Bitcoin (BTC) price decline that started in recent weeks has reached a new level, with the price dropping to $58,500. Although the price has somewhat recovered, uncertainties persist in the market. The “buy the dip” sentiment continues due to the bullish trend reflected by individual investors. An analysis on Binance shows that three out of four trades involve long positions on BTC, leading to views on a potential long squeeze in a short period.

Current Long/Short Market Overview

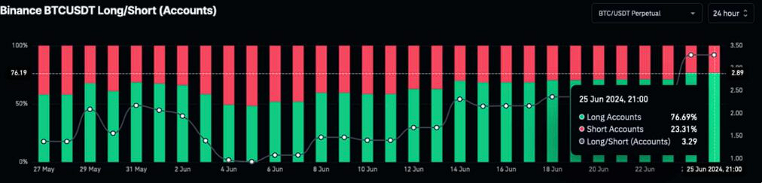

Data from CoinGlass reveals significant information about the 24-hour long/short positions on Binance. The analysis shows that as of June 25, 76.69% of all Bitcoin investors on the largest crypto exchange by volume had taken long positions.

However, a notable difference is observed among individual users. Volume-based analysis indicates a 24-hour long/short ratio showing $8.58 billion in long positions versus $8.67 billion in short positions.

Behavior of Bitcoin Whales

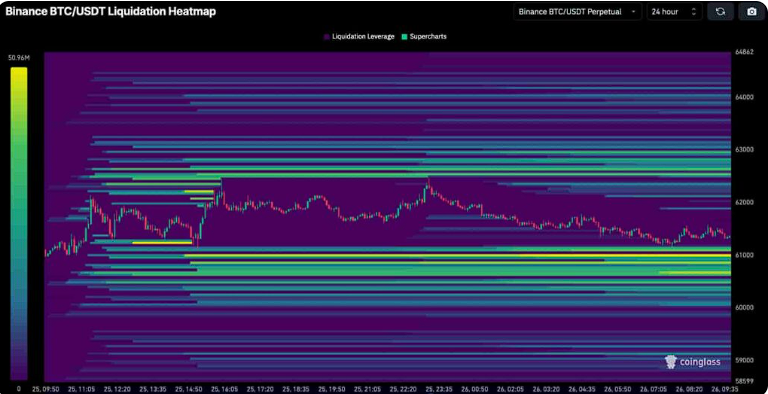

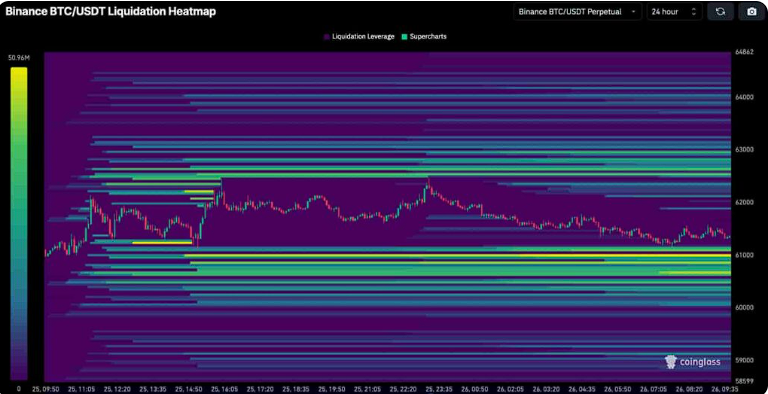

While the mentioned outlook shows a long trend among individual investors, it reveals that whales are moving with a bearish tendency. Therefore, this group of whales might make a significant move, potentially putting pressure on Bitcoin and liquidating individual investors tied to high liquidity in long positions.

Such liquidations could lead to a further drop in BTC price, allowing short-selling Bitcoin whales to make profitable trades. Another analysis on Binance highlights downward liquidity concentrations that whales might target.

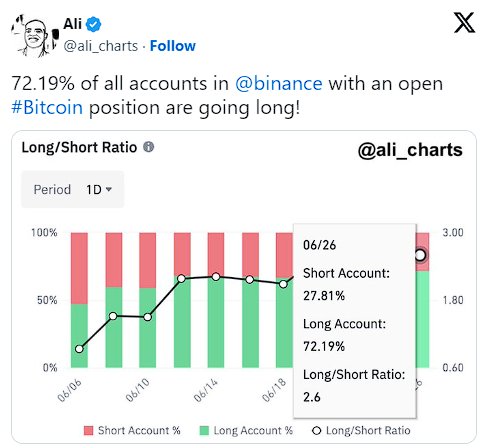

Another notable view was shared by prominent analyst Ali Martinez before the writing of this article. According to Martinez, a similar trend is observed in individual sales focused on Binance. Martinez’s statement on X indicates that 72% of Bitcoin investors trading on Binance have taken long positions.

While these events unfolded, attention was on the Bitcoin price. The Bitcoin price recently dropped from $61,500 to $61,000 following news that the US government sent 4,000 BTC to the Coinbase exchange.

BTC’s market cap stands at $1.2 trillion, while its trading volume fell to $22.6 billion after a 34% decline during this period.