There were comments suggesting a summer slowdown in the cryptocurrency market. Currently, the situation appears worse than expected. This decline caused many users to suffer significant losses in futures trading. Cryptocurrency investors lost $400 million in long positions, and over 165,000 investors’ positions were closed. Bitcoin and Ethereum declines led to substantial losses in other altcoins.

Cryptocurrencies and Liquidation

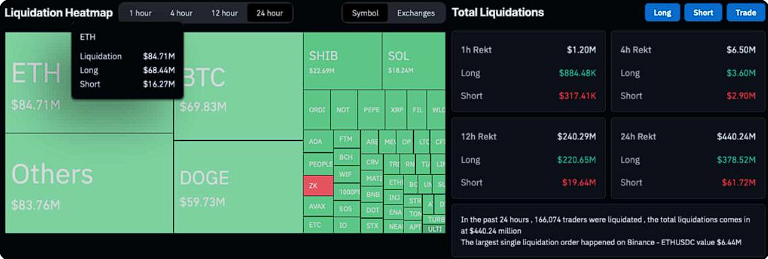

Data from CoinGlass showed that $440.24 million worth of positions were liquidated in the last 24 hours. A large portion of these positions, valued at $378.52 million, were in Ethereum.

Ethereum (ETH) led the liquidation process, with most liquidations tied to long positions. Losses in short positions were calculated to be over $60 million.

Leading DeFi and cryptocurrency investors’ losses reached $68.44 million, while bears in Ethereum short positions lost $16.27 million.

The most notable transaction saw $6.44 million evaporate in a single liquidation. This occurred in a USDC pair ETH transaction on the Binance exchange.

CoinGlass data indicated that the “other” cryptocurrency group ranked second in the largest liquidations, with Bitcoin in third place. Bears and bulls in Bitcoin (BTC) lost $69.83 million.

Current State of Bitcoin

The market experienced a significant shock in overall volume. After the decline on June 17, the market lost $136 billion. The Crypto Total Market Cap Index (TOTAL) fell from $2.385 trillion to $2.249 trillion during this period.

As of the time of writing, Bitcoin is trading at $64,800 after a 0.69% drop. The market cap fell to $1.27 trillion, while trading volume increased.

BTC’s 24-hour trading volume surged by 80%, exceeding $37 billion, indicating a significant increase in selling activity driven by market fear.

Türkçe

Türkçe Español

Español