Bitcoin price increased by 0.14% in the last 24 hours.

Significant sales from a dormant wallet drew market attention.

Spot Bitcoin ETF exits raised short-term price performance questions.

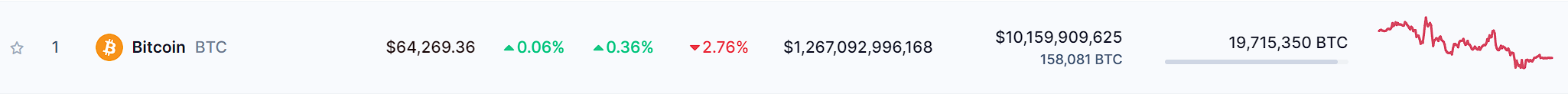

In the last 24 hours, Bitcoin (BTC) price increased by 0.14% according to data provided by CoinMarketCap. After a week of decline, the cryptocurrency was trading at $64,200 at the time of writing, following a period of negativity throughout most of the week. So, how can Bitcoin price rise from its current value?

Bears Lose Strength and Bitcoin Rises

In the past 7 days, significant sales, including from a dormant Bitcoin wallet known to hold 25,000 BTC in six different transactions, caught the market’s attention. It is believed that these BTCs remained in these accounts for approximately 3 to 5 years. Nevertheless, a wallet address transferred 25,000 BTC worth $1.6 billion.

On-chain analyst Maartunn from CryptoQuant also noted that transfers were made by an unknown wallet. The mentioned whale moved more than 11,000 BTC in two transactions. There are comments suggesting that these movements indicate a sale.

On the other hand, it is noted that the declines could be linked to these sales, and there are also views suggesting that the bears might be exhausted after the decline. The view that the bears might be exhausted suggests that the market, especially BTC, could recover, which could create buying pressure.

Spot Bitcoin ETF Exits

On the other hand, significant developments occurred in the spot Bitcoin ETF sector. Exits accelerated last week, raising a big question mark in the market.

According to data provided by Farside Investors, BTC ETFs hosted $545 million in exits throughout the past week, raising questions about Bitcoin’s short-term price performance.

The large exit environment seen in Bitcoin ETFs, combined with stagnant Bitcoin trading activities, also led analysts to speculate about a potential price drop.

The approach of spot Bitcoin ETF providers and investors to the issue was more optimistic, with the view that the exits and falling prices could bring in eager investors.

Spot Ethereum ETF Process

On the other hand, what might happen regarding spot Ethereum ETFs continues to be a topic of curiosity. Applicants refiled their S-1 amendments. Now, they are waiting for the United States Securities and Exchange Commission (SEC) to approve the process.

Information that emerged last week indicated that the process could be approved in the first week of July. Recently, the SEC also notified that the investigation related to Ethereum 2 in the ConsenSys case would not be pursued.

The process following the first approval of the spot Ethereum ETF might have created a positive outlook, which could, in turn, trigger a positive process for Bitcoin.

Considering all these situations in the market, BTC could first reclaim the $70,000 level and then reach $100,000 in the medium term.

Türkçe

Türkçe Español

Español