Bitcoin price appears more eager to decline as it lingers at $65,800 at the time of writing. The risk increases as time passes. The king of cryptocurrency fell following the US moving $2 billion worth of BTC and the upcoming Fed meeting. Of course, many issues, including geopolitical risks (such as the war expanding to Lebanon), negatively affect short-term sentiment.

How Low Will Bitcoin Drop?

Bitcoin has not been able to stay above $70,000 for months. The weakness in the price could signal further losses. On the other hand, despite Trump saying everything positive he could, the chart’s current state is quite discouraging. There are many reasons for the sharp drop from the resistance level.

Cryptocurrency commentator Skew expects a deeper dip. According to him, a new drop to the $64,000 level might be inevitable. In the last sell-offs, $800 million worth of open positions were either liquidated or closed. This situation reflects the fear among investors.

Skew thinks the selling pressure might be related to shifting 10% of GBTC to the Mini Trust. At the same time, strong net outflows in the ETF channel discourage spot market buyers. The fact that the Mini Trust will take 10% from the main ETF is not new, but today GBTC experienced double-digit losses in pre-market trading because of this.

Will Cryptocurrencies Drop?

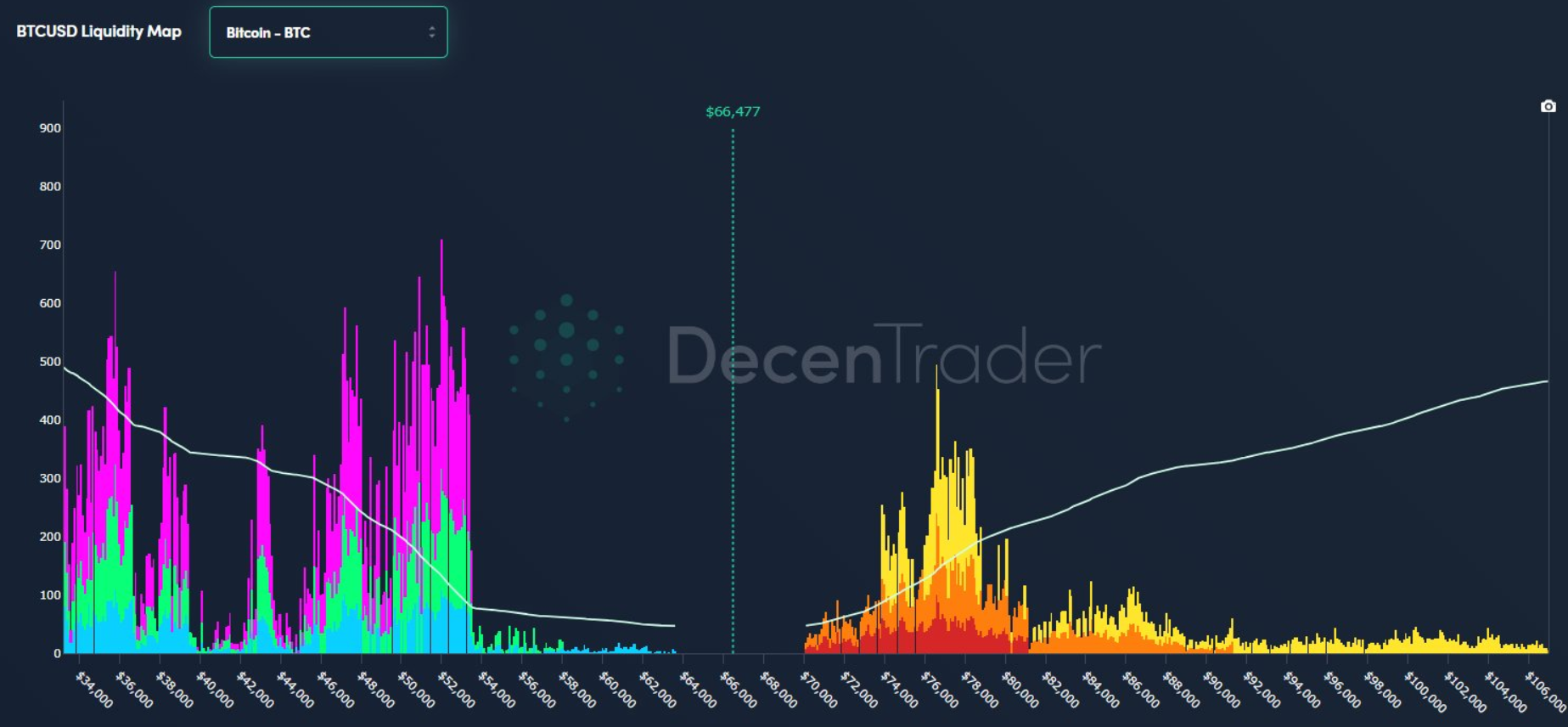

DecenTrader mentions in its latest market assessment that the BTC price could drop to $63,600. If this happens, we need to be prepared for nightmare days for altcoins. Altcoins, which have not been able to get their share from the rise, might now fall into the middle of a selling wave that could bring deeper dips.

“There are some 10x liquidations below $63,600 for longs. Below this level, liquidations will significantly intensify.”

Jelle wrote the following;

“To pull the price back down, we need to climb above $72,000. A significant portion of short liquidations will be triggered here. After this, bears will struggle to pull the price down.”

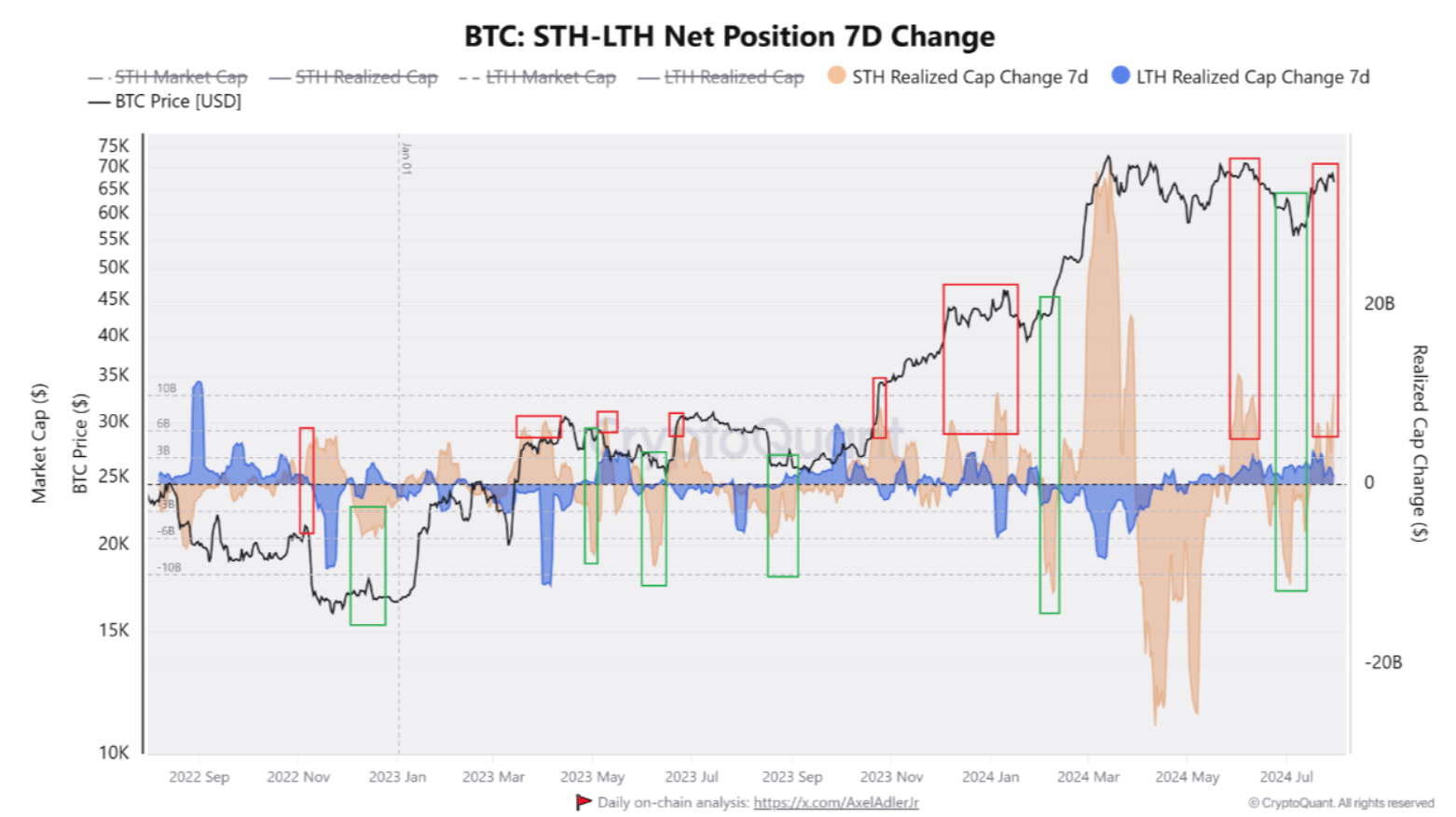

In one of CryptoQuant Quicktake’s blog posts, Amr Taha pointed to the accumulation trend among short-term investors, suggesting that those expecting deep dips might be disappointed.

Türkçe

Türkçe Español

Español