Arkham’s decision to rebrand millions seized from Alameda Research as ‘US Government’ assets has sparked significant debate within the cryptocurrency community. This move, which places over $300 million worth of cryptocurrencies under a government label, has led to widespread speculation about potential regulatory impacts and future market dynamics in the cryptocurrency sector.

Government’s Approach to Cryptocurrencies

This reclassification marks a new phase in the government’s involvement with cryptocurrency and indicates increased regulatory oversight. This change could lead to new standards in how seized cryptocurrencies are managed and redistributed. Stakeholders and observers are keenly watching for further developments, as this rebranding could reshape the landscape of cryptocurrency regulation.

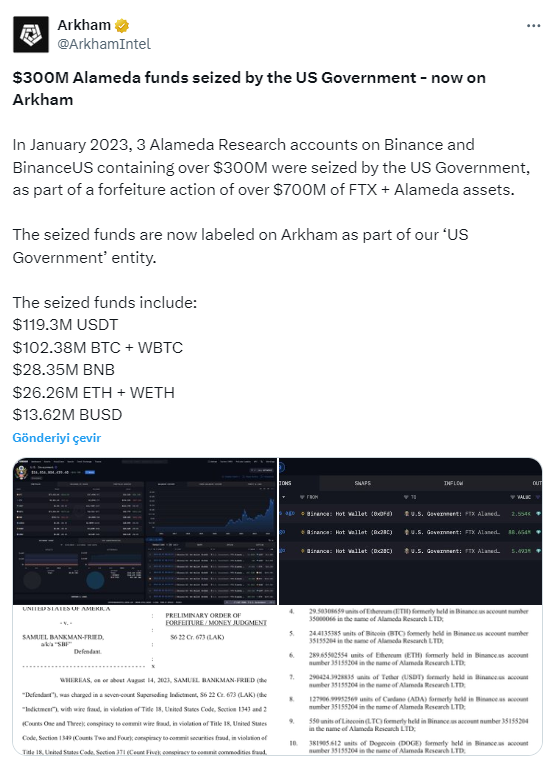

Details of Alameda’s seized assets now provide a clear picture of significant amounts under government control. In January 2023, the US Government seized three Alameda Research accounts on Binance and BinanceUS containing over $300 million. This seizure was part of a broader move that saw over $700 million in assets seized from FTX and Alameda. The seized funds now labeled under a ‘US Government’ entity on Arkham include 119.3 million USDT, $102.38 million in BTC and WBTC, $28.35 million in BNB, $26.26 million in ETH and WETH, and 13.62 million BUSD.

US Government in a Leading Position

This rebranding and detailed accounting of seized assets not only provide transparency but also highlight the significant control the US Government currently holds over a substantial amount of cryptocurrency. This development raises questions about the future use of these assets and their potential impact on the broader market.

Globally, the US is not alone in holding significant amounts of cryptocurrency at the government level. According to Arkham’s data, the US government leads with 216,788 BTC, surpassing MicroStrategy’s 207,189 BTC valued at $13.5 billion. The United Kingdom and Germany also rank high in terms of state-owned crypto assets. El Salvador, which has adopted Bitcoin as legal tender, holds a relatively smaller amount.

Meanwhile, speculation continues about the potential liquidation of other significant crypto assets, such as the hidden stash from Silk Road and Bitfinex’s ill-gotten gains. Increasing government control over cryptocurrency may mark a significant moment at the intersection of government policy and cryptocurrency markets.

Türkçe

Türkçe Español

Español