Dogecoin (DOGE) price, after breaking its ascending triangle formation on May 16, continues to trade within a symmetrical triangle over the past three weeks. The price remains just below the $0.16 level, approaching an expansion point at $0.163. If a price breakout above the resistance area occurs, a sharper rise in price could be possible. However, if visible momentum for a breakout is not achieved, consolidation may continue in the short term.

Doge Price Levels

According to the latest data, Dogecoin continues to trade around the $0.16 region after a 2.47% drop in the last 24 hours and a 0.96% drop in the last 7 days.

Dogecoin’s price outlook continues to move within a symmetrical triangle formation. The price seems to be stepping towards a critical expansion area around the $0.163 level. If Dogecoin surpasses this level, movements could become more intense.

The Stochastic RSI value remains at a neutral level, indicating neither overbought nor oversold conditions. The MACD indicator shows lines close to each other, suggesting potential horizontal movements before a clear trend direction emerges. The consolidation pattern indicates that Dogecoin tends to move horizontally for a short period.

Dogecoin Comments

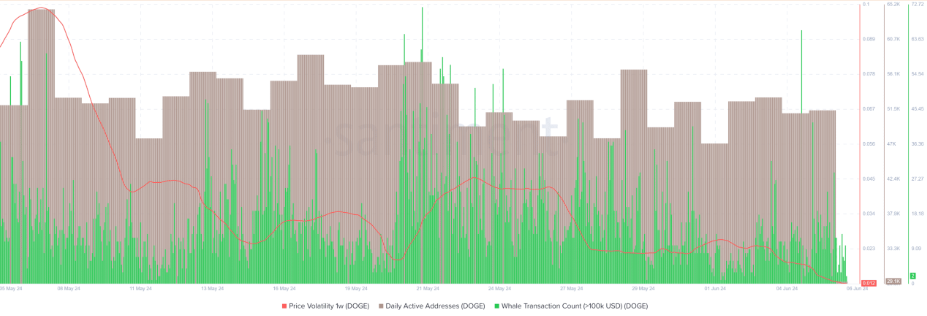

Data provided by Santiment continues to highlight important points specific to DOGE. The decrease in Dogecoin’s price volatility indicates that the price remains in a consolidation phase. There was also a noticeable decline in the number of daily active addresses for DOGE. Network activity, which was around 65,000 in early May, dropped to 29,100 by the beginning of June.

The number of whale transactions (transactions over $100,000) remains relatively stable, indicating that large investors are not clearly buying or selling. This shows stability, while the decreasing activity parallels the consolidation model.

Future of DOGE

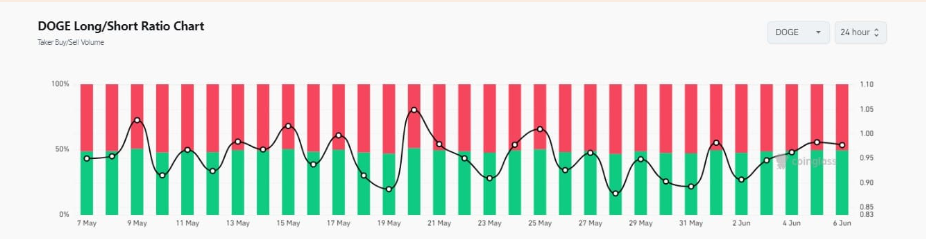

The existing negative outlook in market sentiment, calculated with the long/short ratio, indicates that bears have taken control in the short term due to the filling of price gaps. While current technical indicators suggest a potential consolidation phase, on-chain data shows stable but reduced activities.

Investors should closely monitor the $0.163 level for a possible price breakout. If the resistance is broken and sustained, new high levels could be targeted. However, the consolidation process may continue in the near term.

Türkçe

Türkçe Español

Español