Bitcoin price lingers at $67,500, and altcoin losses during the fluctuation are not yet compensated. Perhaps we will have a good weekend, and altcoins can focus on new peaks after weeks. So, will there really be a rise in cryptocurrencies? What do the current data tell us?

Are Bitcoin Investors at a Loss?

For short-term Bitcoin (BTC) investors, it is not possible to talk about devastating losses. According to the current price, more than 75% of short-term Bitcoin investors (STH) are profitable. This actually shows that the king cryptocurrency has found a reasonable ground for a rise. Kraken and Bitstamp returns are over. However, MtGox still holds $5 billion worth of BTC.

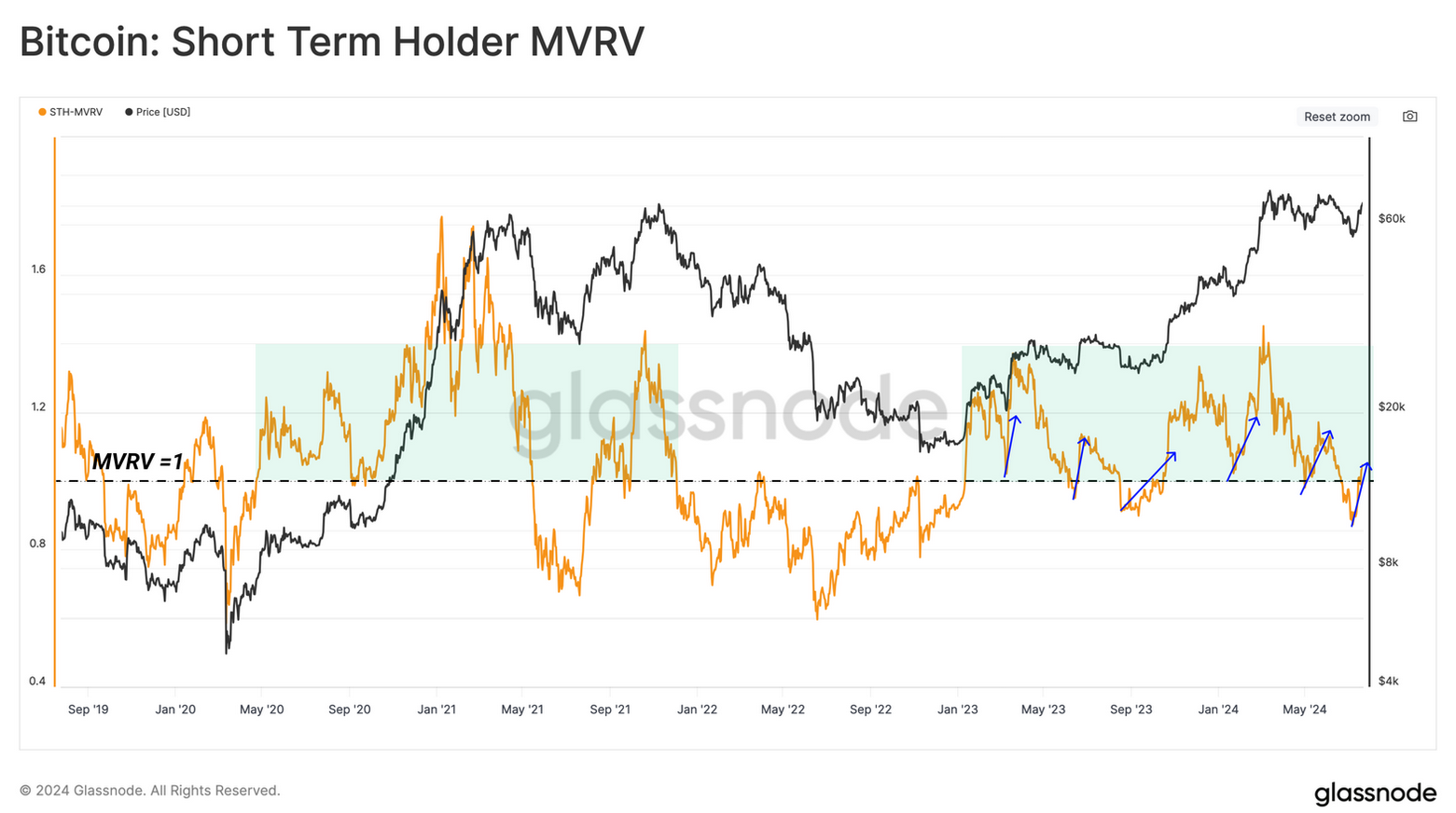

The latest Glassnode report states;

“This rally has now risen above the STH cost base, turning 75% of the supply they hold into unrealized profit. This can be seen in the STH-MVRV metric, which has now risen above the breakeven level of 1.0.”

Will Cryptocurrencies Rise?

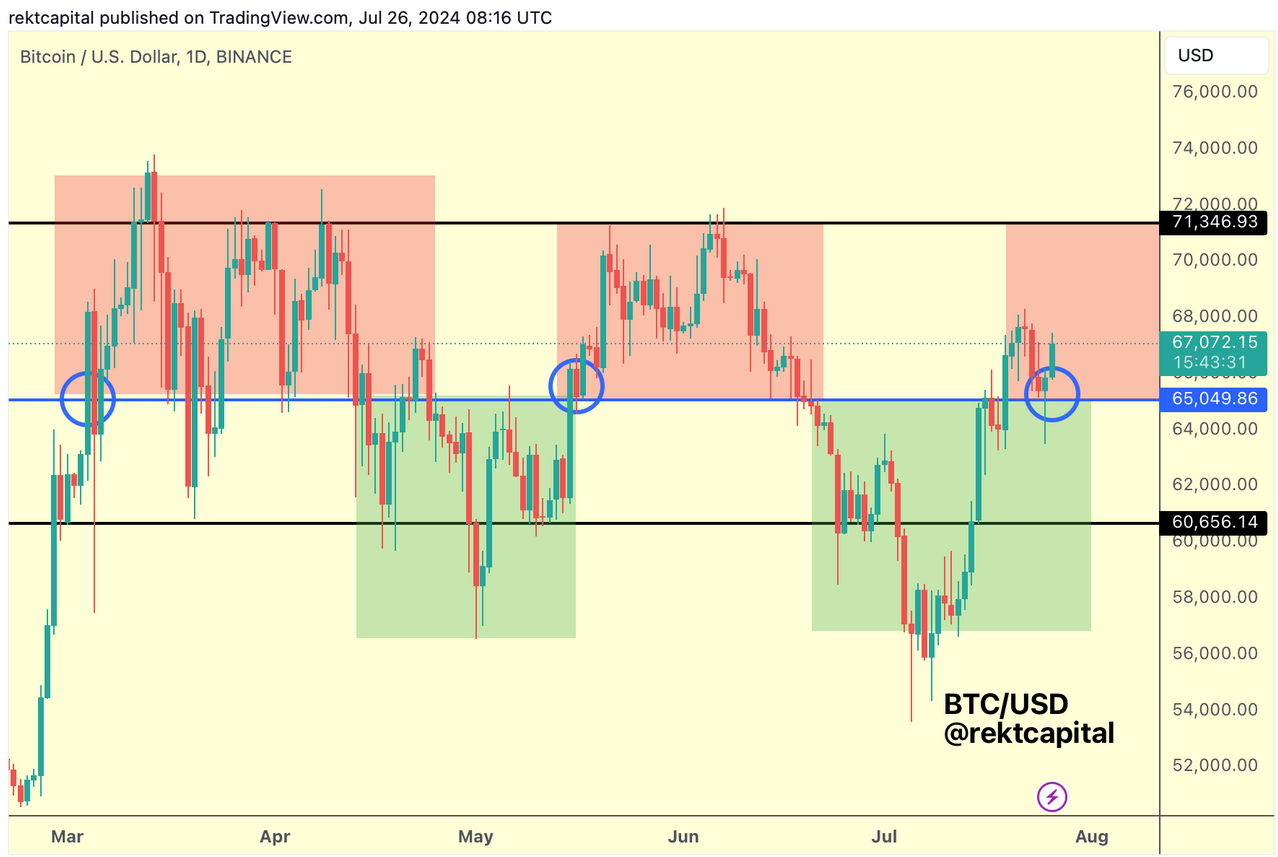

For the price lingering at current levels, the least resistance is expected to be upwards. With the important support level at $65,000 being maintained, a new attempt at $73,777 is possible, and the STH cost supports this. Moreover, the panic brought by the Mt. Gox story is weakening as exchanges complete their returns. Germany’s sales are already over, and it has been a long time since we exited bear markets.

Moreover, we need to see the delayed ETH ETF pricing. According to Rekt Capital, the price may continue to linger with a ceiling of $71,000 for a while.

“The retest was successful. Bitcoin confirmed $65,000 as support. The price will now continue to occupy the $65,000-$71,500 region (red).”

If the BTC price starts to see closures above $68,000, this will mean the liquidation of $1 million in short positions up to $68,500. Thus, short-sellers can easily fuel the rise. On the other hand, today’s recovery should also increase entries in the ETF channel (along with the rise in US exchanges). If we see net entries for BTC and ETH ETFs today, the appetite of the bulls may increase towards the daily close.