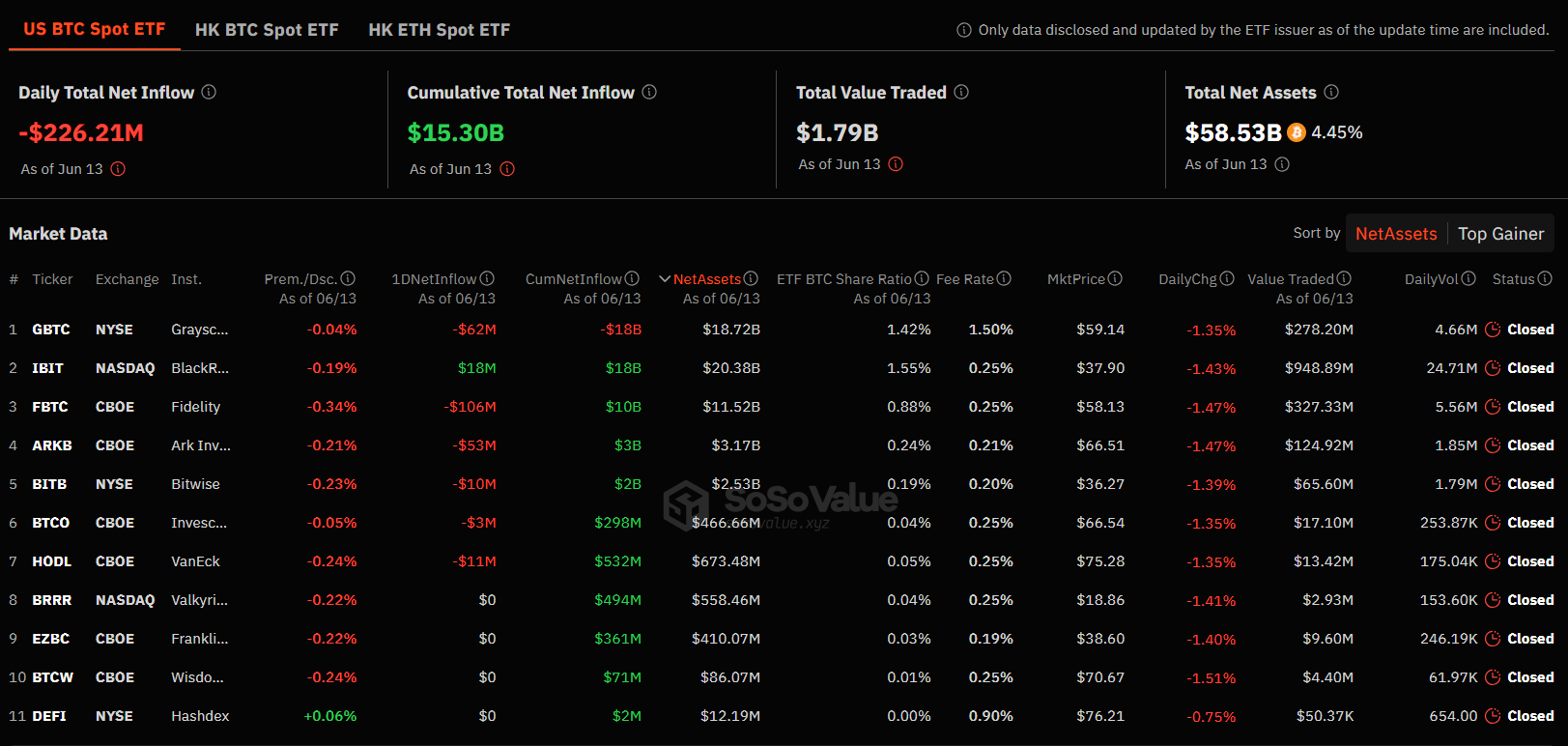

Bitcoin price volatility seems unending. BTC was below $67,000 while writing this article. Volatile movements also reflect on spot Bitcoin ETFs. One day sees significant inflows, another sees outflows. Price instability likely makes spot Bitcoin ETF investors pessimistic. We observed such pessimism yesterday. Let’s look at the details.

Withdrawals from Spot Bitcoin ETFs

Yesterday’s figures showed withdrawals from Bitcoin ETFs. Spot Bitcoin ETFs saw $226.21 million in outflows. Interestingly, on a day of heavy outflows, only one Bitcoin ETF had inflows. That was BlackRock’s Bitcoin ETF with an $18 million inflow. IBIT currently holds $20.38 billion in Bitcoin ETF assets.

Looking at the withdrawals, the largest was Fidelity’s Bitcoin ETF with $106 million. Other withdrawals included Grayscale with $62 million, Ark Invest with $53 million, VanEck with $11 million, Bitwise with $10 million, and Invesco with $3 million. Valkyrie, Hashdex, WisdomTree, and Franklin had no withdrawals.

Numbers Change Based on Market Sentiment

We are at a stage where institutional investors’ sentiment clearly depends on market trends. Expecting significant inflows while Bitcoin price drops is difficult. Withdrawals may increase as Bitcoin price falls.

The total assets in spot Bitcoin ETFs are currently around $58 billion. Considering Bitcoin’s market value of $1.3 trillion, approximately 4.5% of BTC supply is in spot Bitcoin ETFs.

Finally, the excitement in spot Bitcoin ETFs has already turned into stagnation, making future predictions difficult. However, an announcement of interest rate cuts by the Fed could significantly boost Bitcoin price and spot Bitcoin ETF inflows. Spot Ethereum ETFs starting operations could also catalyze a Bitcoin price increase.

Türkçe

Türkçe Español

Español