On July 30, the SEC withdrew its request to determine whether certain cryptocurrencies, including Solana, are securities as part of its lawsuit against Binance. However, this development does not signify a change in the SEC’s stance that Solana is a security. The SEC’s withdrawal led to misunderstandings among crypto observers. Various experts emphasized that this step is a strategic maneuver rather than a change in the SEC’s fundamental position.

Opinions of Crypto Executives

Jake Chervinsky, Chief Legal Officer of Variant Fund, stated that he sees no reason to believe the SEC has determined SOL is not a security. The SEC’s decision not to seek a court ruling on the security status of cryptocurrencies in this case indicates a litigation tactic. Chervinsky noted that the SEC has considered tokens as securities in other cases, such as the Coinbase lawsuit.

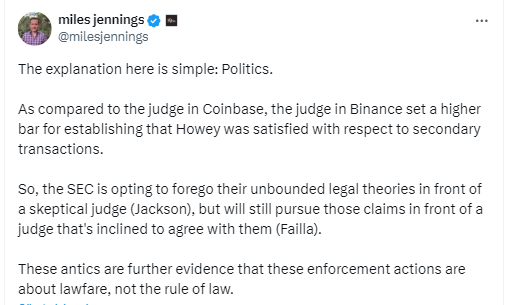

Miles Jennings from a16z Crypto and Justin Slaughter from Paradigm also supported this view. Slaughter noted that the SEC’s filing was misinterpreted and that the SEC has not changed its view on Solana and other tokens. Jennings expressed that Judge Amy Berman Jackson saw the SEC’s effort to establish the Howey test in the Binance case as a high bar and that the SEC’s effort to prove these tokens are securities might not surpass this high bar.

Regulatory Framework and Its Impact on the Crypto Market

The SEC claimed that at least 68 different tokens are securities in its broader enforcement actions, affecting over $100 billion worth of cryptocurrencies in the market. This regulatory scrutiny is expected to have significant impacts on the cryptocurrency industry. Although the SEC’s recent filing may appear as a retreat to some, it is viewed as a strategic maneuver rather than a fundamental change in the regulatory perspective on cryptocurrencies.

The misunderstanding among crypto observers highlights the uncertainty of the legal status of cryptocurrencies and the impact of the SEC’s tactics on the crypto market. As legal battles continue, the classification of cryptocurrencies as securities remains a critical issue for regulators, crypto firms, and investors.

Türkçe

Türkçe Español

Español