PEPE price’s lack of momentum for recovery has led to potential profit exhaustion. Memecoin enthusiasts remain hopeful for recovery, which could be possible if a significant resistance level is breached. Trading at $0.00000881, PEPE price remains below $0.00001000, awaiting a bullish trigger to initiate an uptrend.

What is Happening with PEPE?

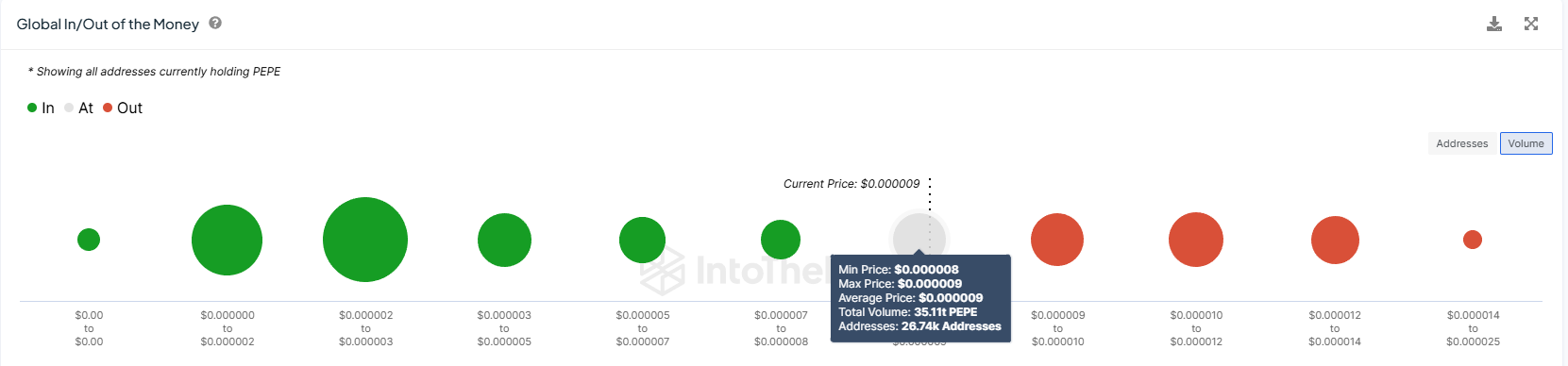

This process will be beneficial for investors as profits remain uncertain due to the popular memecoin‘s consolidation. According to the Global In/Out of the Money (GIOM) indicator, approximately 70 trillion PEPE worth over $617 million were purchased between $0.00000800 and $0.00000990. This supply will only become profitable if PEPE price secures the $0.00001000 level as a support base.

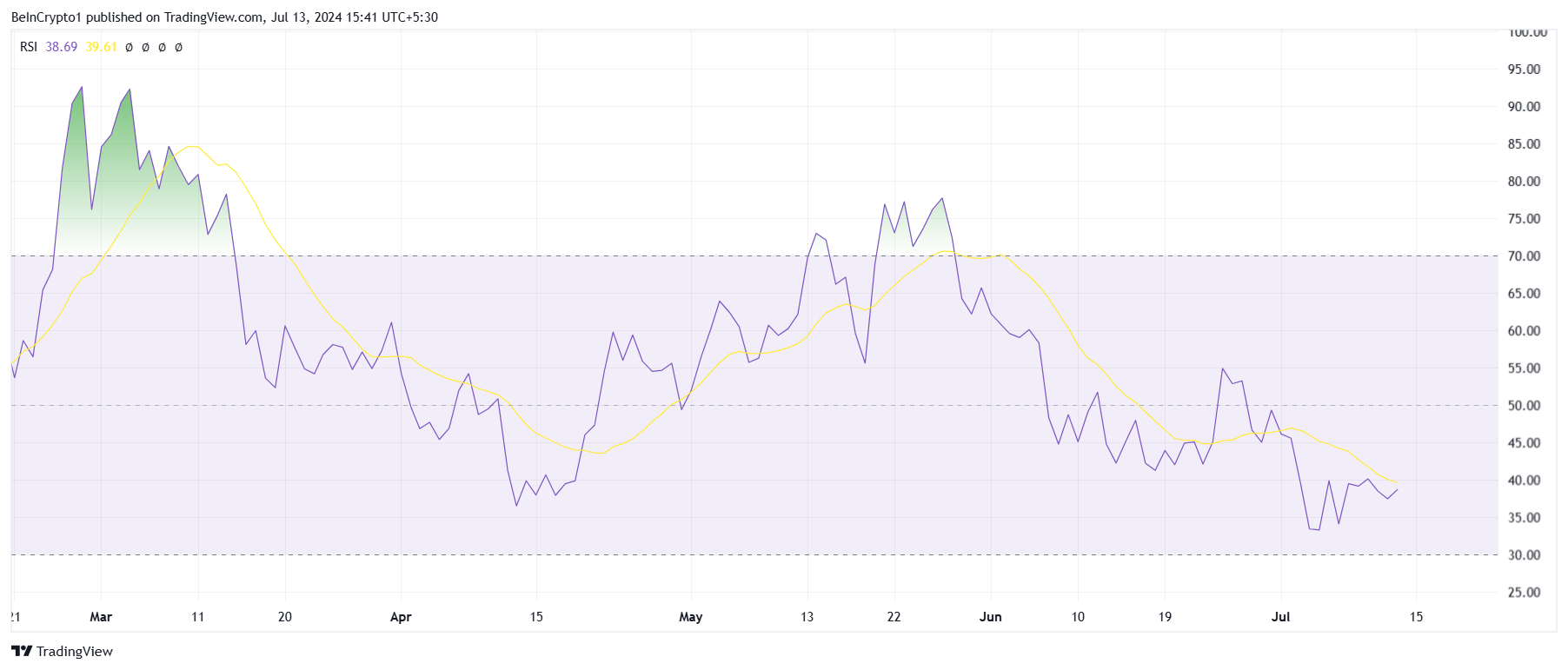

However, despite the potential for significant profits, demand is currently not high, as seen in the Relative Strength Index (RSI). The bullish momentum in the RSI appears weak, indicating that buying interest is not strong enough to sustain upward price movement. Weak RSI momentum typically suggests that the asset may struggle to gain more ground and may encounter resistance in maintaining a bullish trend. Additionally, the market is currently dominated by selling pressure. Due to this selling pressure, purchases remain weak, causing prices to move downward.

This selling pressure neutralizes potential gains from bullish momentum and creates an environment where further price declines are more likely. The dominance of sellers in the market is a significant factor contributing to the weakening RSI levels and the overall bearish outlook for PEPE.

PEPE Chart Analysis

PEPE price can only turn $0.00001000 into support and escape consolidation when demand is high. Currently, with weak overall market signals, recovery may take longer. This will keep profits away from investors and ensure consistent green candlesticks until the breach occurs.

This process could lead to an increase to $0.00001146 for PEPE. On the other hand, a drop to $0.00000775 means the memecoin project will remain consolidated. This could invalidate the bullish thesis and leave the memecoin vulnerable to further declines.

Türkçe

Türkçe Español

Español