Bitcoin, 60,000-dollar support strength doubts continued on June 28 as US macro data received little attention. TradingView data showed Bitcoin price movement revolving around the range below 61,000 dollars after the Wall Street opening. The latest release of the Personal Consumption Expenditures (PCE) Index, known as the Fed’s preferred inflation gauge, aligned with overall expectations.

US Data and Bitcoin

At an annual rate of 2.6%, core PCE reflected the lowest value since March 2021. While lower PCE data was expected, a popular investor, Skew, responded on X, stating that personal income was slightly higher than expected but personal spending slowed, and described the figures as quite good.

Bitcoin and altcoins barely moved on the PCE, while Skew noted that the drop in retail clothing sales, along with a 17% drop in Nike’s shares, could potentially be a future volatility factor and shared the following statement:

“The US market will still focus on the September rate cut under Trump’s presidency and how this will look/affect industries.”

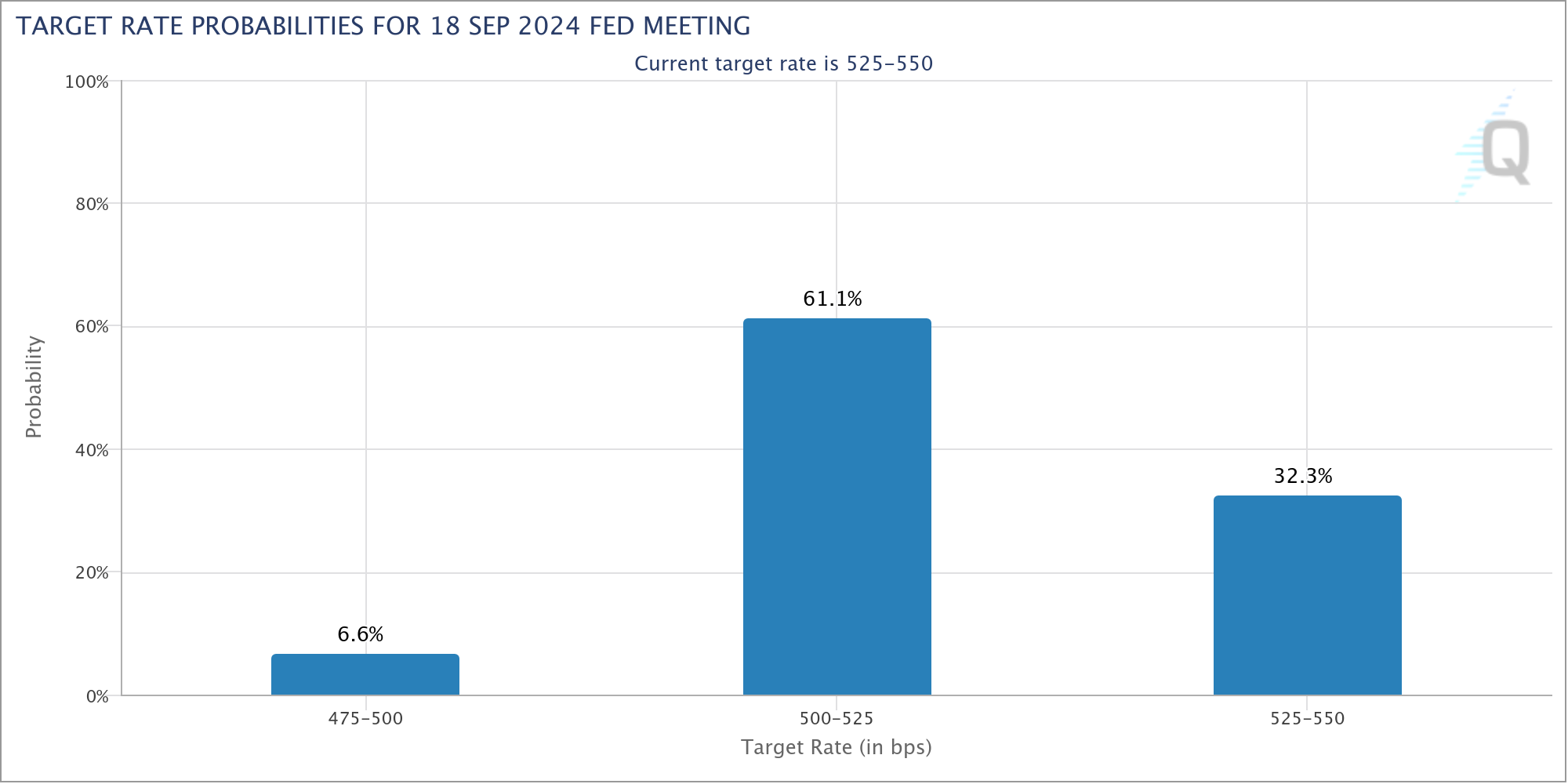

Regarding the topic, market sentiment continues to lean towards the Federal Reserve lowering interest rates at the Federal Open Market Committee’s (FOMC) September meeting; this would be a significant liquidity event for risk assets and cryptocurrencies. The latest data from CME Group’s FedWatch Tool reveals that the probability of a rate cut for the day is approximately 68%.

What’s Happening on the Bitcoin Front?

Turning to Bitcoin, investors saw little change in conditions as the BTC/USD pair moved sideways above the 60,000-dollar level. Popular investor and analyst Rekt Capital shared the following statements with his X followers along with an explanatory chart:

“Bitcoin closed below the Daily Bull Flag peak, so it is still subject to additional consolidation within the formation, but the price is just one daily close above a breakout of the bull flag peak.”

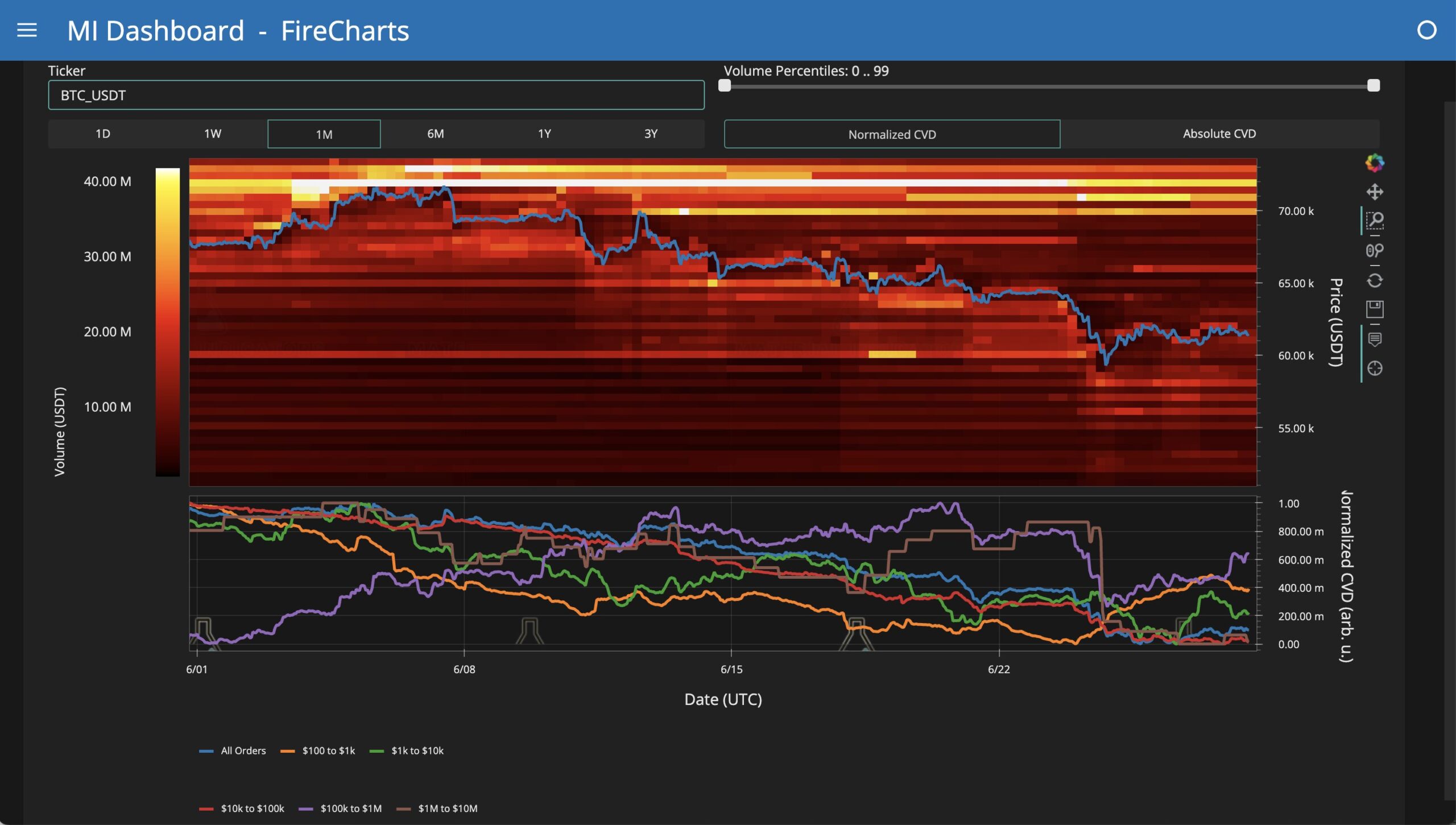

However, data from Material Indicators reveals a concerning situation in terms of the trading process. Analysts warned that bid support below 60,000 dollars has dissipated and shared the following statements regarding an output of the BTC/USDT order book liquidity of the largest global exchange Binance:

“FireCharts shows a block of Bitcoin bid liquidity extending up to 60,000 dollars, but the support ladder below this is thinning. We expect more volatility until the monthly close.”

Türkçe

Türkçe Español

Español