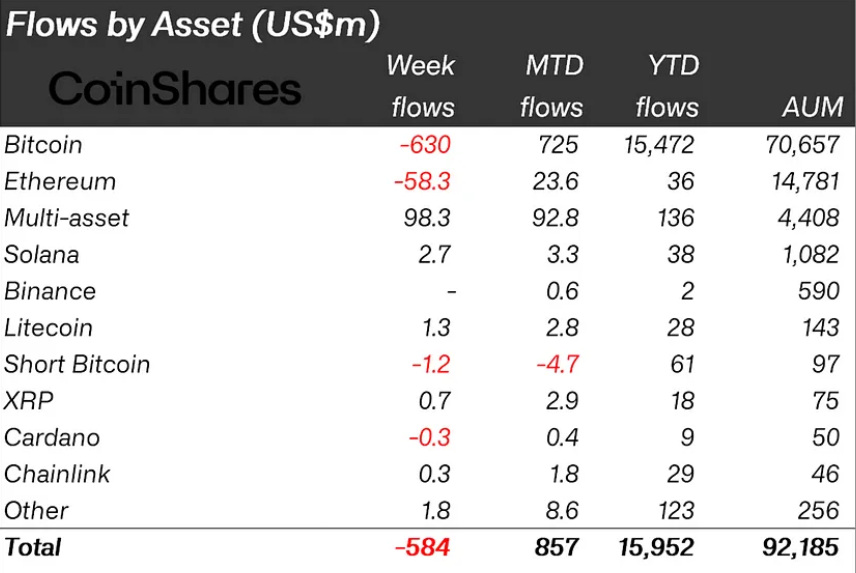

Crypto-focused investment products experienced a $584 million outflow, marking losses for the second consecutive week. This trend led to a total reduction of $1.2 billion in crypto asset investments during this period. The primary catalyst for this decline appears to be investor pessimism regarding potential interest rate cuts by the Federal Reserve (FED) this year. The expectation that the FED will maintain or even raise interest rates discouraged investors, causing them to withdraw their funds from these products.

Bitcoin Was Most Affected

Bitcoin was the most affected, witnessing a $630 million outflow. Despite this significant pullback, there was no corresponding increase in short positions against Bitcoin, indicating that investors were not actively betting against the asset while withdrawing their funds.

In contrast, multi-asset products saw an inflow of $98 million. This trend suggests that investors are taking advantage of the current weakness in the altcoin market to diversify their portfolios. By investing in a range of assets, they may be attempting to mitigate the risks associated with the volatility of individual cryptocurrencies.

Trading volumes on Exchange Traded Products (ETPs) dropped to just $6.9 billion last week, the lowest level since the launch of US ETFs in January. This decline in trading volume reflects broader market hesitation as investors adopt a wait-and-see approach amid economic uncertainties.

Geographical Situation

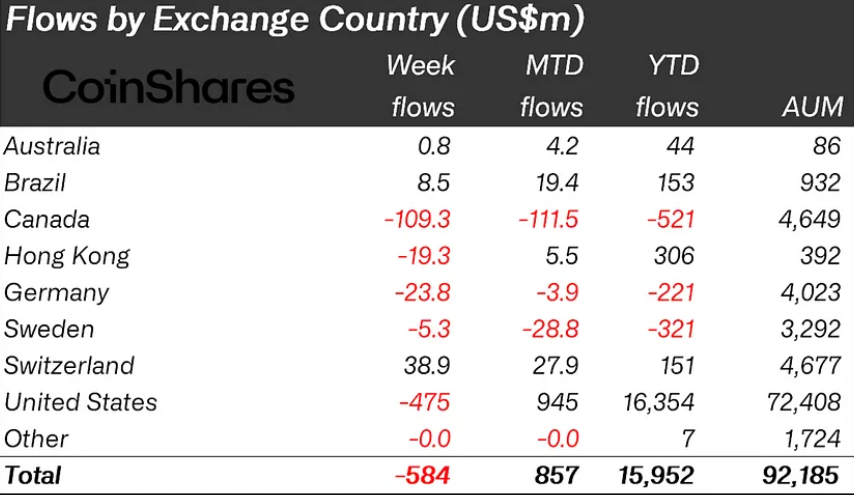

Geographically, the United States saw the largest outflow with $475 million, followed by Canada with $109 million. Germany and Hong Kong also experienced outflows of $24 million and $19 million, respectively.

Interestingly, Switzerland and Brazil defied this trend, recording inflows of $39 million and $48.5 million, respectively. These inflows suggest that some regions remain bullish on cryptocurrencies, likely due to differing economic conditions or investor sentiment.

Altcoin Situation

Ethereum also faced negative sentiment with a total outflow of $58 million. Despite this, several altcoins, including Solana, Litecoin, and Polygon, saw small inflows of $2.7 million, $1.3 million, and $1 million, respectively.

This selective interest in certain altcoins may indicate that investors see specific opportunities in the altcoin market despite the broader downturn.

Türkçe

Türkçe Español

Español