Bitcoin price fluctuated within a range of less than $500 in the last 24 hours, and notable declines occurred in altcoins. Despite the recent drop, Bitcoin has not seen a significant upward movement since its all-time high in the first quarter. What are the predictions and views of popular market experts?

Bitcoin and Expert Predictions

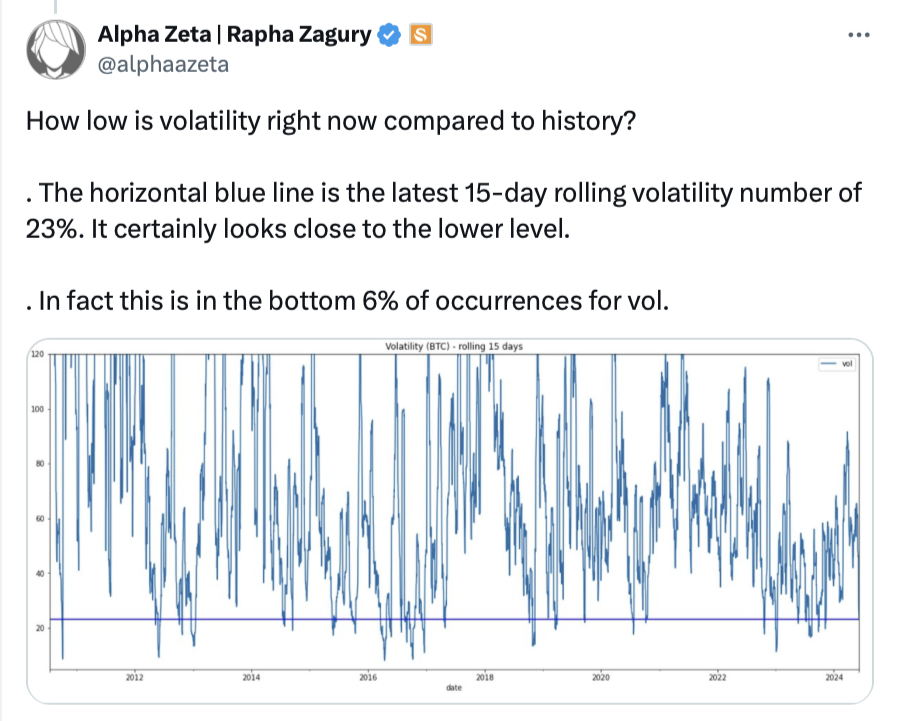

For 15 days before the sharp drop on Friday, June 7, BTC moved very little. Volatility reached historically low levels during this 15-day period. Swan Bitcoin’s Chief Investment Officer Rapha Zagury states that the period from May 24 to June 7 represents a rare segment of 6% in terms of volatility.

“The horizontal blue line represents the most recent 15-day rolling volatility number of 23%. It definitely looks close to the lower level.”

Bitcoin being stuck in a range is not a common occurrence, experts reiterate. In the last 24 hours, BTC traded in a narrow range with a ceiling of $69,582 and a floor of $69,130.

What Will Happen to Cryptocurrencies?

Bitcoin price may trade in a shallow range, but we have seen continuous rises in the long term. The European Central Bank made its first interest rate cut a few days ago. Given the economic slowdown, we know that the Fed will also have to start cutting rates at some point. If it doesn’t, it will have to take much more inflationary steps to support the economy ultimately.

It is normal for investors to remain cautious these days, as Wednesday’s data includes 3-year interest rate forecasts. On the other hand, the shallow volatility mentioned in the first section is often seen before significant movements. Zagury points out the double-digit increases in Bitcoin price following similar low volatility periods.

Looking at the 365-day period following previous similar low volatility periods, gains ranged from 55% to 820%. Of course, the past should not give us definitive conclusions about the future, but the potential for shallow volatility to trigger a new rise period should not be forgotten.

Türkçe

Türkçe Español

Español