Venture capitalist Chris Burniske recently changed his stance on Bitcoin (BTC) and the broader cryptocurrency market, expressing a strong belief that the markets are ready for a significant upward movement. Placeholder’s partner Burniske shared his newfound optimism with his followers on social media platform X, raising expectations as Bitcoin continues to consolidate within a wide range.

Now Expects Bitcoin to Rise

Burniske’s change in expectations is noteworthy given his past. In 2022, Burniske correctly predicted the levels at which the cryptocurrency market would bottom out and mentioned in February that he had switched to a bearish stance shortly before Bitcoin reached its all-time high of $73,000.

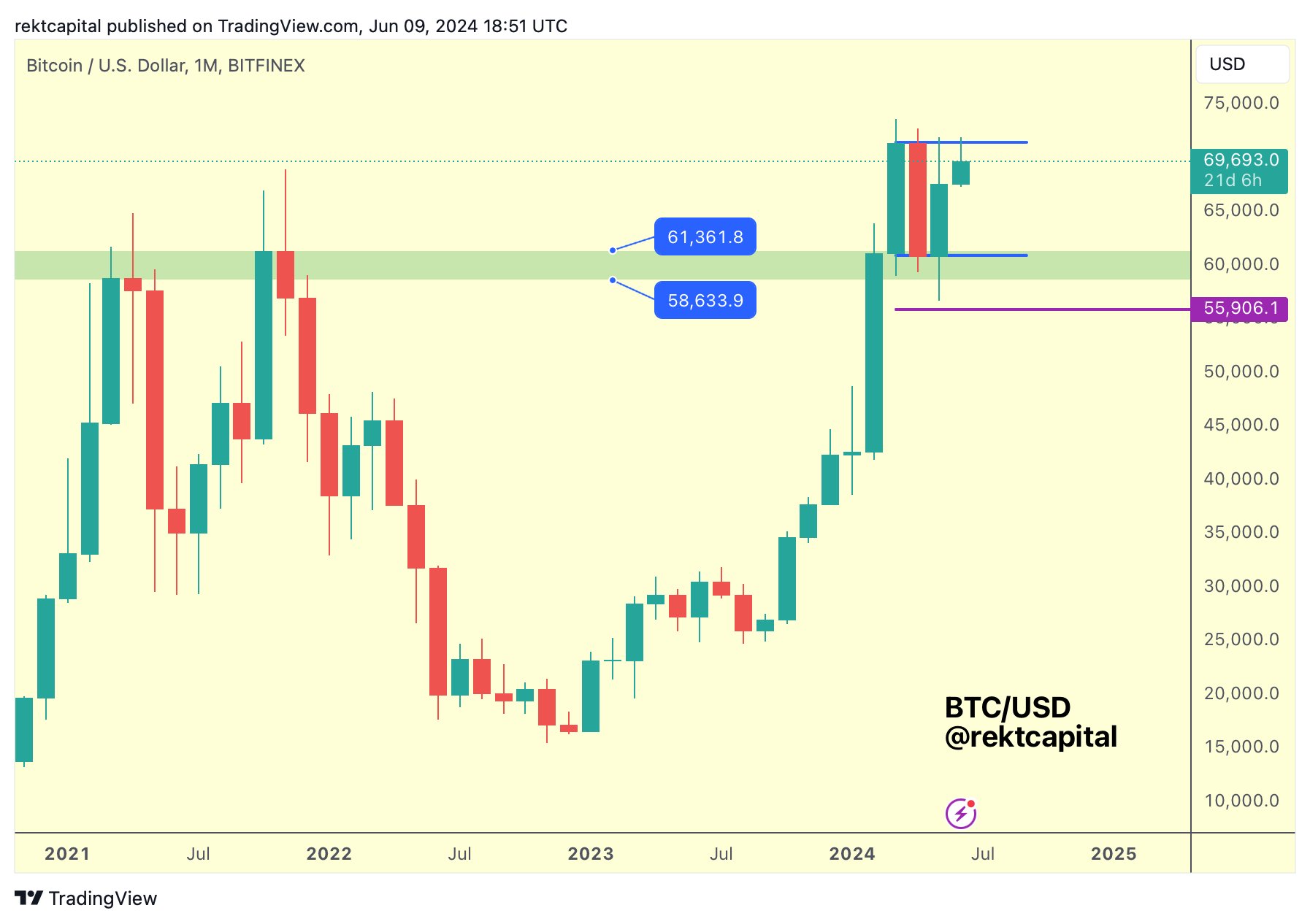

However, after several months of market consolidation, Burniske expressed that he sees parallels between the current Bitcoin price movement and its performance in late 2020, when BTC struggled to surpass its all-time high of $20,000.

The expert noted that, looking back a few years from now, observers would likely see similarities between Bitcoin’s testing of previous all-time highs of $20,000 and $69,000, its consolidation, and its eventual breakout. He described this pattern as “poetic” and indicated a belief that the market forces driving the largest cryptocurrency are irresistibly strong, stating that “resistance to the algorithm is futile.”

“Formed a Consolidation Range” Comment

Last week, Bitcoin managed to trade above $67,000-$68,000, reinforcing Burniske’s bullish outlook. Furthermore, an anonymous cryptocurrency analyst known as Rekt Capital supported this view and shared with followers that Bitcoin had formed a bullish continuation pattern. The analyst emphasized that Bitcoin had achieved a significant technical feat by turning its former resistance area into new support, creating a consolidation range resembling a Bull Flag trend continuation pattern.

At the time of writing, Bitcoin is maintaining its position just above $67,000, above the key support level identified by analysts. This technical development suggests that the price could rise, in line with Burniske’s bullish perspective.