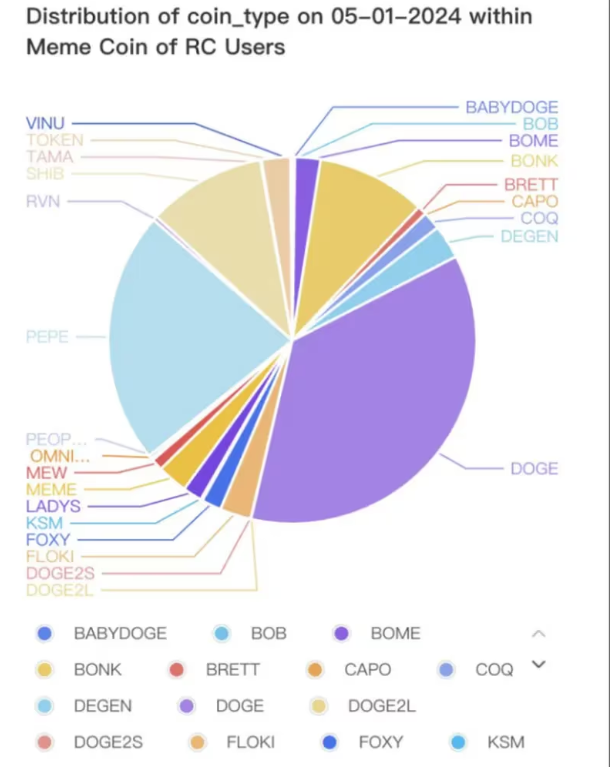

As of May 1, Dogecoin had the largest share of meme coin holdings among both individual and institutional investors. However, while institutional investors allocated 36% of their meme coin investments to DOGE, individual investors allocated 24.5%. This preference among institutions could be attributed to DOGE’s higher liquidity and perceived stability compared to other meme coins. Both groups invested in Ethereum-based meme coins like PEPE and SHIB. However, there were some differences in the distribution.