BTC price may be preparing for an exciting turn following the latest development. The price is near the $70,000 mark. At the time of writing, it had only been 1.5 hours since the US inflation data was released. However, Bitcoin has now jumped from the daily low of $66,000 to $69,700. Moreover, this was continuing as this article was being prepared.

Why is Bitcoin Rising?

The Consumer Price Index (CPI) for May came in lower than expected, boosting investor appetite for risk markets. The CPI was reported at 3.3%, 0.1% below forecasts. The continued decline in inflation and the ongoing impact of the Fed’s tight monetary policy could calm Powell this evening.

The US Bureau of Labor Statistics report stated;

“The all items index increased 3.3% for the 12 months ending in May, down from the 3.4% increase for the 12 months ending in April. The index for all items less food and energy rose 3.4% over the last 12 months.”

With the rise in BTC price, DOGE, AVAX, SOL, LINK, SHIB, and others gained over 4%. This indicates that investors who bought the dip made a good move.

Fed Meeting and Crypto

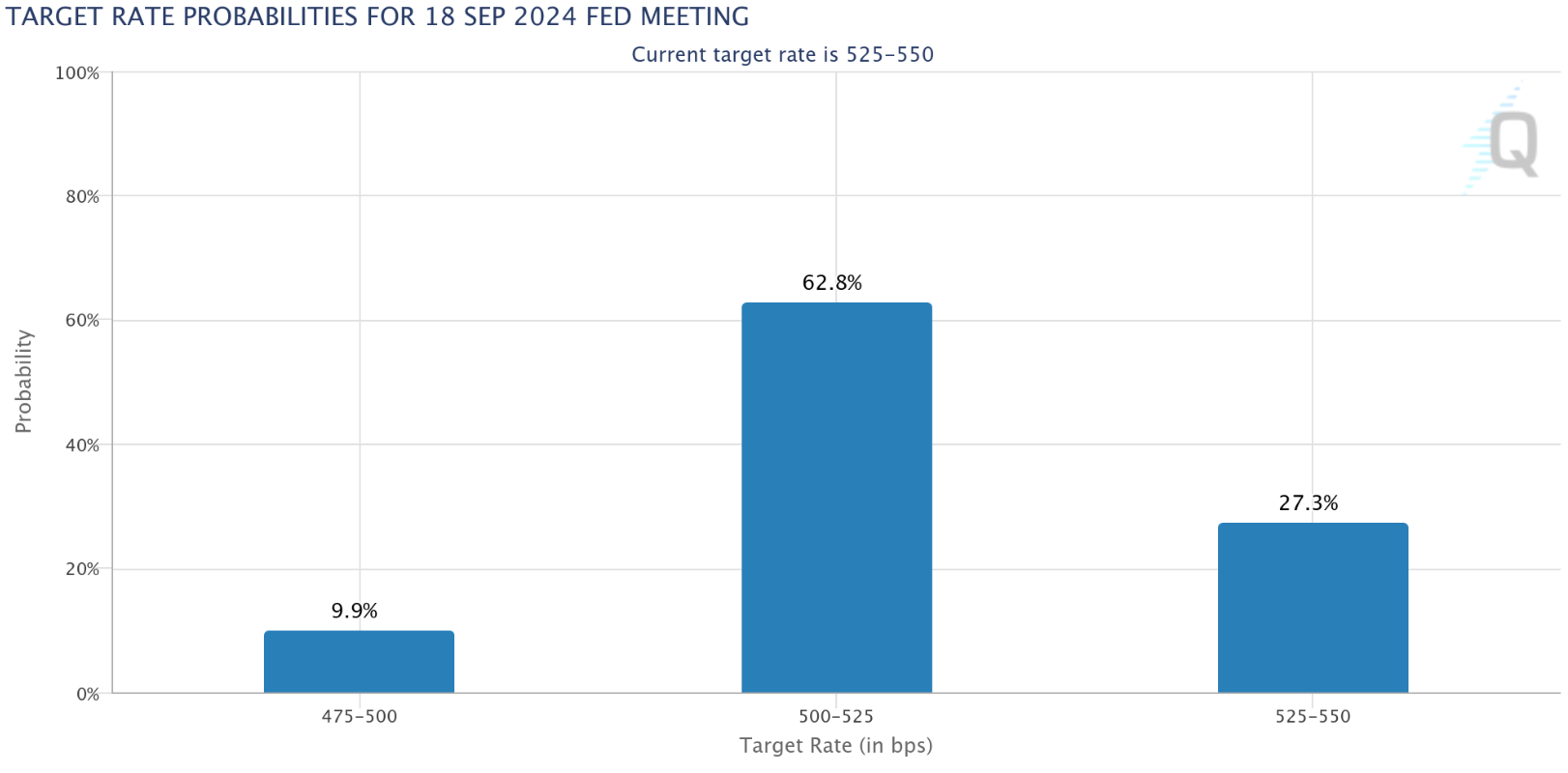

All eyes are now on the announcements following the Federal Reserve’s Federal Open Market Committee meeting. It is almost certain that interest rates will remain unchanged at this meeting. Market expectations are steady on this matter. Two things are important here;

- Fed members’ 3-year interest rate forecasts

- The tone of Powell’s statements

Tedtalksmacro wrote the following on this topic;

“The stage is set for Powell to talk about easing. Let’s wait for the meeting”.

Poppe pointed out the easing in the dollar.

“Markets are significantly dropping the Dollar and Treasury Yields as they expect rate cuts. This drop could be a big sign for Altcoins and Bitcoin.”

The market’s expectation of a rate cut exceeded 70% for the September meeting. The increase is the clearest indicator that optimism has recovered following Friday’s data. If the Fed does not deliver a bad surprise, new attempts at $72,000 and even beyond could be seen in the BTC price towards today’s daily candle close. If $73,777 is surpassed, a rapid rally to $80,000 and $88,000 is expected, and experts have been warning bears about this scenario for months.