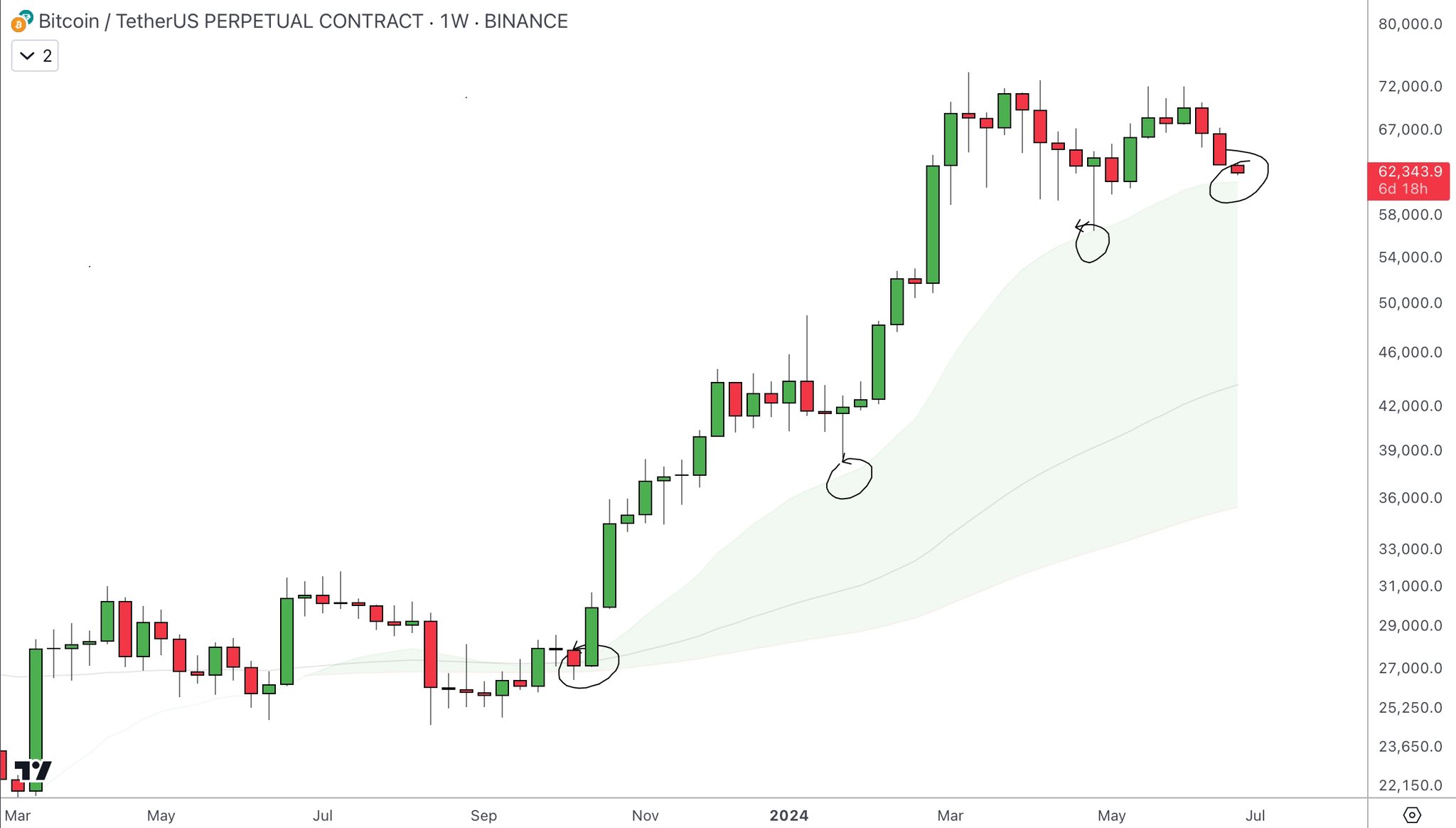

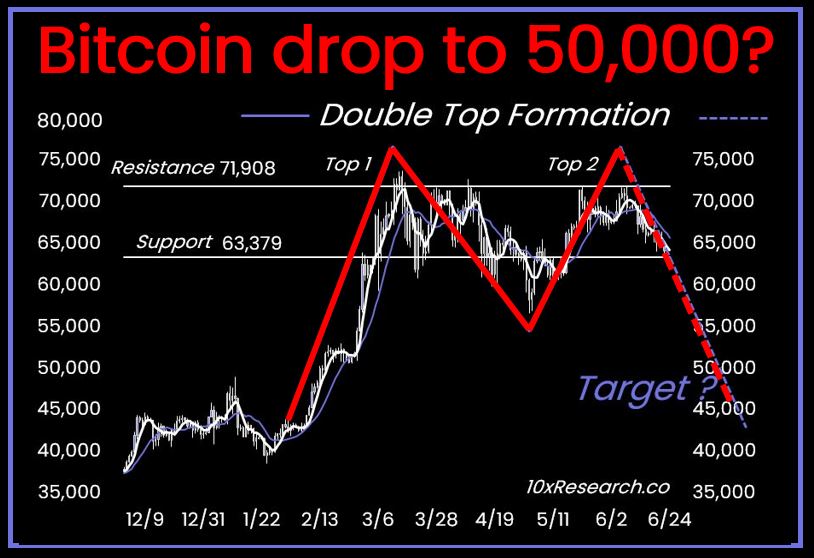

Bitcoin price continues to fall, decreasing by 1.5% during the day and 7.65% over the past week, reaching $62,130 on June 24. Several indicators suggest further price drops in the coming days, making recovery unlikely. Bitcoin has been consolidating within a descending parallel channel since the bull run in March 2024, reaching a new record high around $74,000.

What’s Happening on the Bitcoin Front?

Bitcoin pulls back to the lower trend line every time it tests the upper trend line as resistance, showing signs of recovery afterward. As of June 24, Bitcoin is experiencing a similar scenario, pulling back after reaching the upper trend line around $72,000 two weeks ago. BTC/USD pair is currently moving towards the lower trend line, which corresponds to the psychological support level of $60,000.

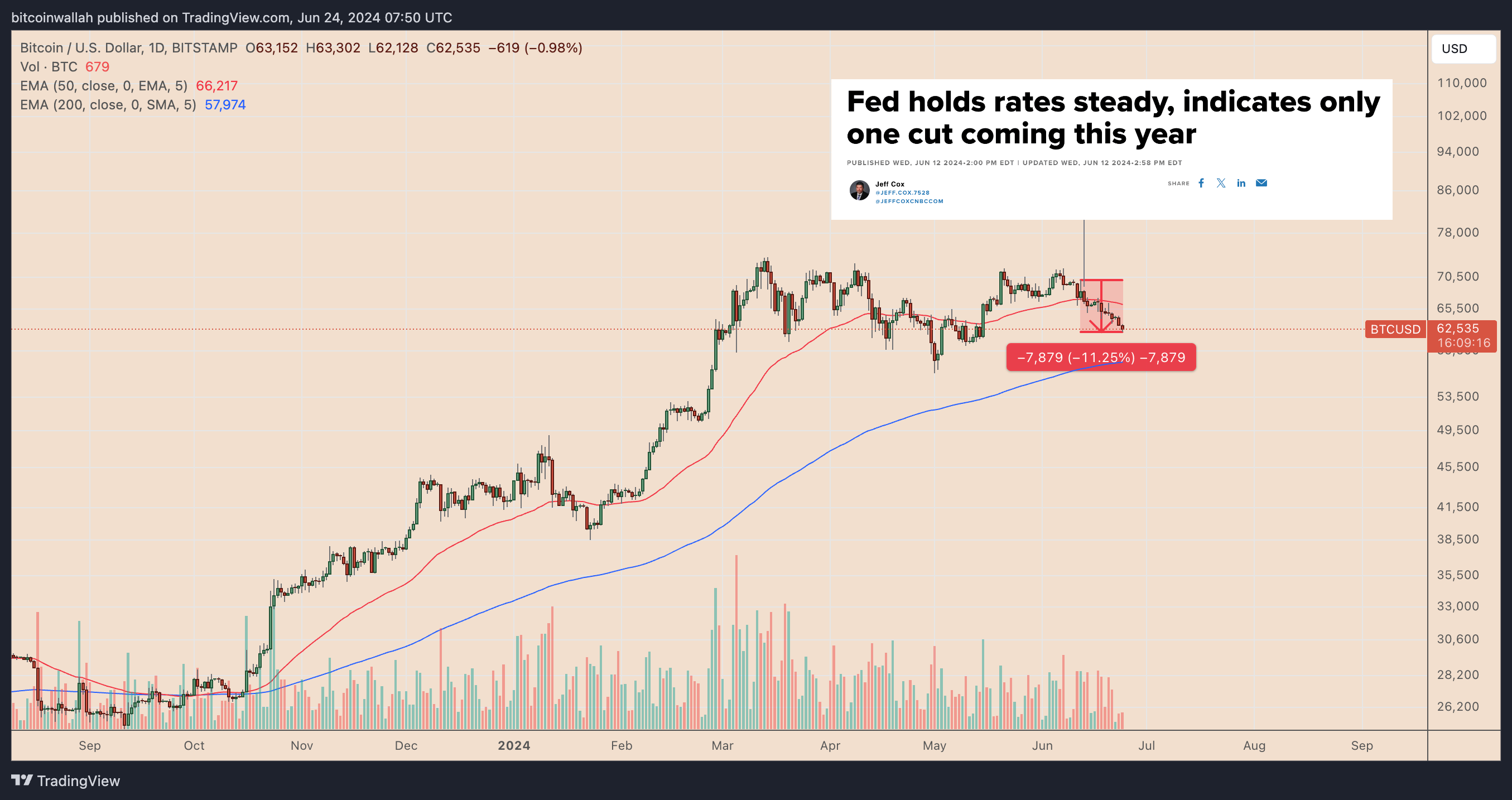

Interestingly, the downward target of $60,000 is closer to Bitcoin’s 200-day exponential moving average of $58,000. This convergence increases the likelihood of Bitcoin approaching the $58,000-$60,000 range in July. Independent market analyst Teddy Cleps predicted that Bitcoin would fall to $61,000 due to this level being the 21-week EMA and historical support, sharing the following statement:

“Bitcoin has dropped to the 21-week EMA and bounced back with every correction since the bull run started. As we speak, we are approaching it, and if history repeats itself, the $61,000 level could be the bottom.”

Notable Statements from a Famous Name

Bitcoin’s ongoing consolidation trend aligns with the predictions made by Galaxy Digital Holdings Ltd. founder Michael Novogratz in May. He argued that Bitcoin would trade in the $55,000-$75,000 range throughout the second quarter of 2024. Novogratz expects new market events to drive prices higher following the bull runs fueled by the launch of spot U.S. Bitcoin ETF funds and Bitcoin’s halving event.

Novogratz cites strong economic readings and decreasing optimism about Fed rate cuts as reasons for the current market pause. According to the investor, the $55,000-$75,000 consolidation will continue until economic slowdown or post-election legislative clarity.

Türkçe

Türkçe Español

Español