Bitcoin price fluctuations continued all day, and the expected weekend rise trigger did not come. US data negatively impacted cryptocurrencies, causing Bitcoin to dip below $70,880. Hourly wage increases and Non-Farm Employment data were discouraging. So, what is the latest situation on the spot Bitcoin ETF front?

BlackRock Bitcoin ETF

The world’s largest asset manager, BlackRock, suddenly became interested in Bitcoin in mid-2023. During lawsuits against Binance and Coinbase, they boldly applied for a spot BTC ETF with the SEC. Other companies, seeing BlackRock’s confidence after only one ETF rejection out of 576, updated their applications. However, none reached reserves as large as BlackRock’s.

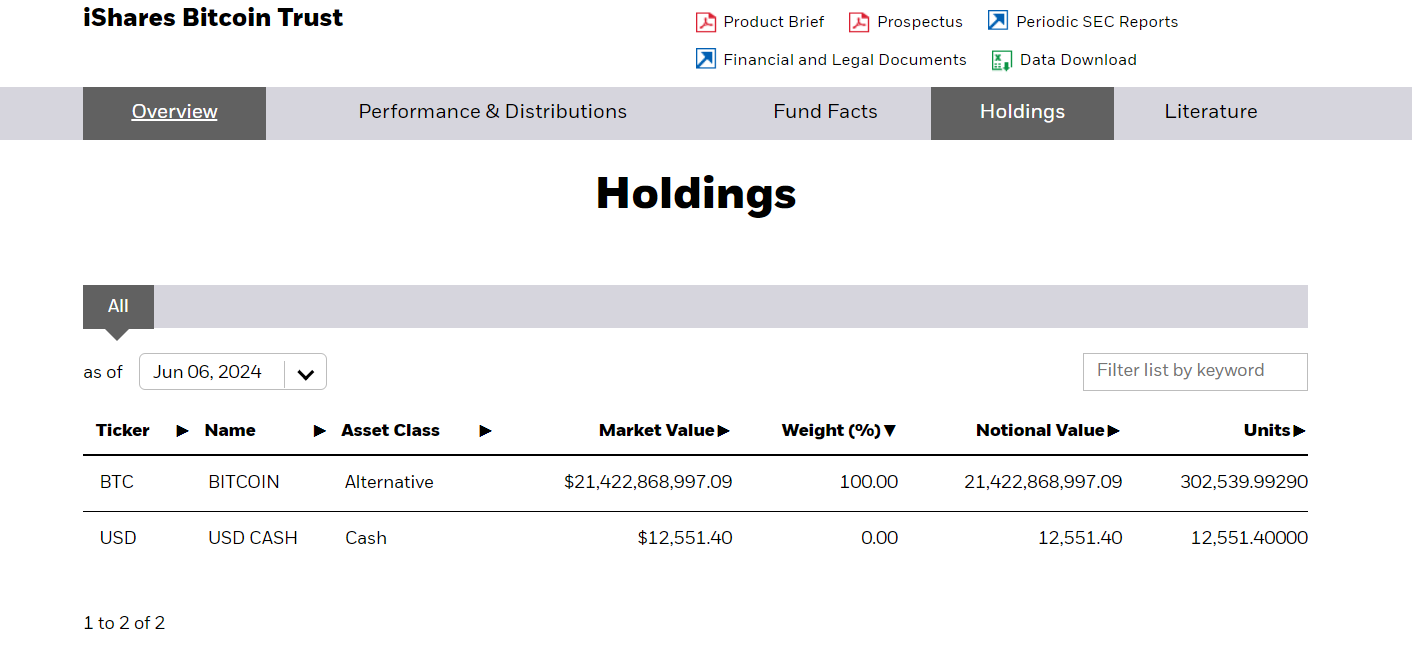

BlackRock‘s IBIT spot Bitcoin investment fund began trading on January 11 alongside others. While GBTC saw continuous net outflows, IBIT grew significantly. Competing with FBTC, it experienced hundreds of millions of dollars in daily net inflows. Just five months after trading began, IBIT reserves exceeded 300,000 BTC, roughly $21 billion.

According to the fund page, BlackRock’s Bitcoin ETF currently holds 302,534 BTC, and with approximately 4,920 BTC added in net inflows yesterday, this milestone was surpassed.

Spot Bitcoin ETFs

For years, US investors used the GBTC product for BTC. The fund, trading at negative and positive premiums, resulted in many staying away due to its high risk. Those who took advantage of the negative premium bought at up to a 50% discount and gained at least 50% when the ETF approval reset the premium.

Last week, IBIT surpassed Grayscale’s GBTC in total size, becoming the ETF with the largest reserves. GBTC, launched in the OTC market in 2015, dominated the US market for years without competition.

Compared to IBIT’s current 0.25% fee, GBTC, which charges a 1.5% fee, saw massive net outflows as an opportunity. GBTC’s reserves in US dollars fell from $28.7 billion on the January 11 launch day to $20 billion.

Türkçe

Türkçe Español

Español