The once-prominent Mt. Gox exchange suffered a massive attack involving hundreds of thousands of Bitcoin (BTC) in 2014, leading to its collapse. After a decade, the exchange has taken significant steps and initiated the repayment process. However, this development has raised questions among market followers and investors, as there is speculation that creditors might sell the BTC they receive.

Developments on the Mt. Gox Front

Arkham provided Blockchain data showing two notable Bitcoin transactions by Mt. Gox. The first transaction, typically done as a test before larger movements, involved sending 0.021 BTC.

Following this, a massive transaction of 44,527 BTC, valued at approximately $2.84 billion, took place. Comments on these transactions suggested that the exchange was preparing to repay its creditors.

Similarly, on July 4, a wallet address known to be associated with Mt. Gox transferred 47,000 BTC, valued at around $2.7 billion, to another address.

Two more transactions followed. These involved sending 1,544 BTC ($84 million) to Bitbank and 1,200 BTC ($64 million) to another wallet.

Bitcoin Price Update

Following these transactions, Bitcoin’s price dropped from just below the $65,000 region to under $63,000 due to fears of selling. BTC’s price later recovered and surpassed the $65,000 level multiple times today. At the time of writing, BTC is valued at $64,670.

Meanwhile, a wallet known to belong to Mt. Gox holds 138,985 BTC, valued at $8.87 billion at the time of writing. The distribution of 142,000 BTC, part of the repayment plan, is being closely monitored.

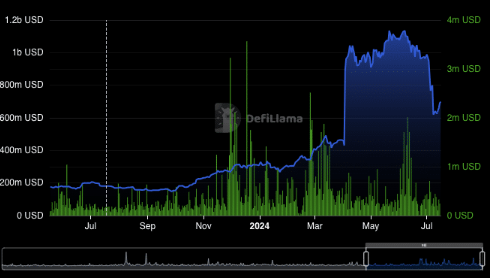

The Total Value Locked (TVL), a significant indicator for Bitcoin, reached its peak at $1.2 billion in May 2024 but later dropped to $699.04 million.

Despite this low level, Bitcoin remains active with 787,506 active addresses transacting in the last 24 hours. Considering all these factors, interest in BTC continues to grow, while investors face fears of potential massive sales. Whether creditors will quickly sell the BTC they receive is unknown, but it is clear they exert significant pressure on the market.

Türkçe

Türkçe Español

Español