Bitcoin (BTC) and altcoins face negative predictions, but crypto expert Rekt Fencer presents a bullish outlook with concrete data. In his latest post on social media platform X, he emphasized the importance of patience and a long-term perspective for investors expecting significant moves in the crypto market.

Highlighting Bitcoin’s “Natural Phase” Post Block Reward Halving

Rekt Fencer discussed Bitcoin’s current consolidation post-block reward halving, describing it as a typical phase following significant price movements. Bitcoin has seen a 13% drop from its all-time highs and a 15-week consolidation, which he noted is a normal low volatility period. According to him, this phase mirrors past consolidation stages observed in 2017 and 2021, where prices consolidated for 4-5 months before a parabolic rise.

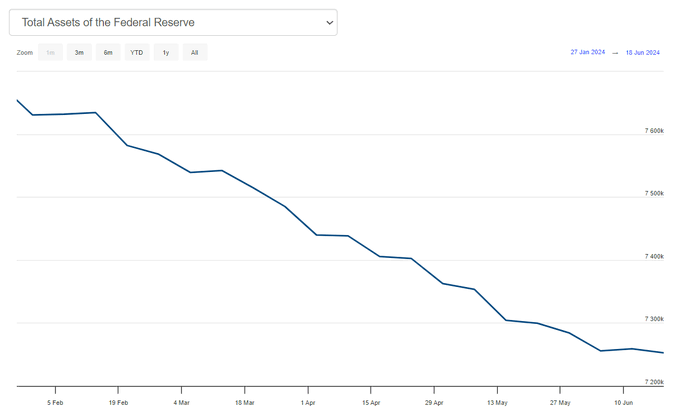

Rekt Fencer pointed out that some fundamental indicators currently suggest a promising future for the crypto market. The first indicator he mentioned is the Fed balance sheet. The Fed’s total assets are nearing a bottom, indicating potential future liquidity injections that could benefit cryptocurrencies. Additionally, liquidity is extremely low compared to previous cycles, suggesting high growth potential as new capital enters the market.

Rekt Fencer noted that venture capital investments in the crypto market are currently 3-4 times lower than the 2021 peaks, indicating significant room for funding increases during the next bull run. He also added that the consolidation in major central banks’ assets and Fed reserves suggests a potential future increase in liquidity.

Political and Regulatory Catalysts for Future Growth of the Crypto Market

Additionally, Rekt Fencer highlighted upcoming political events and regulatory changes as potential bullish catalysts for Bitcoin and altcoins. He pointed to the 2024 US Presidential elections as the first significant political event. According to him, promises from candidates like Donald Trump to support the sector make the crypto market a significant political issue. Furthermore, he noted that central banks in countries like Canada and Switzerland have already lowered interest rates, suggesting that the US might follow suit, potentially revitalizing the market.

Rekt Fencer specifically addressed altcoin investors, advising them not to sell now. He mentioned that a drop in Bitcoin dominance while it remains stable could signal the start of an altcoin season. According to him, the US Securities and Exchange Commission (SEC) potentially approving a spot Ethereum ETF in July and discussions about launching a spot ETF for Solana (SOL) could trigger a bullish trend for altcoins.

Türkçe

Türkçe Español

Español