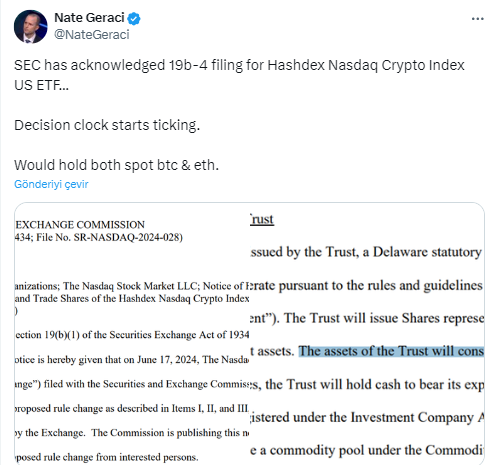

The U.S. Securities and Exchange Commission (SEC) has accepted Hashdex’s 19b-4 application for the Nasdaq Crypto Index U.S. ETF. This ETF aims to include both Bitcoin (BTC) and Ethereum (ETH) in its portfolio, marking a significant development in the cryptocurrency investment landscape. If approved, the ETF is expected to launch in March 2025.

Importance of the 19b-4 Filing for the Crypto Space

The 19b-4 filing under the 1934 Securities Exchange Act is a regulatory procedure detailing the review and approval process for certain types of Exchange-Traded Funds (ETFs).

This application facilitates a comprehensive evaluation by the SEC, ensuring that submissions meet regulatory standards. The acceptance of Hashdex’s application by the SEC indicates a step forward in the approval process for this ETF.

Hashdex’s Strategic Move

Hashdex, a recognized name in the cryptocurrency investment field, previously attempted to launch a spot Ethereum ETF but withdrew the proposal due to a competitive market. This new ETF proposal represents a strategic shift towards a combined Bitcoin-Ethereum approach.

The fund’s allocation is planned to reflect a balanced approach to the two leading cryptocurrencies, with 70.54% in Bitcoin and 29.46% in Ethereum. Hashdex aims to ensure robust security measures by collaborating with Coinbase Custody Trust Company and Bitcoin Trust for the safe custody of these assets.

By including both Bitcoin and Ethereum, Hashdex aims to attract a broader investor base and meet the growing demand for diversified crypto investment options. Public opinion on the ETF will play a crucial role in the SEC’s final decision, and despite initial positive reception, it may face delays based on feedback and scrutiny.

Potential Milestone for Investors

Investors should closely follow this development as it represents a potential milestone in bridging traditional financial markets with the cryptocurrency sector. The approval of a spot Bitcoin-Ethereum ETF would signify substantial regulatory endorsement of cryptocurrencies and potentially pave the way for more widespread adoption.

Industry experts, including Nate Geraci, expect interest and scrutiny to increase as the SEC’s decision date approaches. This growing interest already indicates the broad impacts such an ETF could have on the future of crypto investments and the regulatory landscape.

Türkçe

Türkçe Español

Español