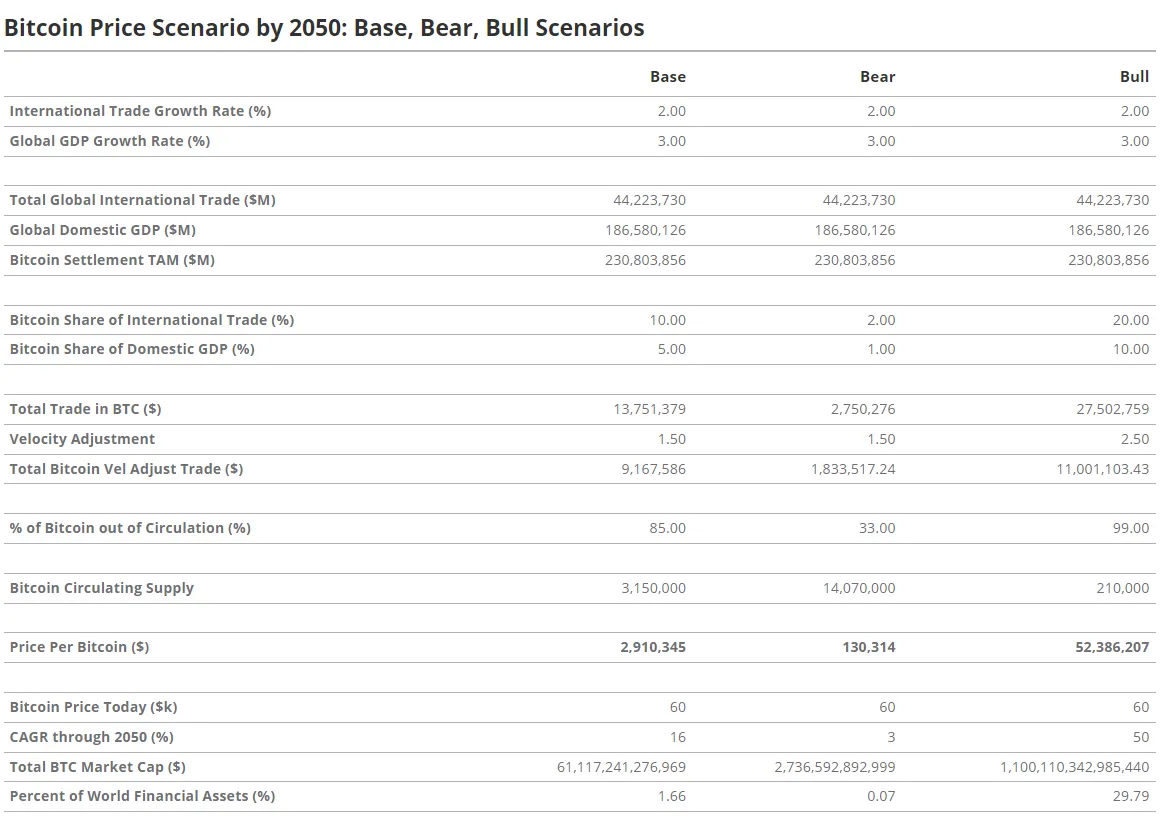

We are accustomed to recent Bitcoin predictions in the cryptocurrency world. However, today an interesting prediction came from asset management giant VanEck. The prediction is for the year 2050, and we have 26 years ahead. You might say there is still a lot of time, but looking back, we all see how it has flown by. VanEck made a prediction of $52.38 million for BTC.

VanEck’s Bitcoin Prediction

VanEck’s analysis foresees Bitcoin becoming a significant international exchange medium and primary reserve currency in the future. This prediction, considering the dynamics of global trade, GDP growth, and Bitcoin’s monetary velocity, assumes the dominance of traditional currencies like the US Dollar, Euro, GBP, and Yen will diminish. Bitcoin is expected to replace these currencies and be preferred more in cross-border payments.

The forecast that the global GDP contributions of economic leaders will decrease over time is another significant factor that will increase the demand for Bitcoin. The confidence in traditional reserve currencies is shaken due to excessive budget deficit spending and geopolitical issues, enhancing Bitcoin’s appeal as a stable and reliable store of value. Businesses and consumers appreciate Bitcoin’s predictable monetary policy and immutable property rights. Due to its decentralized nature, Bitcoin is seen as a safer haven against inflation and political influences.

Layer-2 Solutions and Bitcoin’s Future

VanEck analysts predict that by 2050, Bitcoin will handle 10% of international trade and 5% of domestic trade. In this scenario, central banks are expected to hold 2.5% of their assets in Bitcoin. A significant part of this prediction is the expectations of how Bitcoin’s Layer-2 (L2) solutions will solve scalability issues.

Technologies like the Lightning Network and various sidechains are expected to enhance Bitcoin’s transaction capabilities, enabling it to handle higher volumes efficiently. These solutions will make Bitcoin more practical for daily transactions and facilitate its adoption as part of the global financial infrastructure.

Bear and Bull Scenarios

VanEck predicts that in the base scenario, Bitcoin’s price will reach $2.9 million, while in the bear scenario, a more modest estimate points to $130,314. However, these bold predictions generally reflect a rising optimism about Bitcoin’s future.

In the shorter term, there is a widespread belief that Bitcoin will reach the $100,000 mark by the end of this year. This upward trend is driven by increased institutional adoption, growing acceptance of Bitcoin’s potential as a store of value, and advancements in Blockchain technology.

Türkçe

Türkçe Español

Español