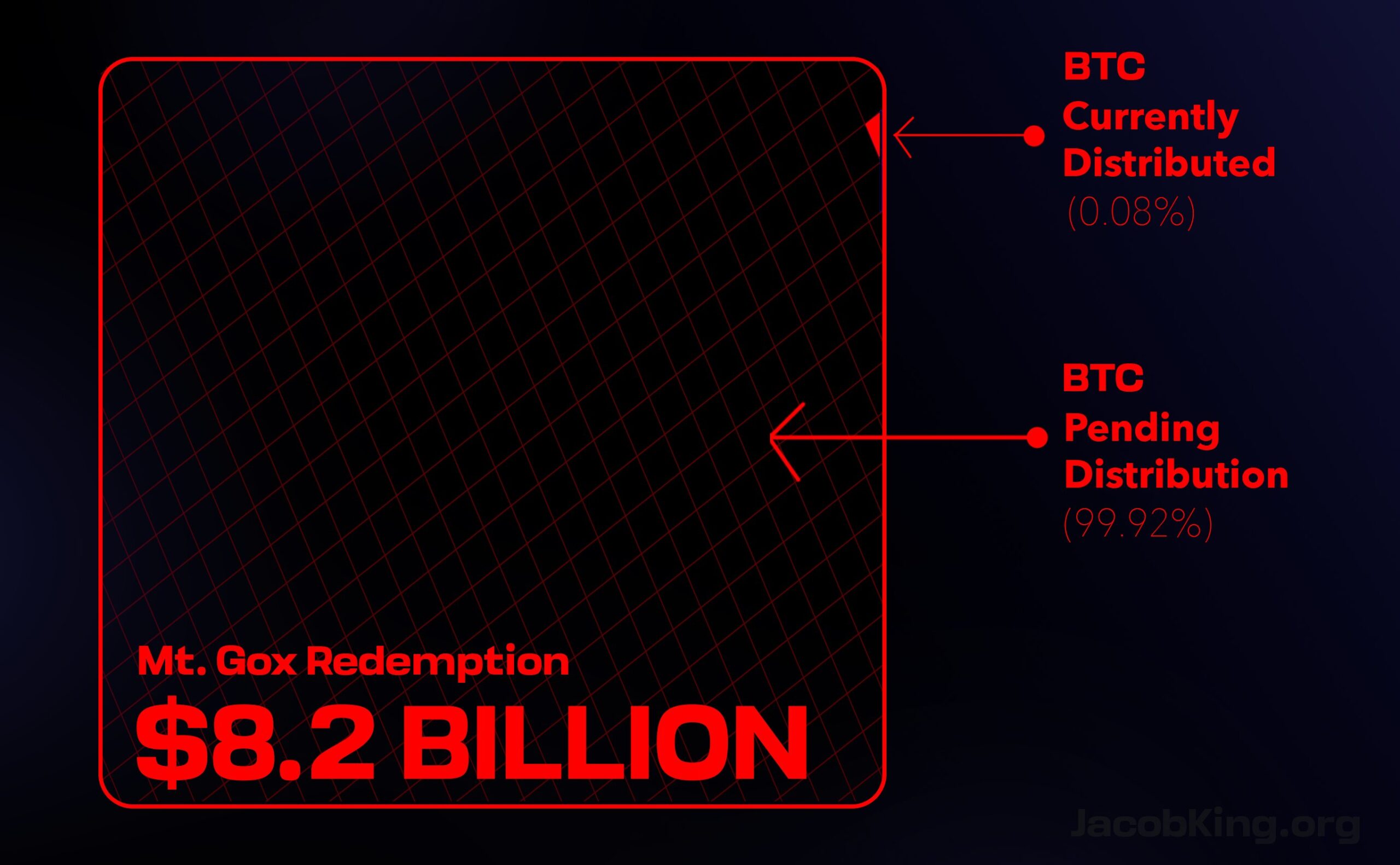

A large portion of the Bitcoin repaid by the bankrupt Japan-based exchange Mt. Gox will be sold on the market, posing a threat of increased downward pressure on Bitcoin. Financial analyst Jacob King suggests that Mt. Gox repayments could add $8.2 billion worth of additional selling pressure to Bitcoin’s price.

What’s Happening with Mt. Gox?

King, in a July 4th X post, pointed out that on-chain movements indicate Mt. Gox creditors have already started selling, sharing the following statement:

“No investor will say this out loud, but most of the $8.2 billion worth of Bitcoin to be distributed to former customers will be sold.”

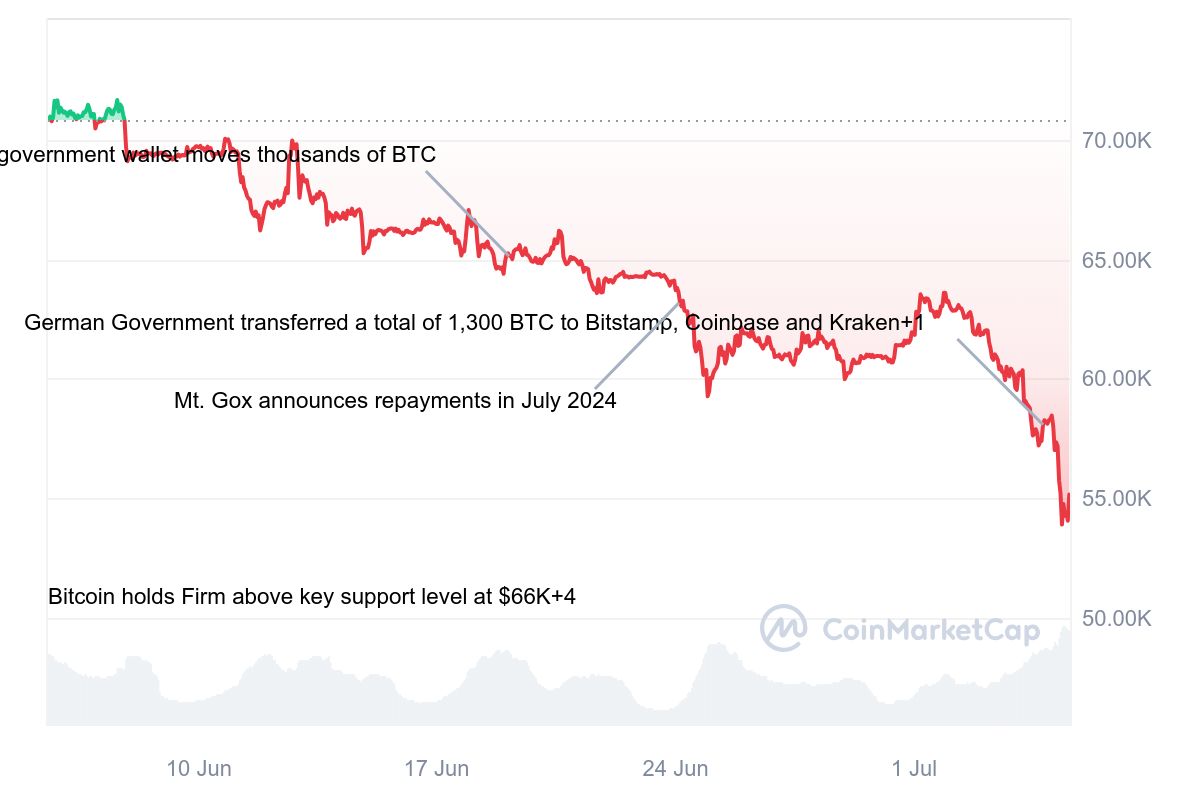

This grim prediction came hours after the bankrupt cryptocurrency exchange announced on July 5th that Mt. Gox had begun repaying its debts in Bitcoin and Bitcoin Cash. The predictions raise concerns about Bitcoin’s price, which has been struggling to gain momentum for over a month and is currently trading below $60,000.

Bitcoin was in a downtrend throughout June, experiencing a loss of approximately 18% in the second quarter of 2024. However, analysts suggest that market sales by Mt. Gox creditors could potentially push Bitcoin back into bear market territory:

“I understand this is controversial, but given the current low demand volume, this situation could easily send Bitcoin back into a severe bear market.”

Details on the Matter

Bitcoin price dropped 3.9% in the last 24 hours, trading at $55,250. According to CoinMarketCap data, the world’s first cryptocurrency saw a decline of over 10% on the weekly chart. Despite the potential selling pressure, the repayments are a positive development for the sector and the exchange’s users. This sentiment is echoed by Mt. Gox’s former CEO Mark Karpelès, who emphasized this in a July 5th X post:

“Mt. Gox customers have finally started receiving Bitcoin! After more than 10 years, I wasn’t sure if this would ever happen, but here we are at last. It has been a long journey, and I’m happy to see we’ve finally made it, just a little bit more to go.”

Türkçe

Türkçe Español

Español