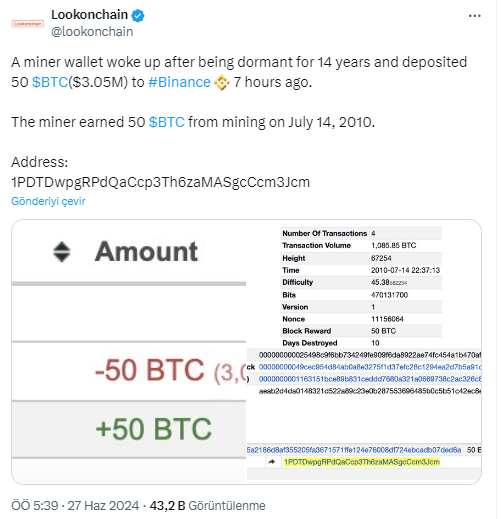

Cryptocurrency mining’s early days saw an inactive Bitcoin wallet recently become active after 14 years. According to blockchain analysis platform Lookonchain, this miner wallet deposited approximately $3.05 million worth of 50 BTC into the Binance exchange. These coins were initially obtained as a mining reward on July 14, 2010, when Bitcoin mining could be done with personal computers and the block reward was up to 50 BTC. When such old wallets become active, speculations arise, and social media commentators suggest connections to Satoshi Nakamoto.

Rare and Noteworthy Transactions for Bitcoin

Such transactions from the early Bitcoin mining days are quite rare. In a similar event in April, another 50 BTC earned on April 23, 2010, was moved for the first time in 14 years. A similar transaction occurred in March, highlighting the infrequent but notable activities of early Bitcoin miners.

In 2010, Bitcoin was trading below $1, which starkly contrasts with its current value of $61,040. The cryptocurrency BTC surpassed the $1 mark in February 2011 and reached $30 in June 2011.

The significant increase in Bitcoin’s value over the years underscores the substantial gains early miners achieved, transforming what was once a modest investment into an asset worth millions of dollars. The reactivation of such old wallets reminds us of Bitcoin’s early days and its evolution from a niche hobby to a major financial phenomenon.

Nostalgia of Early BTC Mining Days

In Bitcoin’s early days, there was no specialized mining hardware, and enthusiasts could mine using regular computers. As Bitcoin’s popularity grew, so did the mining difficulty.

For example, on July 16, 2010, after increased attention to Bitcoin on a well-known technology website Slashdot, the mining difficulty quadrupled. This increased interest and participation marked a significant shift in the cryptocurrency’s mining environment. The resurgence of activity in long-unused wallets reminds us of Bitcoin’s early days and its transformation from a niche hobby to a major financial phenomenon.

Türkçe

Türkçe Español

Español