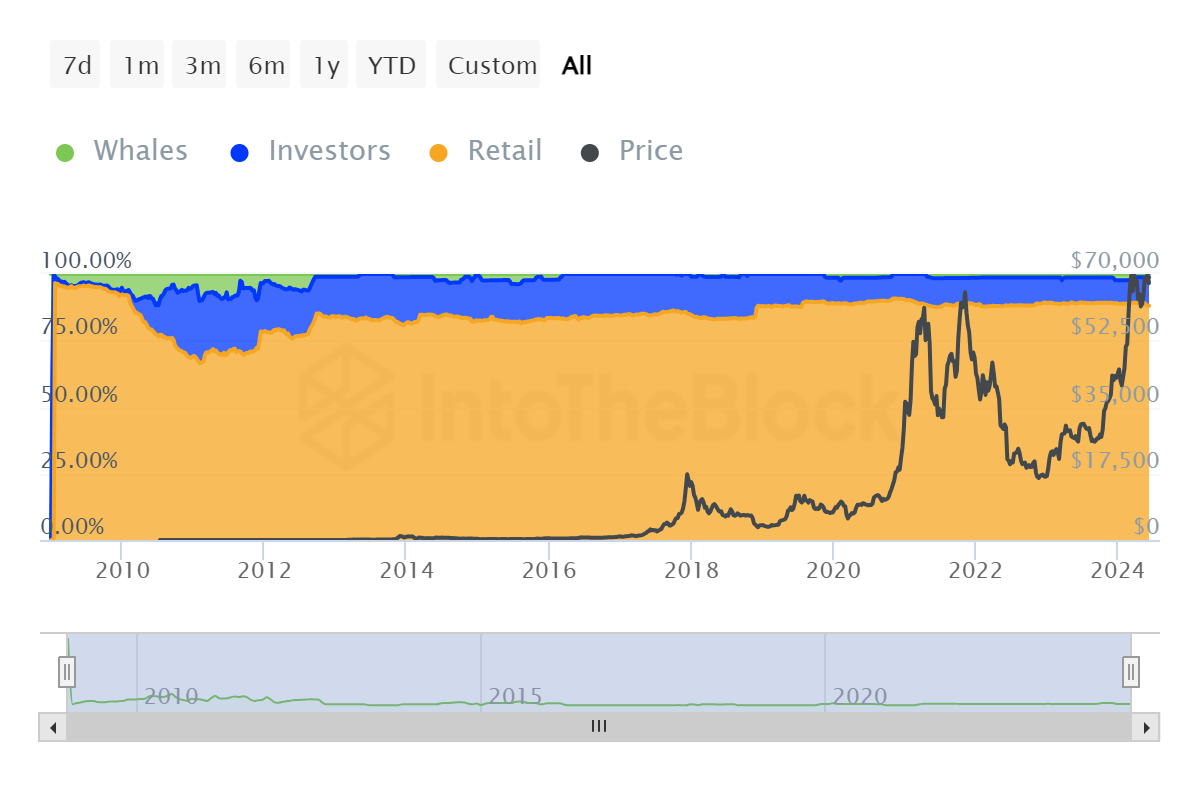

Especially to predict possible fluctuations in altcoin prices, whale movements are frequently monitored. This yields much better results in low-liquidity altcoins. There are many platforms that track and report whales. But is this really useful? Glassnode’s Chief Analyst made some important statements on this topic.

Crypto Whales

Wallets with assets above a certain amount are defined as whales in the crypto space. These investors have much more cash and crypto assets, which can cause movements in prices. For example, when a popular whale buys an obscure altcoin, many more individual investors show interest in that altcoin, and its price increases further.

Tracking the assets in the reserves of crypto whales is also something individual investors frequently do. For example, the altcoins held most by the top 500 Ethereum whales or the stablecoins they use more intensively are important. These whales are usually early adopters of crypto, companies, and individuals who are wealthy and have delved into crypto.

Crypto Whales Are Insignificant

Glassnode’s chief analyst James Check, also known by his pseudonym “Checkmatey,” made some evaluations about crypto whales yesterday. Warning investors, James argues that tracking them does not provide any benefit.

“Don’t track whales, kids; this is not useful information. I have never seen real special information or a correct investment option obtained from whale watching even once. It’s good for talking on social media but almost never a serious or valuable analysis.”

TXMC, the host of the Alpha Beta Soup channel, also issued a similar warning. He emphasized that crypto whale metrics can be misleading.

“The mechanical gradual decline here talks about wallet management, and you are seeing only a part of a larger picture. These whales are sometimes firms and institutions with multiple wallets and hundreds/thousands of clients. In my honest opinion, it’s cheap interaction bait.”

On May 15, crypto analysis firm CryptoQuant reported that whale demand on the Bitcoin front had started to accelerate again after a two-month downtrend.

“Bitcoin demand growth seems to be stabilizing after lingering in a slowing trend since March.”

Türkçe

Türkçe Español

Español