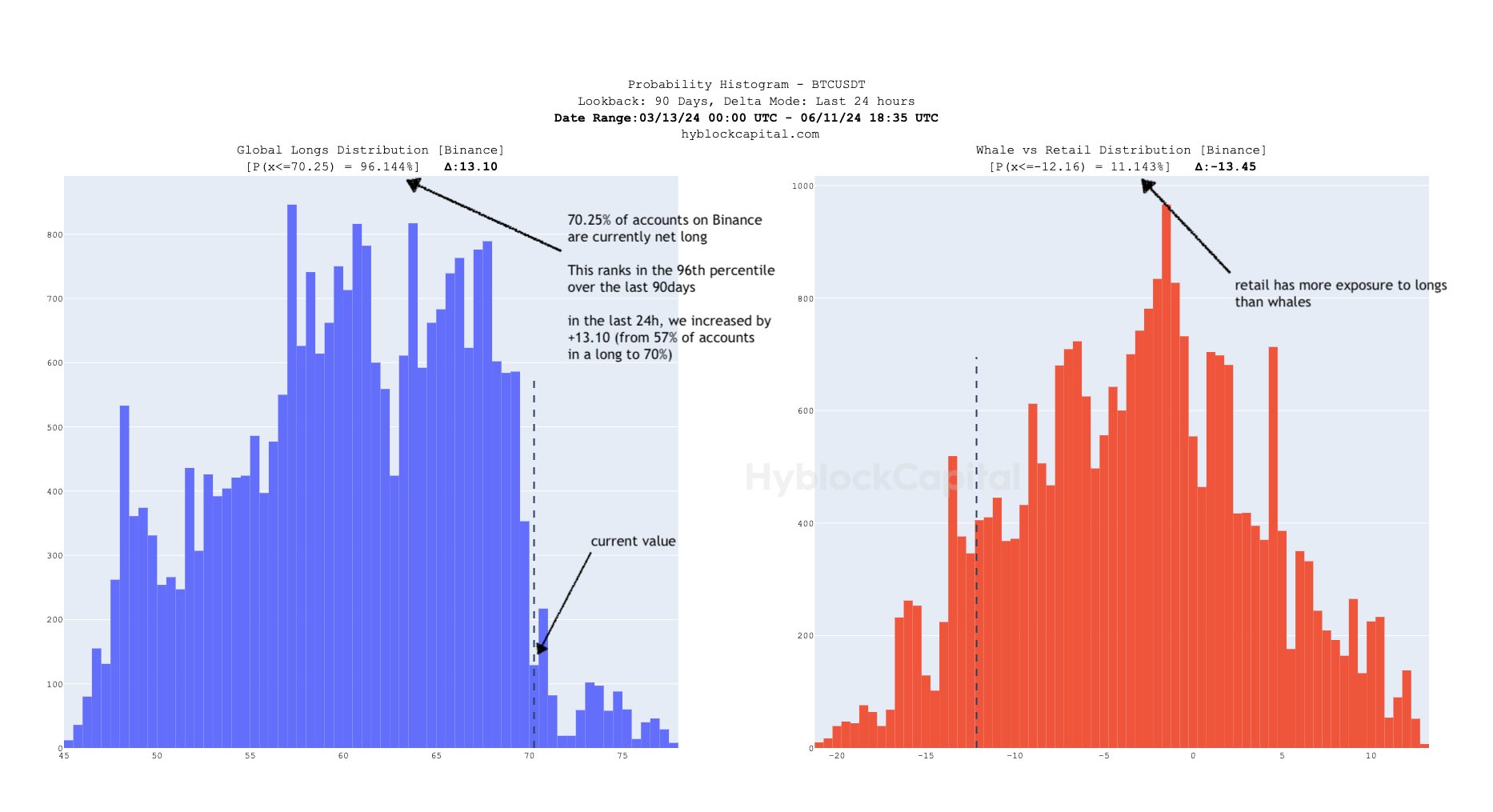

With its trading volume, the world’s largest cryptocurrency exchange Binance sees individual investors significantly favoring long positions in Bitcoin (BTC) despite a notable market decline. Currently, 70.25% of accounts on the platform are net long on BTC, a significant increase from 57% just 24 hours ago. This change indicates a strong belief among individual investors that the current market downturn is an opportunity to buy at a lower price, expecting future recovery.

Individual Investor Confidence in Long Positions

Data shows that 70.25% of individual investors are currently positioned for a price increase in Bitcoin. This level of long positions is in the 96th percentile over the last 90 days, indicating an unusually high confidence in market recovery. The significant increase in long positions within a single day suggests that many individual investors are trying to capitalize on what they perceive as a temporary dip in Bitcoin’s price.

Unlike individual investors, larger players or “whales” seem less interested in long positions. Distribution data shows that individual investors are taking more long positions compared to whales. This discrepancy indicates a difference in market sentiment between smaller investors and larger, more experienced market participants.

Analysis of the Increase in Long Positions

The rapid rise in long positions from 57% to 70.25% within 24 hours is noteworthy. This reflects strong buying activity from individual investors trying to catch the market bottom. This behavior is typical during market corrections, where individual investors see dips as buying opportunities, expecting the downtrend to reverse and prices to rise.

While individual investor confidence is significant, it also carries risks. High long positions could lead to increased liquidation if the market continues to fall. Individual investors need to be aware of volatility and the potential for further downside that could negatively impact their positions.

The current trend of individual investors predominantly taking long positions could impact market dynamics. If the market recovers, the high number of long positions could strengthen the upward movement. Conversely, if the decline continues, it could result in significant losses for those heavily invested in long positions, potentially triggering a wave of liquidations.

Türkçe

Türkçe Español

Español