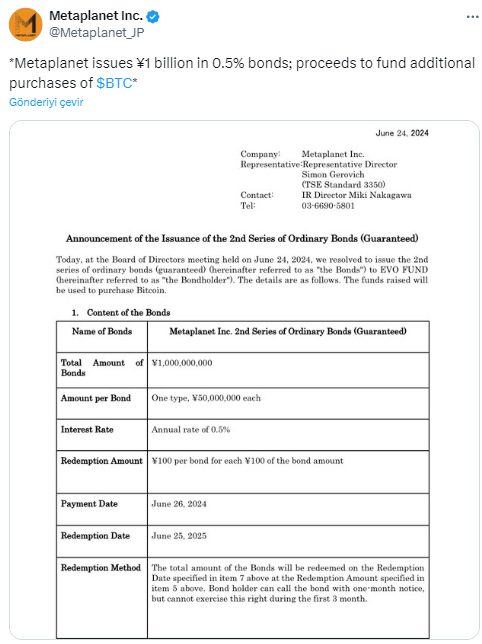

Japan’s financial environment facing significant challenges led Metaplanet, a publicly traded company, to take decisive steps to mitigate risks associated with the country’s economic conditions. In an announcement made today, Metaplanet’s board of directors approved a significant investment of 1 billion yen (approximately 6.26 million dollars) in Bitcoin. This investment was financed through the company’s second bond issuance, offering an annual interest rate of 0.5% and maturing in June 2025.

Why is Metaplanet Buying Bitcoin?

The primary motivation behind Metaplanet’s turn to Bitcoin is to hedge against the volatility of the Japanese Yen and broader economic uncertainties related to Japan’s high debt levels. As of 2023, Japan holds the highest net debt-to-GDP ratio among G7 countries at approximately 159%. This strategic shift mirrors the approach adopted by MicroStrategy, a US company known for its significant Bitcoin holdings, aiming to use Bitcoin as a hedge against economic instability.

Further increasing its commitment to Bitcoin, Metaplanet made an additional purchase on June 11, acquiring 23.35 Bitcoin. This acquisition raised Metaplanet’s total Bitcoin holdings to 141.0727 Bitcoin.

BTC Move Towards the Future

A significant reason for Metaplanet’s Bitcoin purchases is to reduce dependency on the Japanese Yen. This way, the company aims to protect itself from Japan’s growing debt burden. Looking ahead, Metaplanet plans to further expand its Bitcoin holdings by raising an additional 935 million yen (approximately 5 million euros) through “Stock Acquisition Rights.”

Metaplanet’s Bitcoin purchases are resonating in the cryptocurrency market. As institutions move into this space, it inevitably instills a sense of confidence among investors. It is also worth noting that the investment decision came at a time when BTC prices were declining.

Despite the widespread fear, uncertainty, and doubt (FUD) among investors due to Bitcoin’s price fluctuations between 62,000 and 66,000 dollars, large-scale investors, or whales, are accumulating Bitcoin. Historically, such accumulations by whales typically occur before market recoveries. In this context, Metaplanet’s move can be interpreted as an expectation of a rise in BTC. At the time of writing, the flagship cryptocurrency Bitcoin is trading at 62,297 dollars.

Türkçe

Türkçe Español

Español