Last month’s weak market performance significantly affected the price of the leading AI-based token Render (RNDR). This situation particularly led to a decrease in activities in the futures market. At the time of writing, Render (RNDR) was trading at $7.62, and the low market activity last month caused a 26% depreciation.

What’s Happening on the Render Front?

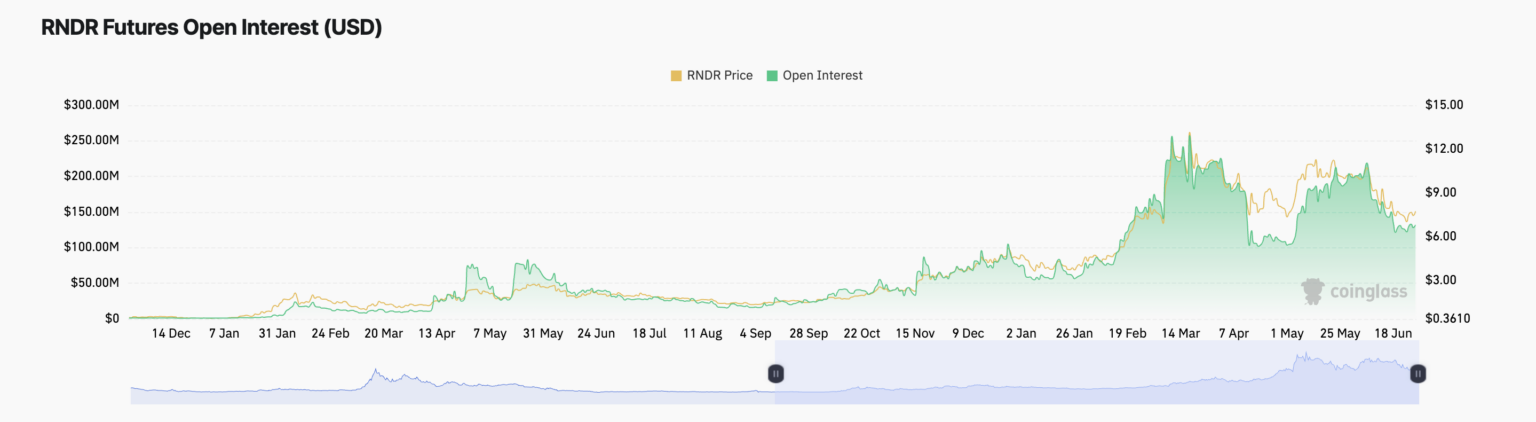

The mentioned price drop forced many traders to exit the futures market, as evidenced by the decrease in open futures positions expected to close at a monthly low in June. As of the time of writing, RNDR’s open futures positions were recorded at $132 million. Since the beginning of the month, there has been a 35% decrease.

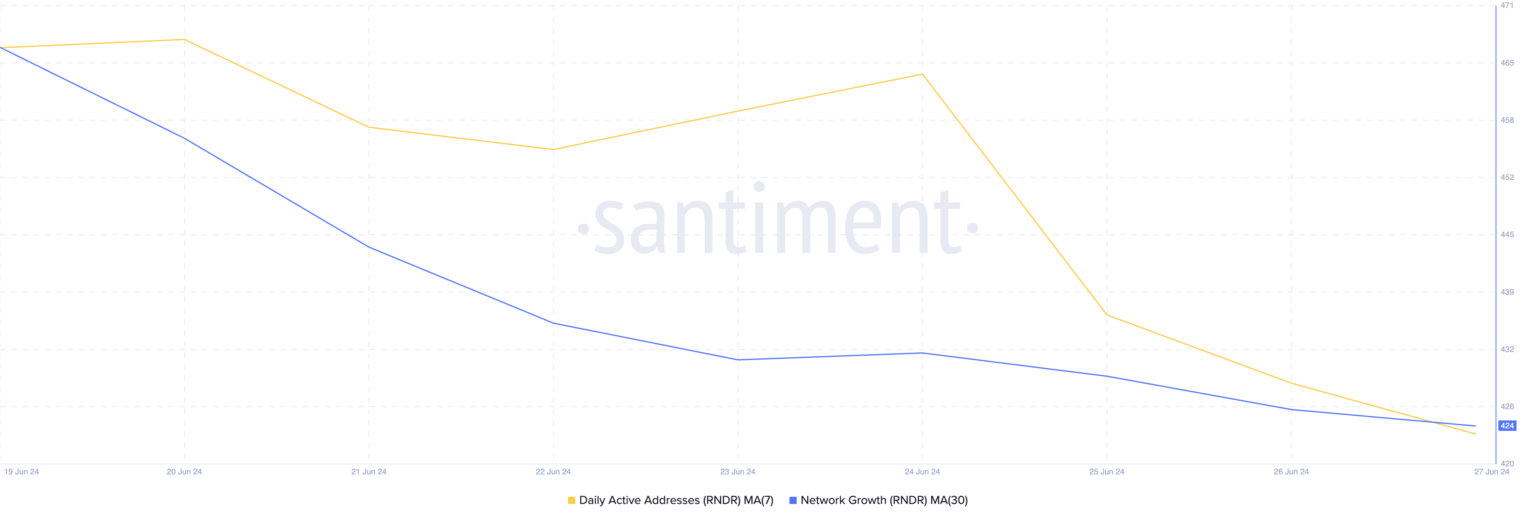

The open interest of a futures asset highlights the value of unpaid or unclosed futures contracts. A decrease in this value indicates that investors are closing their positions without opening new ones. This is a bearish signal indicating a decrease in market activity and investor interest. The decline in interest is seen in the decrease in RNDR’s daily active addresses and new demand for the token.

When evaluated using the 30-day moving average, the number of daily addresses participating in RNDR transactions decreased by 11% last month. Similarly, new demand for the AI token also decreased. During the same period, the number of new addresses created daily for RNDR trading decreased by 9%.

RNDR Chart Analysis

The decline in RNDR’s price seems to be losing momentum, so a potential recovery might occur. According to the token’s Aroon Down Line readings, its value was recorded at 28.57% at the time of writing. The Aroon Indicator defines an asset’s trend strength and potential price reversal points. When the bottom line is close to zero, the downtrend is weak, and the asset’s most recent price was reached a long time ago. This is usually considered a sign of a potential trend reversal.

If RNDR recovers, it could trade at the $7 level and rise to the $7.9 price level in the future. However, if the current downtrend continues, its price could drop to $6.67.

Türkçe

Türkçe Español

Español