Polygon price continues to hover between breakout and consolidation due to mixed market sentiment. While demand for a rise remains high due to potential million-dollar profits, the market signals a different direction. What do on-chain data and chart analysis say for MATIC as the crypto market rises? Let’s explore together.

What’s Happening on the Polygon Front?

At $0.51, MATIC price failed to break through a significant resistance that could substantially increase profits. According to the Global In/Out of the Money (GIOM) indicator, approximately 512 million MATIC worth over $264 million could soon become profitable.

This supply was purchased between $0.52 and $0.59 and will become profitable when the altcoin reaches $0.60. This could trigger a significant price increase as it sparks a rise among investors.

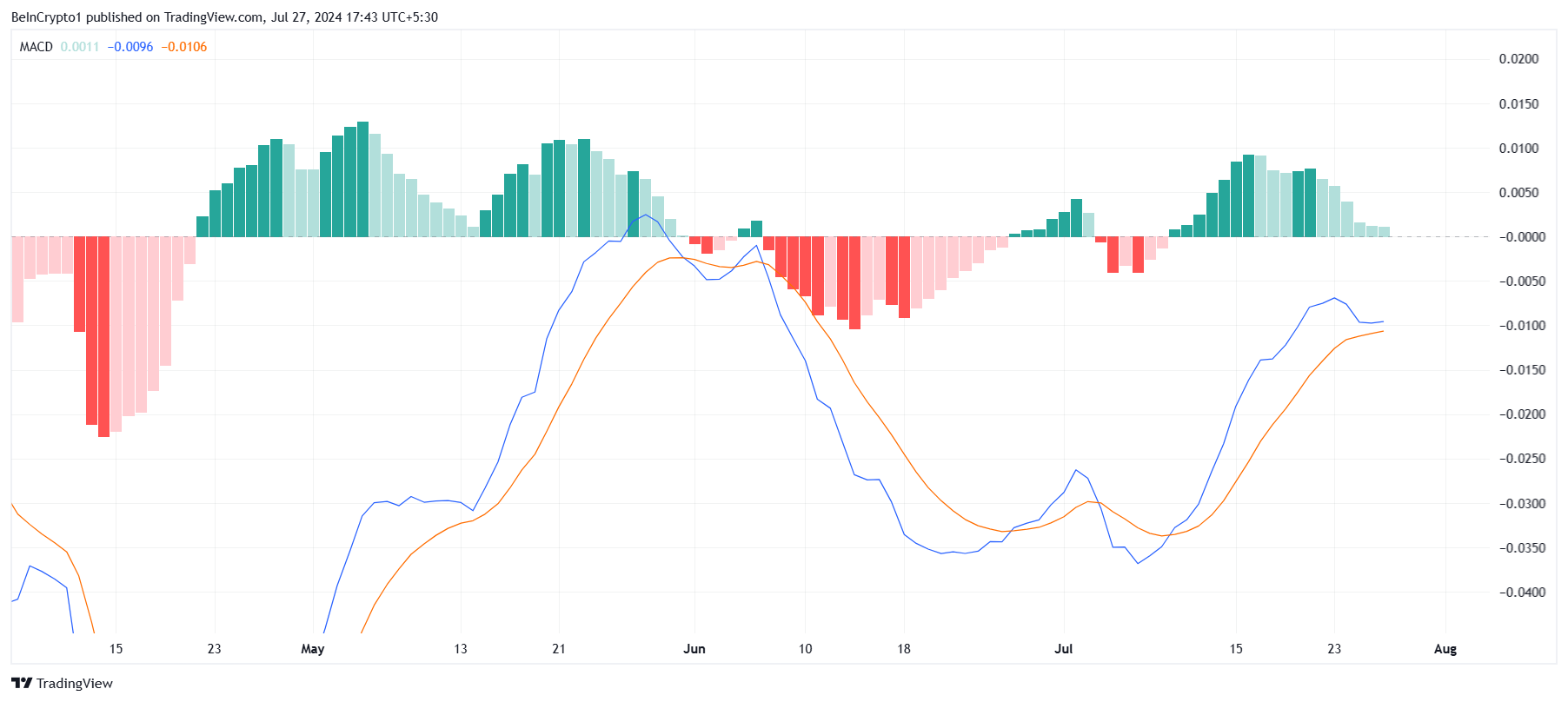

However, the MACD indicator does not yet support this sentiment. The MACD indicator highlights that bullish momentum is waning, indicating that the upward movement is losing strength. As the bullish momentum weakens, there is an increasing sign that a decline could be on the horizon for MATIC. This could eventually lead to a bearish crossover, increasing selling pressure.

MATIC Chart Analysis

MATIC price is expected to consolidate between $0.54 and $0.49 in the foreseeable future. This is due to the altcoin’s ongoing struggle to break through resistance. The lack of support from the broader market could further this failure, causing Polygon to remain sideways.

If MATIC price successfully breaks through the resistance at $0.54, a rise could come to the forefront. This process could send the altcoin price to $0.60, bring profits to investors, and invalidate the bearish-neutral thesis. Additionally, with the upcoming update on the Polygon front, the MATIC token will be replaced by the POL token, and staking and DAO operations will become prominent in the ecosystem. This step could enable MATIC price to gain in the future.