Artificial intelligence (AI) is increasingly impacting various sectors globally, enhancing aspects of human life, and fostering innovation in the Blockchain industry. This technology is used to improve security measures, transaction efficiency, and decentralized governance methods, making AI-focused altcoins highly attractive investment options. Recently, there has been a significant increase in social interest in AI tokens like Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN), suggesting potential price increases during Bitcoin’s decline, creating a promising scenario for altcoin investors.

Fetch.ai (FET)

Fetch.ai (FET) is a Blockchain project that uses artificial intelligence to create a decentralized digital economy. It operates through autonomous agents, which are programs that perform tasks on behalf of users. Despite experiencing a significant correction since the end of March, where its price fell from $3.48 to $1.65, FET shows potential for an upward trend.

Currently supported by the 200-day EMA slope, the asset is trading at $1.8 with a market cap of $1.529 billion. A strong support level at $1.65 could push the FET price upward, potentially reaching $2.7 and then $4.8 if the current resistance trend line is surpassed.

SingularityNET (AGIX)

SingularityNET (AGIX) aims to democratize AI access by creating a decentralized marketplace for AI services. This platform allows developers to create, share, and monetize AI algorithms globally using the AGIX token for transactions and governance.

The AGIX price has been moving horizontally within a symmetrical triangle formation for the past ten weeks and is currently trading at $0.758. With a market cap of $974.5 million, breaking this formation could increase buying momentum, pushing the price to $1.46 and potentially $2.5.

Ocean Protocol (OCEAN)

OCEAN coin currently has a market cap of $434.8 million. It has faced a significant correction, dropping from $1.67 to $0.765. The price halted at the 61.8% Fibonacci retracement level, indicating renewed demand pressure. If this support continues, surpassing the current resistance could lead to price targets of $1.10 to $1.67, indicating a possible market dynamic shift.

The broader cryptocurrency market has seen a pause in recovery momentum since April and May, with many major altcoins undergoing new corrections. Bitcoin’s effort to maintain its price above $70,000 increases market uncertainty. However, the growing utility of AI tokens and a broader upward trend present a lucrative opportunity for investors looking to capitalize on the current downturn.

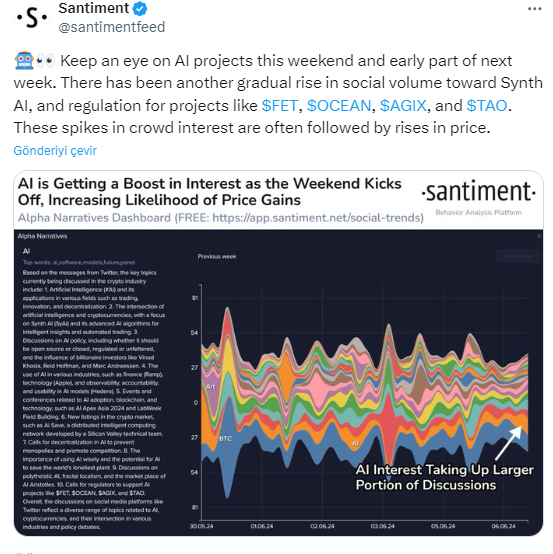

Regarding the topic, Santiment also shared that there has been a gradual increase in social volume towards the above projects. These sudden increases in community interest are usually followed by price increases.

Türkçe

Türkçe Español

Español