Bitcoin (BTC) mining hash rate showed remarkable resilience despite recent market disruptions, including CrowdStrike’s failure. This stability coincided with a significant recovery in BTC’s price, indicating a robust rebound in mining activities and market value for the largest cryptocurrency.

Bitcoin Hash Rate and Mining Difficulty

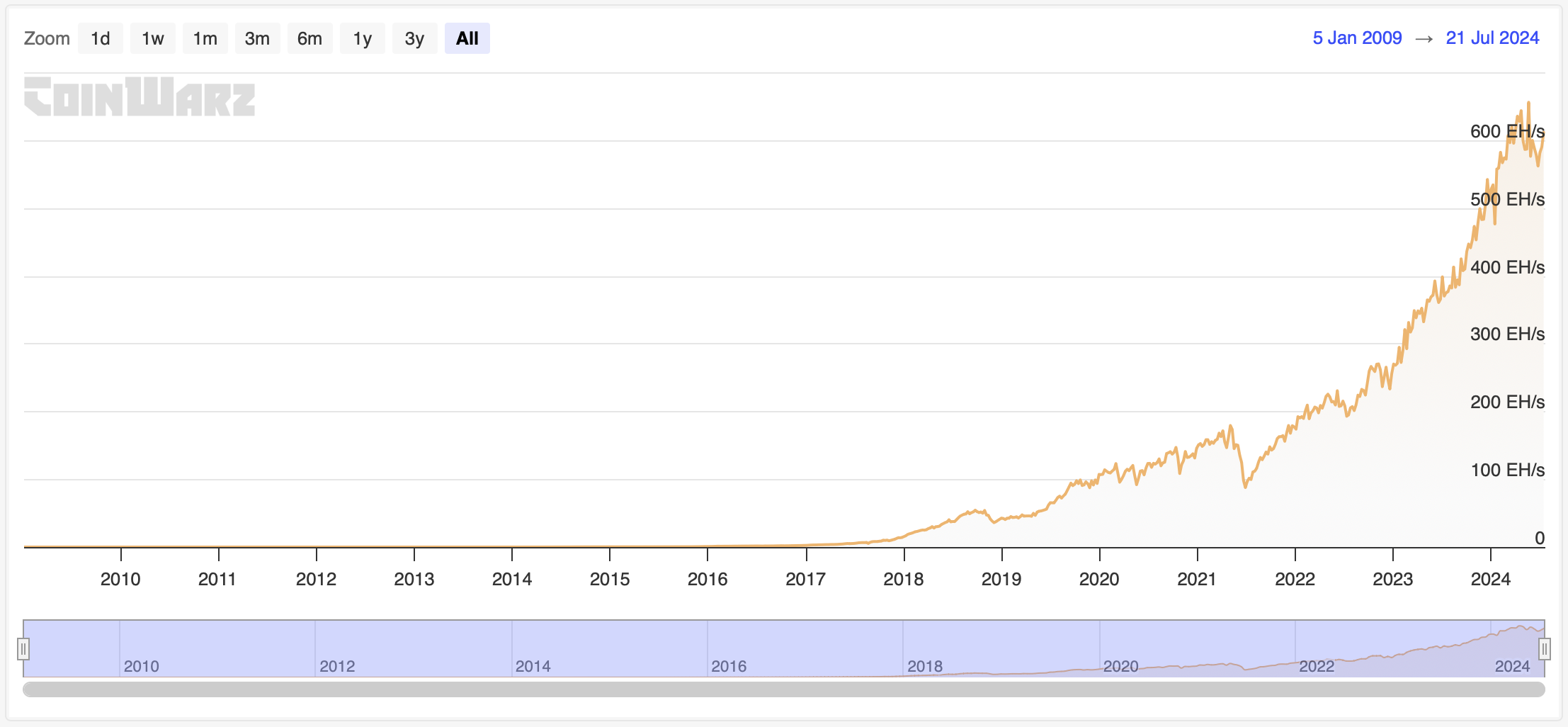

According to Coinwarz, Bitcoin’s current mining difficulty is fixed at 82.05 trillion as recorded at block number 853,077. This figure remained stable over the last 24 hours with a 0.00% change. However, the hash rate increased by 3.21% over the past 7 days. Despite this short-term increase, the hash rate experienced a 1.95% decrease over the last 30 days and a more significant 5.02% decrease over the last 90 days.

The next adjustment in Bitcoin’s mining difficulty is expected to occur on July 31, 2024. Predictions suggest that the difficulty could increase to 88.54 trillion, affecting 1,707 blocks from the current 82.05 trillion.

Bitcoin’s mining difficulty is a crucial metric that determines how hard it is to mine the next block. It represents the number of hashes required to find a valid solution for the next Bitcoin block and thus earn the mining reward. This metric is regularly adjusted to maintain a consistent block production rate and ensure that blocks are not produced too quickly despite fluctuations in the hash rate. The difficulty retargeting process helps control this by increasing or decreasing the difficulty as needed.

Bitcoin’s Current Price Situation

Bitcoin’s price showed a strong V-shaped recovery from the support level at $53,500. This rise increased BTC’s value by 24.86%, and the largest cryptocurrency is now trading at $66,597. Bitcoin’s market value also rose to $1.315 trillion during this period. Currently, BTC is trading at $67,109, reflecting a 0.83% increase over the last 24 hours.

The recent price surge is attributed to various factors, including the recovery in spot Bitcoin ETFs. This contributed to the overall market recovery, pushing BTC’s market value above $1.3 trillion. However, according to CoinMarketCap, Bitcoin’s trading volume showed a mixed picture with a 29.14% decrease over the last 24 hours, dropping to a total of $23.32 billion. Despite this, BTC remains the second most traded cryptocurrency.

Looking ahead, Bitcoin’s outlook appears positive as long as the hash rate remains stable. A strong hash rate combined with increasing mining difficulty and a robust price recovery positions the largest cryptocurrency well for making significant strides in the market.

Türkçe

Türkçe Español

Español