A North Korean-linked hacker converted most of the $230 million stolen from WazirX into Ethereum (ETH) and currently holds $200 million in this cryptocurrency. This major hack significantly impacted WazirX‘s liquidity and the prices of listed cryptocurrencies, causing a notable 40% drop in the exchange’s WRX token in the last 24 hours.

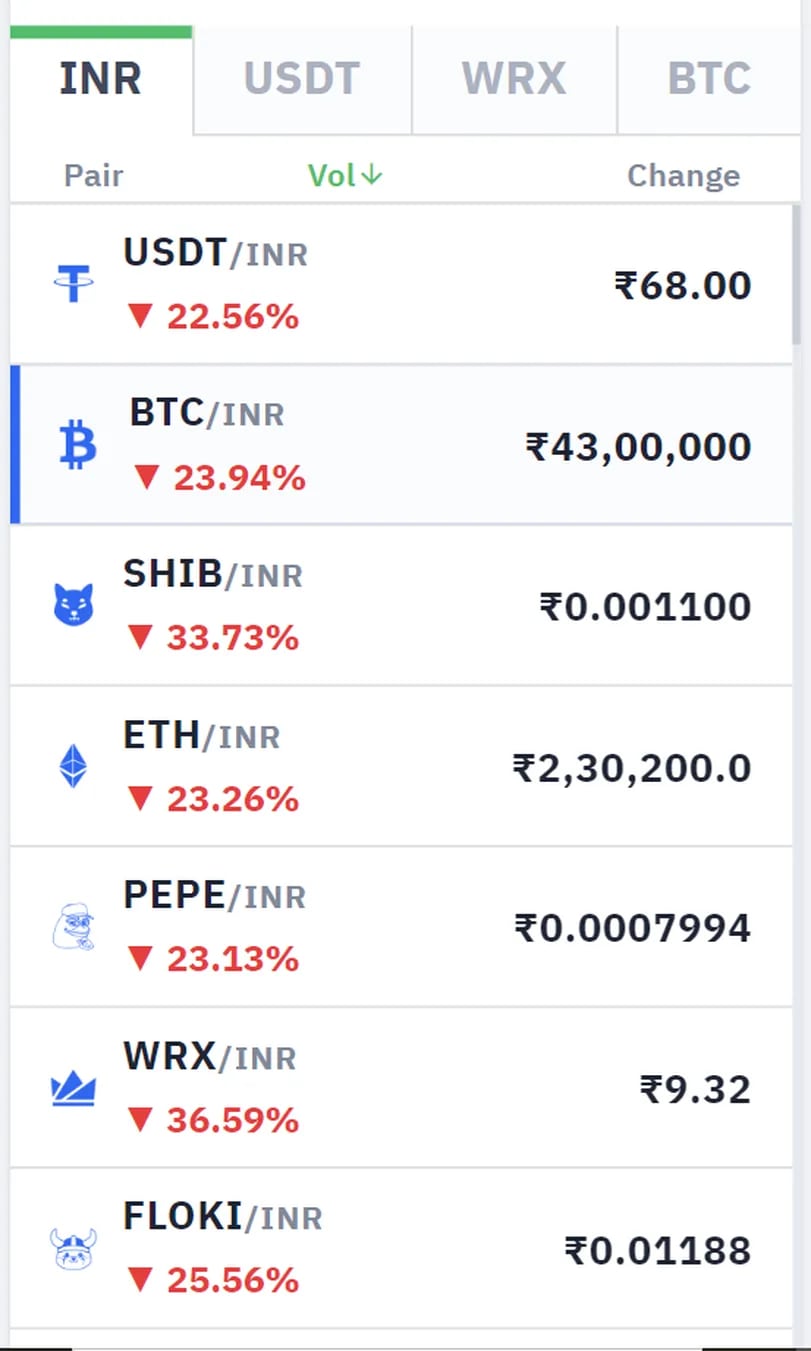

Cryptocurrencies Listed on WazirX in a Bloodbath

Blockchain tracker Lookonchain reported that the hacker holds 59,097 ETH worth $200 million, along with $15 million in various other cryptocurrencies.

Currently, cryptocurrencies listed on WazirX are trading at significant discounts compared to their global and local prices, indicating weak liquidity and significant selling pressure on the exchange. For example, the Bitcoin/rupee trading pair on WazirX dropped 22% in the last 24 hours, while other local exchanges like CoinDCX and Zebpay saw only a 2% decline.

Similarly, the Shiba Inu/rupee trading pair fell by 30%. The 40% drop in the WRX token is particularly notable in these market conditions. Despite this, the exchange’s trading volume significantly increased from $2.2 million on Wednesday to $8 million in the last 24 hours.

Reason for the Hack Explained

The hack on July 18 targeted one of WazirX’s multisig wallets, stealing over $100 million in Shiba Inu and $52 million in Ethereum among other cryptocurrencies. The stolen funds represent more than 45% of the exchange’s total reserves as reported in June 2024, significantly undermining user confidence and recovery expectations.

WazirX explained that the hack involved a discrepancy between the information displayed on Liminal‘s interface and the actual signed information, with the payload altered to transfer wallet control to the attacker. However, this explanation was met with skepticism within India’s cryptocurrency market. Leading crypto YouTuber Pankaj Tanwar and others questioned the adequacy of WazirX’s security measures and compliance practices.

In response to the hack, WazirX temporarily halted both crypto and fiat withdrawals. The incident raised concerns about security protocols and trust in the exchange, potentially causing long-term damage to India’s cryptocurrency market.

Türkçe

Türkçe Español

Español