The hottest topic in the crypto space yesterday was the spot Solana ETFs. The file submitted by VanEck came as a surprise development for the crypto sector. Following the development, Bitcoin rose above $62,000, and Solana saw nearly a 10% increase. At this stage, the partial price improvement also brought some inflows into the spot Bitcoin ETF sector.

Current Status of Spot Bitcoin ETFs

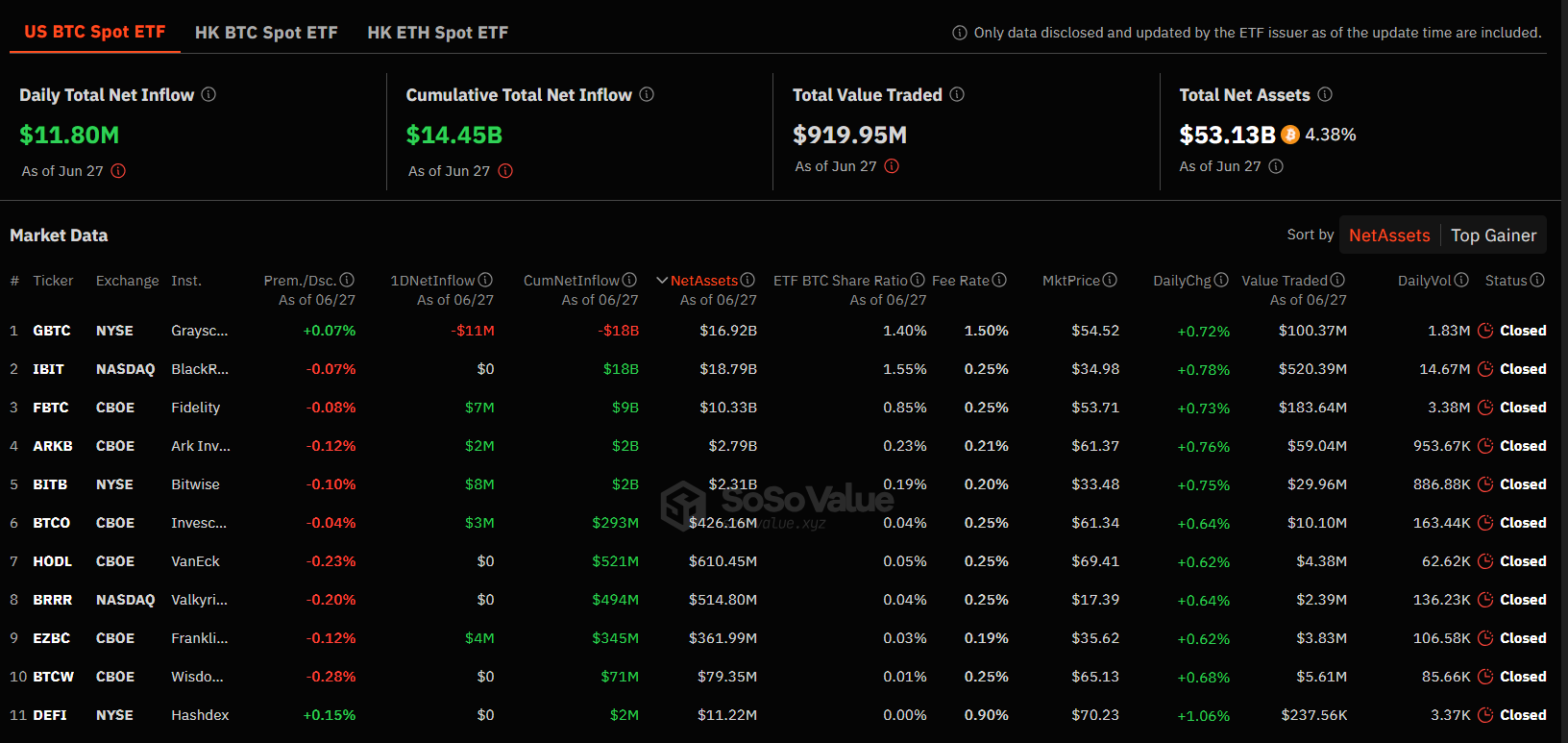

Yesterday, the total inflows into spot Bitcoin ETFs in the US amounted to $11.8 million, a small figure compared to other days. The only ETF with outflows was Grayscale’s Bitcoin ETF, with an outflow of $11 million. With inflows into other ETFs, the day ended in the positive.

Interestingly, there were no inflows into BlackRock yesterday. The previous day also saw no inflows, and the same ETF recorded zero. With zero inflows again, other spot Bitcoin ETFs became the carriers.

Largest Inflow into Bitwise

The largest inflow in the spot Bitcoin ETF sector was $8 million into Bitwise‘s Bitcoin ETF. SoSoValue figures show Fidelity had the second-largest inflow of $7 million.

Franklin recorded a $4 million inflow, Invesco $3 million, and Ark Invest $2 million. Other Bitcoin ETFs saw no inflows and ended the day with zero.

Current Bitcoin Price

At the time of writing, Bitcoin is trading at $61,518. Bitcoin reached a high of $62,389 in the last 24 hours. BTC seems to have quickly returned to its range.

An important factor supporting the Bitcoin price will be the Fed‘s interest rate cuts. However, the earliest these cuts are expected is in December.

Last year, interest rate cuts were expected in May and June 2024, but the timeline has shifted by about 6-7 months. This means the potential bull season for Bitcoin and cryptocurrencies might be delayed or prolonged.