Bitcoin (BTC), with its recent price increase from $55,000 to $65,000, has once again captured global attention. During this rise, artificial intelligence algorithms also showed a positive outlook, suggesting further price increases in the future. The impact of political events on Bitcoin’s price was evident, with the recent price surge possibly influenced by a failed attack on Donald Trump, a vocal Bitcoin supporter and former U.S. President.

Bitcoin Analysis

In a world where artificial intelligence is increasingly influential, their price predictions are gaining strength. According to data from PricePredictions on July 18, Bitcoin could reach $68,953.45 by August 1, 2024.

The AI algorithm considered indicators like Bollinger Bands (BB), Moving Average Convergence Divergence (MACD), and Average True Range (ATR). If the prediction is accurate, Bitcoin could see a 6.16% price increase from its current value.

Renowned market expert Michaël van de Poppe recently stated that Bitcoin has been “consolidating nicely in a four-month range” and will continue its upward movement if it stays around $60,000.

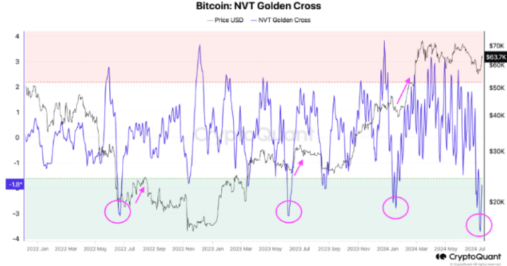

The analyst noted that the NVT ratio, a key Bitcoin indicator, has dropped to “the lowest negative figure in the last 2.5 years,” suggesting the correction is over. In his July 18 post, he advised, “fasten your seatbelts.”

Current Bitcoin Price

At the time of writing, BTC had dropped 1.54%, settling at $64,000. The market cap fell to $1.26 trillion, with a trading volume of $27.8 billion.

The reason for Bitcoin’s decline is currently unknown, but recent reports suggested Joe Biden might withdraw his candidacy. Given AI’s 30-day prediction of $70,188, which is above the previous ATH, investors remain optimistic about a price increase.

However, potential market downturns due to other negative events should not be overlooked. Earlier today, SHIB suffered a 10% drop due to a stock exchange attack and potential selling pressure.

Türkçe

Türkçe Español

Español