In July, Mt. Gox creditors are set to receive approximately $9 billion in Bitcoin (BTC) and Bitcoin Cash (BCH) repayments. Analysts suggest that the impact on Bitcoin’s price might not be as harmful as initially feared, with the main effect expected on Bitcoin Cash.

Background of Mt. Gox Repayments and Expert Opinions

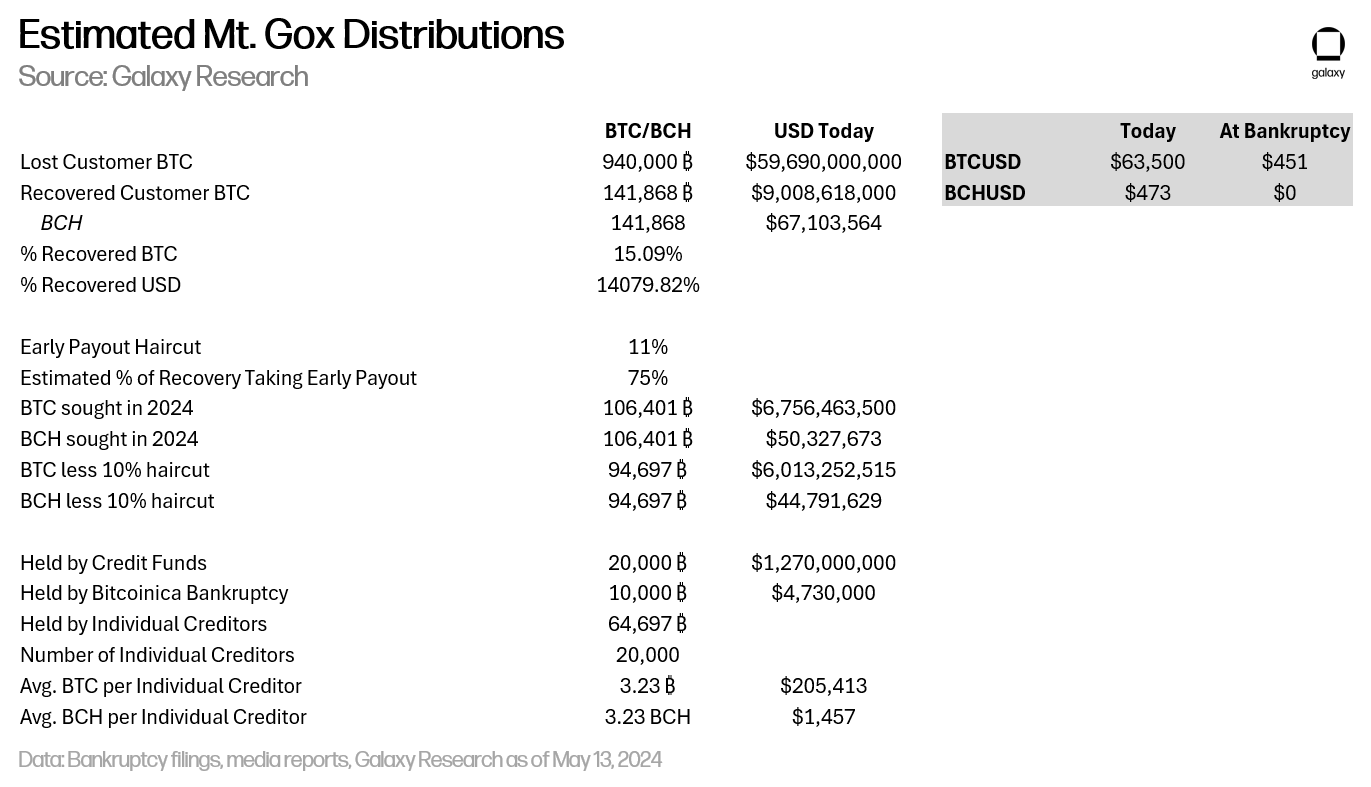

For those unaware, the Japanese cryptocurrency exchange Mt. Gox collapsed in 2014 after losing about 940,000 BTC in a hack. Since then, the exchange has managed to recover 141,687 BTC, worth $8.5 billion. These funds are planned to be distributed to creditors starting next month. Despite the upcoming repayment process causing a stir in the cryptocurrency market, analysts like Tony Sycamore from IG Markets believe that the market has already priced in much of the expected selling pressure.

Sycamore highlighted the difficulty in predicting the exact impact of Mt. Gox repayments due to numerous historical factors. He estimates that about half of the BTC to be repaid (worth approximately $4.5 billion) will enter the market in July. However, he emphasized that the anticipation of these repayments has long been factored into current market conditions.

The Mt. Gox repayments come at a critical time, amid worsening market sentiment, technical sales, and exits from spot Bitcoin ETFs. Many speculators have shifted their investments to more promising stocks like Nvidia and Apple. Despite this, Sycamore pointed out that Bitcoin has found strong support around its 200-day moving average, indicating potential for market recovery.

The analyst also mentioned that the market has already “flushed out” significantly due to the anticipation of Mt. Gox repayments, presenting a good entry point for new investors. Considering the current support levels, he remains optimistic about Bitcoin’s price stability in the coming weeks.

Warning Bells for Bitcoin Cash

Galaxy Digital’s head of research Alex Thorn estimates that only about 65,000 BTC out of the 141,000 BTC will enter the market. Thorn added that approximately 75% of creditors opted for early repayment by forgoing a portion of their repayments. This early repayment decision reduces the initial market impact, with only 95,000 BTC likely to be sold.

Thorn also noted that many Mt. Gox creditors are long-term Bitcoin enthusiasts who resisted selling their claims for years and might prefer to hold onto the BTC they receive rather than cashing out. Additionally, capital gains tax considerations could deter immediate sales. Furthermore, Thorn pointed out that BCH might face greater selling pressure because many investors acquired BCH through the 2017 hard fork rather than direct purchase.

Türkçe

Türkçe Español

Español