LINK price hit a yearly high of $22.6 this year. After the rise, it entered a downtrend. LINK price has now fallen to $13.6. Many are wondering if this downward wave will continue. However, today analyst Ali Martinez shared a development that worries me. LINK is flowing into cryptocurrency exchanges. Here are the details.

LINK Flowing into Cryptocurrency Exchanges

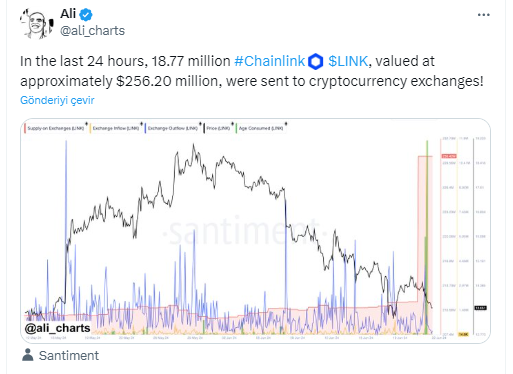

According to the Santiment chart shared by Ali Martinez, there has been significant Chainlink (LINK) token movement in the cryptocurrency market in the last 24 hours. Specifically, approximately 18.77 million LINK tokens, equivalent to about $256.20 million at current market prices, were transferred to various cryptocurrency exchanges.

Chainlink, known by the symbol LINK, is a decentralized oracle network designed to facilitate smart contracts on blockchain platforms like Ethereum. Its primary function is to provide secure and reliable real-world data feeds to these smart contracts, making them more functional and versatile. As a result, LINK tokens are indispensable within the Chainlink ecosystem, used for various purposes such as paying for services and rewarding node operators.

What Does the Large Transfer of LINK Mean?

The transfer of such a large amount of LINK to cryptocurrency exchanges could indicate several potential scenarios in the crypto market. Firstly, it may suggest that LINK token holders are preparing to sell or trade their assets.

Large movements towards exchanges typically occur before periods of increased trading activity, which could lead to a sell-off for LINK. The magnitude of this market movement indicates a concerning situation for LINK’s price. LINK has already dropped significantly. However, a large movement could push the price even lower.

If such a movement towards exchanges is absorbed, a price increase could be expected. However, given the current low investor sentiment in the cryptocurrency market and the wait-and-see approach of many, absorption seems unlikely at the moment. Therefore, based on Martinez’s post, I believe there could be a further pullback for LINK.

Türkçe

Türkçe Español

Español