Cryptocurrencies are falling, and there are exceptions among altcoins, but this is not one of them. During the decline, stablecoin volumes are also increasing. USDC faced tough times during the 2023 US banking crisis but quickly recovered and grew significantly in July with the support of MiCA.

USDC Stablecoin

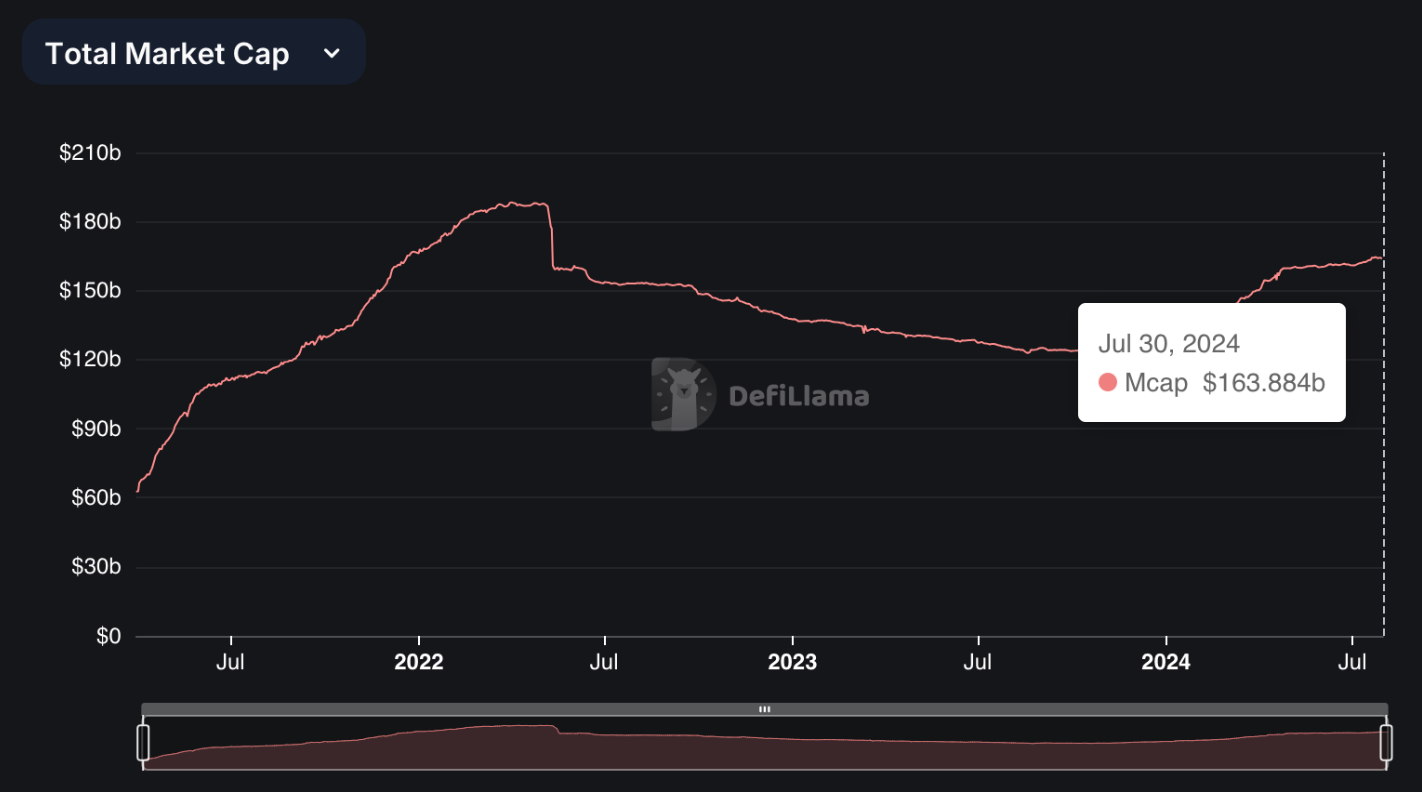

The stablecoin USDC, issued by Circle, which is preparing for an IPO, saw its trading volume increase by 48% in July. The total market value of stablecoins climbed to $164 billion, the highest level since April 2022. According to a report published by CCData just hours ago, the total volume of USDC pairs on centralized exchanges reached $135 billion as of July 25.

Although USDC’s market value climbed to $33.6 billion, USDT still holds the top spot. In fact, a report released by Tether on the last day of the month announced a record profit of $5.2 billion for the first six months of 2024. Tether’s USDT remains the most preferred stablecoin and has reserves exceeding $100 billion.

USDC and MiCA

USDC became the first global stablecoin to receive permission to operate in the European economic area, and we reported this as breaking news. This development was expected to significantly increase interest in the stablecoin. Binance even launched a short-term zero-fee campaign for the USDC/EURO pair. USDC, which received MiCA approval on July 1, grew faster than USDT in July because of this.

USDC’s market value increased by 5.4%, while USDT’s value increased by only 1.6% in July. According to DefiLlama, USDT remains the market’s largest player with approximately 70% market share. Overall, the value of stablecoins increased by 2.1% to $164 billion, while trading volume on exchanges fell to $795 billion. Trading volume for all stablecoins has been declining for four months because BTC has failed to stay above $70,000 despite six attempts.

In summary, USDC, which has met the stringent conditions of MiCA, shows faster growth than its competitors and could widen the gap with USDT during periods of market upturn.

At the time of writing, the price of Bitcoin dipped below $65,000. Although Fed statements were relatively positive, the market is weakening due to the resurgence of geopolitical risks.

Türkçe

Türkçe Español

Español