According to CryptoQuant’s data, although the supply of Ethereum (ETH) is increasing, the amount staked is approaching record levels. As discussions about a spot exchange-traded fund (ETF) in the US progress, Polymarket bettors are pumping confidence into the market with a 90% chance of approval by July 26. Currently, only a few regulatory steps remain for spot Ethereum ETF trading to begin.

27.7% of Total Supply Staked

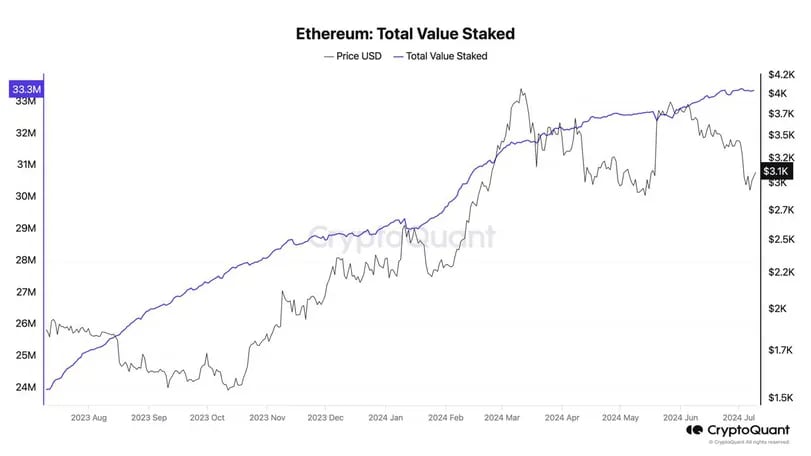

With the potential approval of a spot Ethereum ETF in the US, the amount of staked ETH has approached an all-time high, helping to maintain the circulating supply despite the increasing total supply. CryptoQuant’s research director Julio Moreno highlighted that the total staked ETH amount is 33.3 million or 27.7% of the total supply, indicating that a significant portion of ETH’s supply is staked.

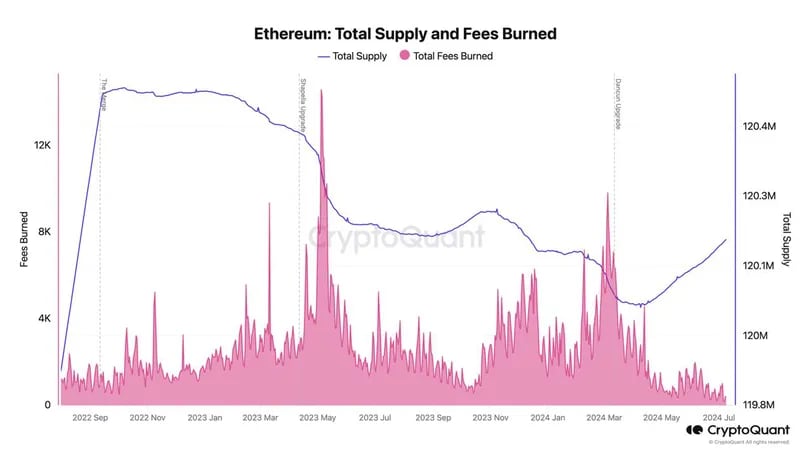

The increasing supply indicates that ETH is becoming an inflationary asset, potentially weakening its ability to act as a long-term store of value, but interest in staking mitigates these negatives. In the Ethereum ecosystem, staking and burning transaction fees are two mechanisms used to counter this inflation. For those unfamiliar, staking involves locking ETH for a fixed period, while burning transaction fees involves permanently removing a portion of ETH used as transaction fees from circulation.

Moreno added that although ETH’s supply is increasing, the narrative of “ultra-sound money” has ended. Currently, the total supply is at its highest level since December 11, 2023, but ETH remains liquid, with spot trading volume rising to 80-90% of Bitcoin’s (BTC) in recent weeks.

CoinMetrics data reveals that approximately 12% of ETH’s supply is used in smart contracts or bridges connecting different blockchains. When combined with staked ETH, this means around 40% of the circulating supply is “locked” and not actively traded, affecting its liquidity and trading dynamics.

Eyes on Spot Ethereum ETFs

Meanwhile, Invesco and Galaxy’s spot Ethereum ETFs awaiting SEC approval have led to comments about intense competition in the spot Ethereum ETF space, with VanEck announcing a management fee slightly higher than Invesco and Galaxy’s 0.20%, at 0.25%. However, the SEC must first provide feedback on the pending applications, and issuers must submit final amended forms with necessary details before trading can commence.

On the Kalshi platform, bettors give a 65% chance that Ethereum will outperform Bitcoin after ETF approval and are 95% confident that Ethereum will reach an all-time high before Bitcoin, reflecting ongoing market sentiment and expectations regarding the future performance of the leading two cryptocurrencies.

Türkçe

Türkçe Español

Español