Despite Bitcoin nearing all-time highs and meme coins resurging, sentiment towards altcoins remains cautious due to low individual interest. This lack of participation is evident in the significant drop in video views on cryptocurrency-focused YouTube channels compared to the previous bull run. Nevertheless, several altcoins are attracting significant interest compared to the majority.

TON Outperforms Ethereum

The current market cycle is primarily driven by the spot Bitcoin ETF narrative, with no clear market catalysts for altcoins. While specific sectors like memecoins, artificial intelligence, and Real World Assets (RWA) have shown superior performance, major altcoins have struggled to keep up. This divergence indicates selective market interest in the current environment.

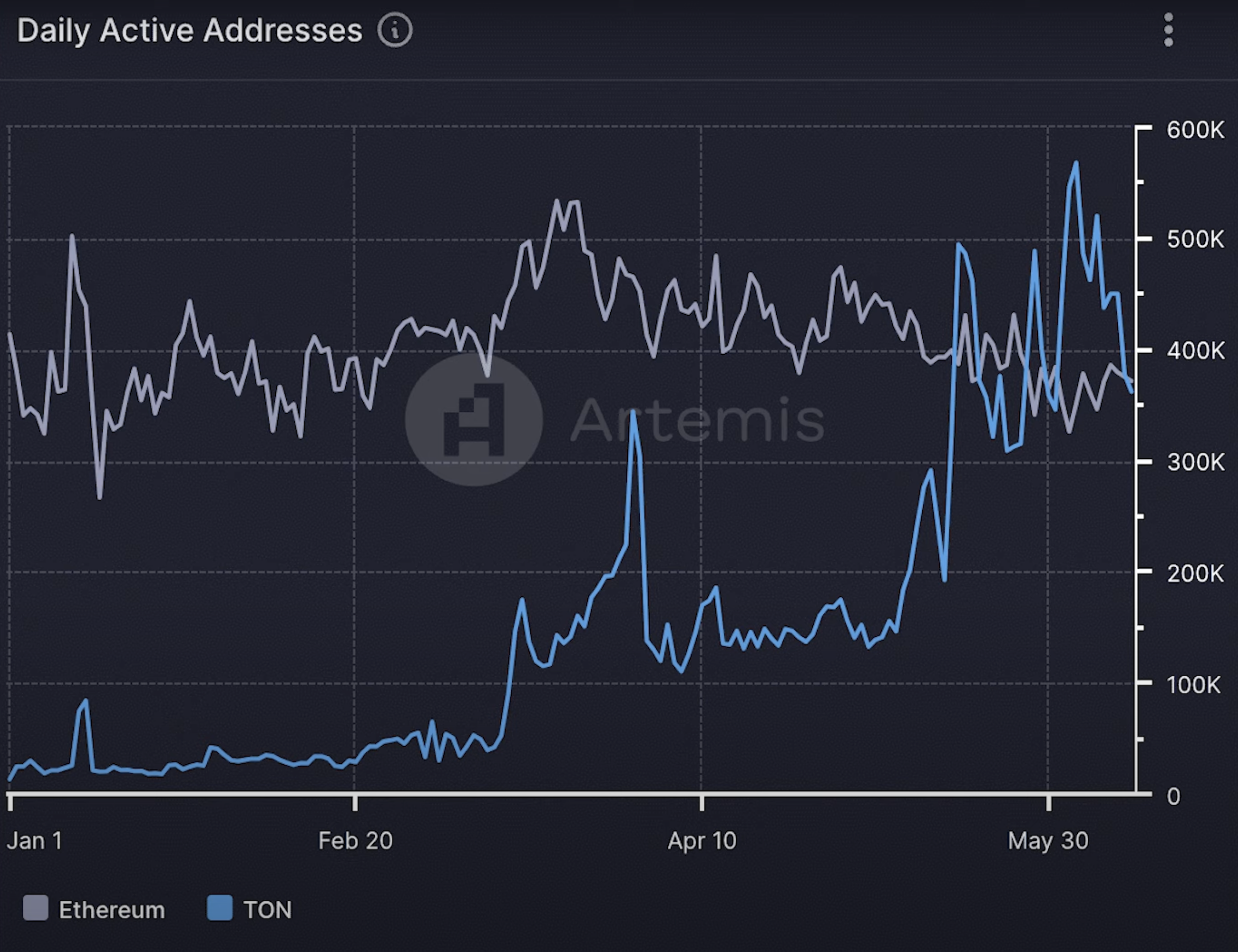

Amid these concerns about altcoins, cryptocurrency analyst Altcoin Buzz noted that The Open Network (TON), associated with the popular messaging app Telegram, has garnered significant interest and is likely to continue doing so. Thanks to Telegram’s massive user base of 900 million, TON’s daily active addresses have consistently surpassed Ethereum‘s since early June.

On June 3, TON peaked with 568,830 daily unique wallet addresses compared to Ethereum’s 351,000. Additionally, TON’s daily transaction count reached a yearly high of 9 million on May 17, significantly surpassing Ethereum’s 1.1 million transactions on the same day.

Analyst Shares High-Potential Sectors and Altcoins

Meanwhile, analyst Miles Deutscher finds the RWA sector particularly attractive. The analyst advocates for accumulating ETH and other altcoins with a medium to long-term perspective, spanning 6-12 months or longer. Deutscher emphasizes the importance of using low volatility periods to position in strong altcoins to effectively weather market fluctuations.

Deutscher considers Mantra, currently trading around $0.75 to $0.85, a promising investment. He also sees high growth potential in the DePIN sector, which is tied to artificial intelligence narratives and innovative projects.

Moreover, meme coins like Pepe and WIF are part of his strategy despite recent declines. He identifies key support levels at $0.11 for PEPE and $2.26 for WIF, expecting these altcoins to reach higher values during the market cycle.

Türkçe

Türkçe Español

Español