The leading smart contract platform Ethereum (ETH) experienced a significant rise due to the excitement surrounding spot ETFs. In the past, ETFs introduced in Bitcoin (BTC) markets were seen as an additional liquidity source by investors, leading to a rise. So, will the rise in Ethereum continue?

Critical Metric in ETH

According to data obtained from cryptocurrency analytics companies, the buyer-seller ratio was 0.96. The buyer-seller ratio of an altcoin measures the ratio between its buying and selling volumes in the futures market. A value greater than 1 indicates more buying volume, while a value less than 1 indicates more selling volume. When the value of the specified metric declines in this way, it shows that there are more sell orders than buy orders in the futures market for the token. CryptoQuant analyst ShayanBTC said the following about the issue:

This trend shows that most futures investors are seriously selling Ethereum for speculative purposes or profit. This significant drop in the metric is a bearish signal, and if this trend continues, the current downward decline will continue.

Futures in ETH

The short-term decline seen in the leading smart contract platform ETH’s futures open position since June 5 confirmed the specified position. According to Coinglass data, ETH’s futures open positions have decreased by 2% since then, to $16.37 billion. The open interest in futures in the cryptocurrency measures the total number of outstanding or unclosed positions of unpaid futures contracts. This decline shows that some futures investors are closing their positions without opening new ones. This is generally seen as a shift in sentiment from a bullish trend to a bearish trend.

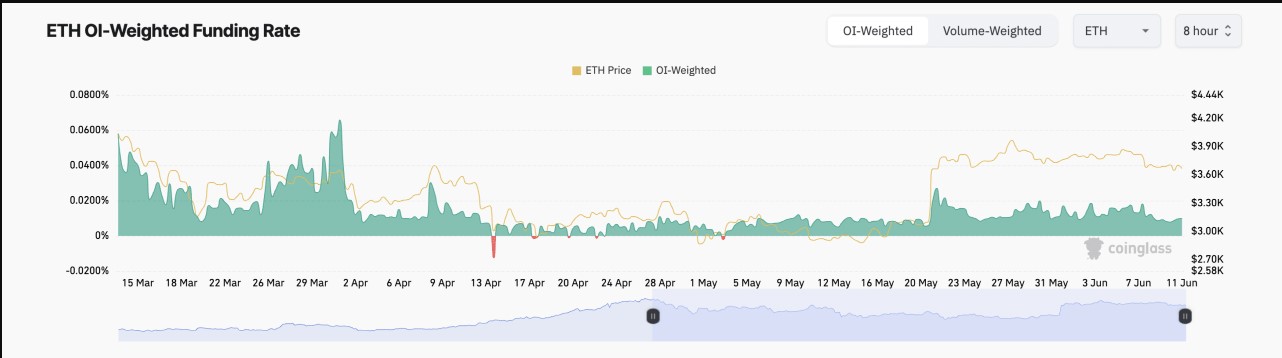

However, despite the bearish trend towards the cryptocurrency, most ETH futures investors have taken positions expecting the price increase to continue. This situation is based on the funding rate data of the token, which has returned only positive values since May 3, according to Coinglass data. Funding rates are used in perpetual futures contracts to keep the contract price close to the spot price. When positive, it indicates significant demand for long positions.

Türkçe

Türkçe Español

Español