According to a report published by the crypto data platform CoinGecko, the cryptocurrency market experienced a notable decline in the second quarter of 2024 after reaching near all-time highs in the first quarter. The total market value of cryptocurrencies fell by 14.4%, dropping to $2.43 trillion by the end of June. This decline contrasts with the 3.9% rise in the S&P 500 during the same period, indicating a significant divergence in market behavior. The correlation between the total crypto market value and the S&P 500 dropped dramatically, signaling different market dynamics.

The Second Quarter Was Challenging for Bitcoin

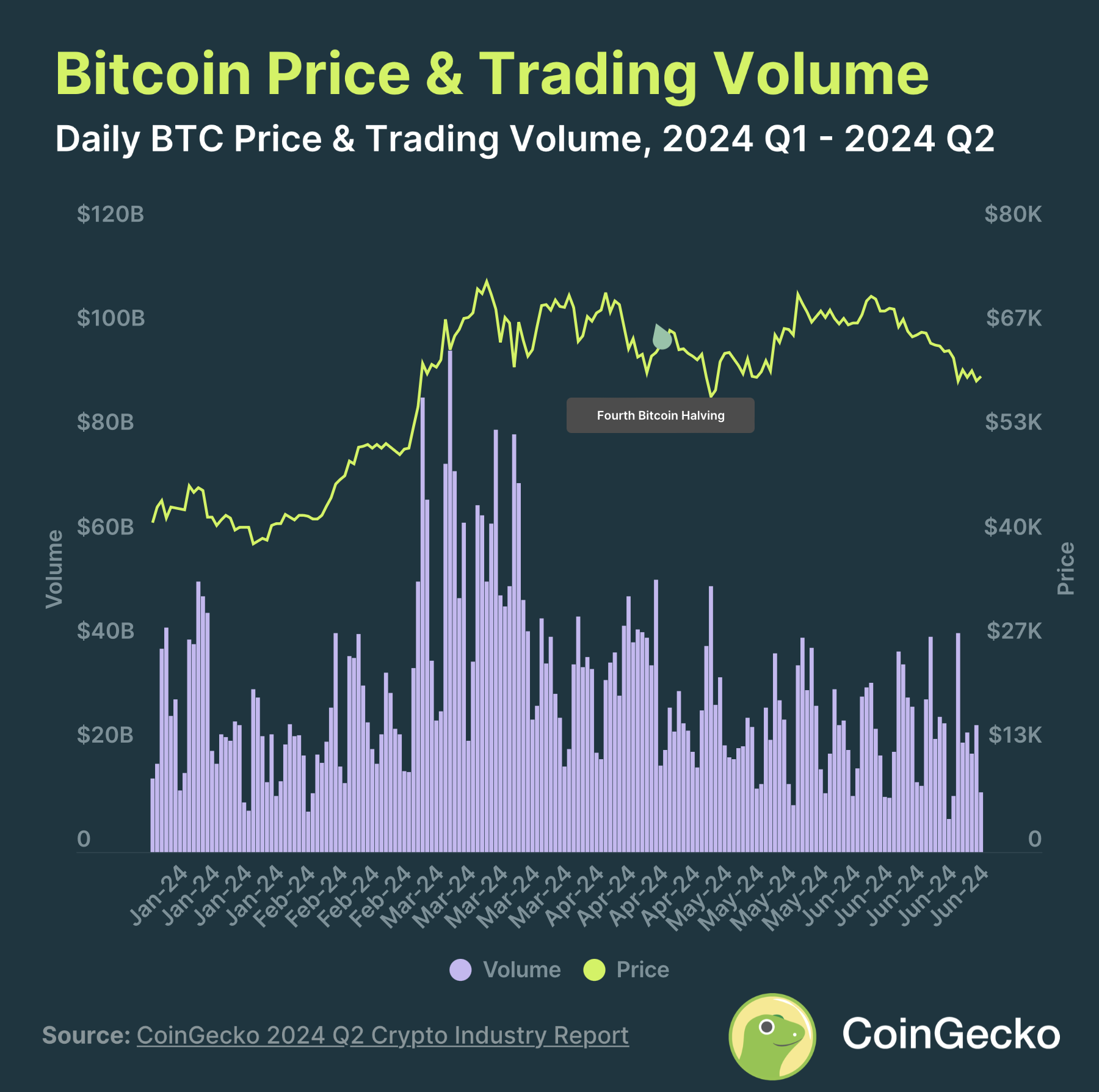

In March, Bitcoin reached an all-time high of $73,750 but faced a challenging quarter. It closed the second quarter with an 11.9% drop, ending at $62,734. Despite the eagerly anticipated fourth block reward halving, the market’s response was muted.

Trading volumes also significantly decreased, with average daily volumes dropping by 21.6%. Market sentiment was heavily impacted by large Bitcoin movements from Mt. Gox and the German government’s sale of approximately 50,000 BTC seized in a January operation.

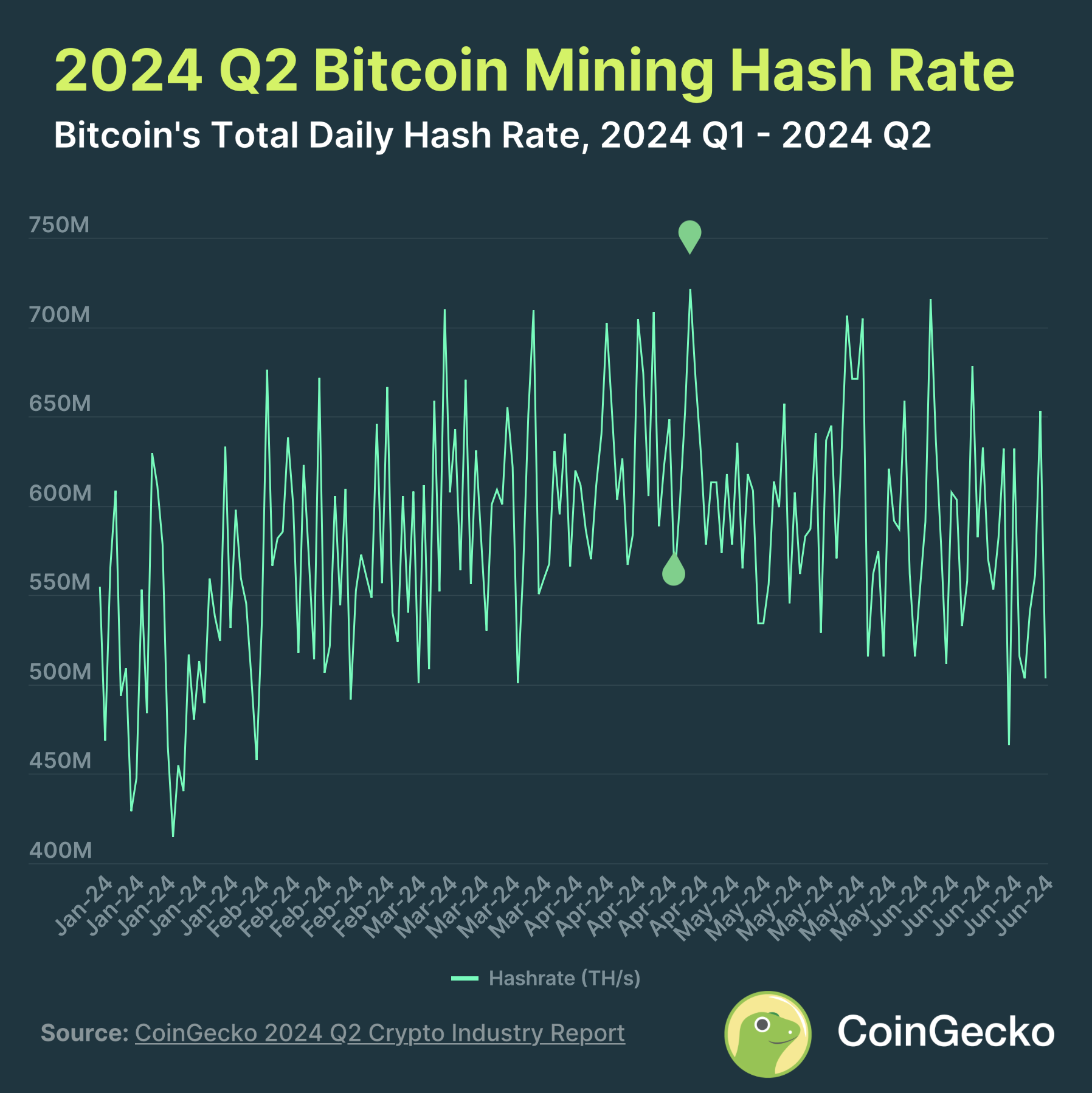

Bitcoin mining sector also experienced significant changes. After reaching an all-time high hash rate of 721 million TH/s in April, the total hash rate fell by 18.8% by the end of the second quarter. This decline was the first since the second quarter of 2022.

Despite this decline, the mining sector witnessed significant investments and expansions, including Tether’s $500 million investment and Block’s development of a new mining chip.

Memecoins Continued to Attract Significant Interest in Q2

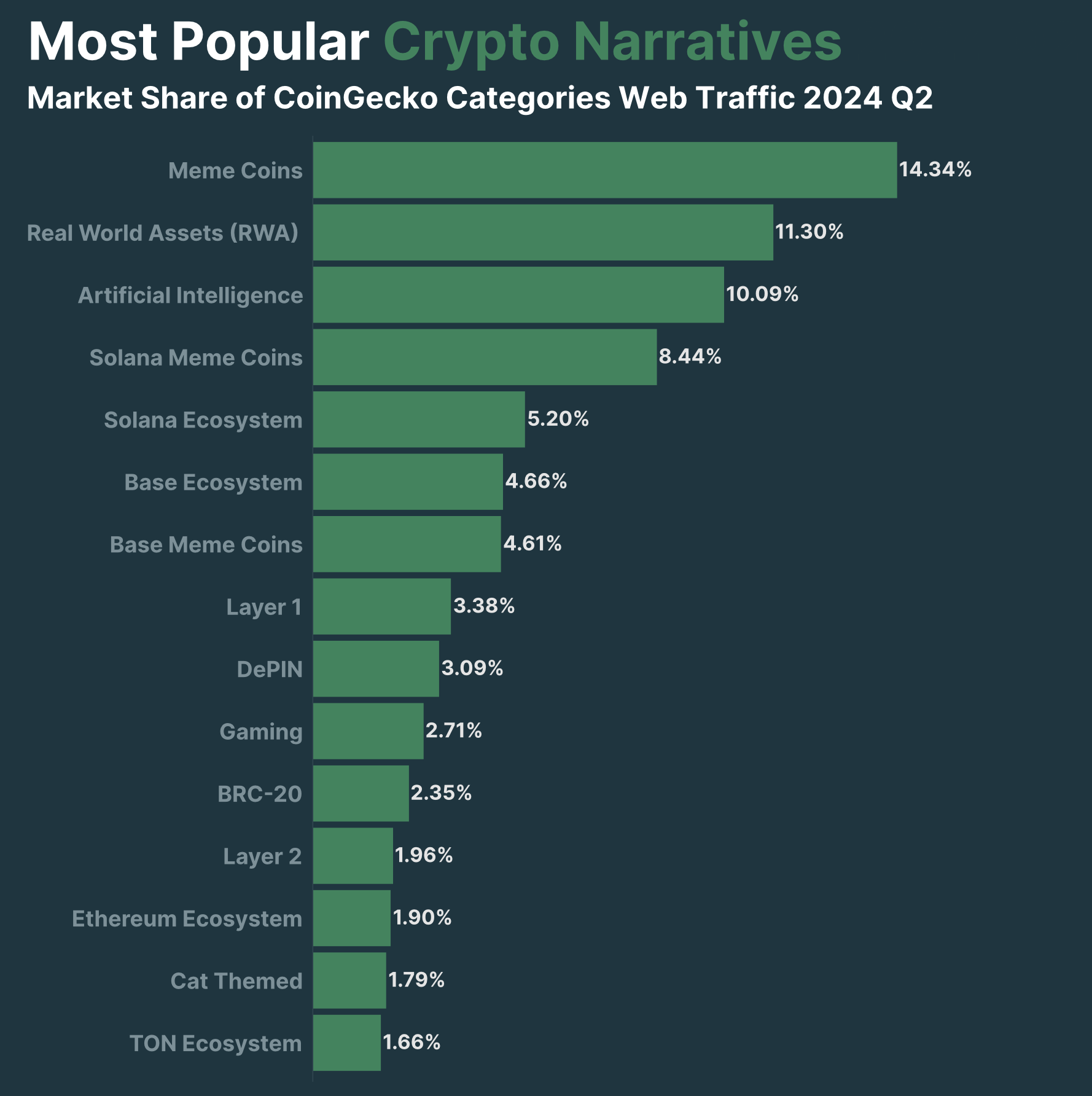

Memecoins continued to attract significant interest in the second quarter, maintaining their position as the most popular narrative. Alongside memecoins, Real World Assets (RWA) and Artificial Intelligence (AI) together accounted for 35.7% of market share, becoming other leading narratives. Solana and Base emerged as the most popular Blockchain ecosystems, garnering significant attention.

The network of the altcoin king Ethereum became inflationary in the second quarter, adding over 120,000 ETH to its circulating supply. The burn rate of ETH significantly dropped due to decreased network activity and low gas fees. Only a few days in the second quarter saw ETH burns exceeding emissions, a stark contrast to the first quarter.

Centralized Exchanges’ Spot Trading Volume Fell by 12.2%

The spot trading volume of centralized exchanges (CEXs) fell by 12.2%, dropping to $3.40 trillion. Binance remained the largest CEX, while Bybit rose to become the second-largest exchange. In contrast, decentralized exchanges (DEXs) saw a 15.7% increase in trading volumes, driven by the popularity of memecoins and various AirDrops.

Uniswap maintained its dominance among DEXs, but new DEXs like Thruster and Aerodrome made significant gains, reflecting the dynamic and evolving nature of the crypto trading environment.