A notable development occurred in the US spot Bitcoin and Ethereum ETF market. Spot Bitcoin ETFs recorded a minimal net daily inflow of only $299,000. However, spot Ethereum ETFs faced significant net outflows totaling $77.2 million, following a $33.6 million inflow the previous day. This divergence between the two cryptocurrencies highlighted differences in investors‘ market strategies.

Fluctuations in Bitcoin ETFs

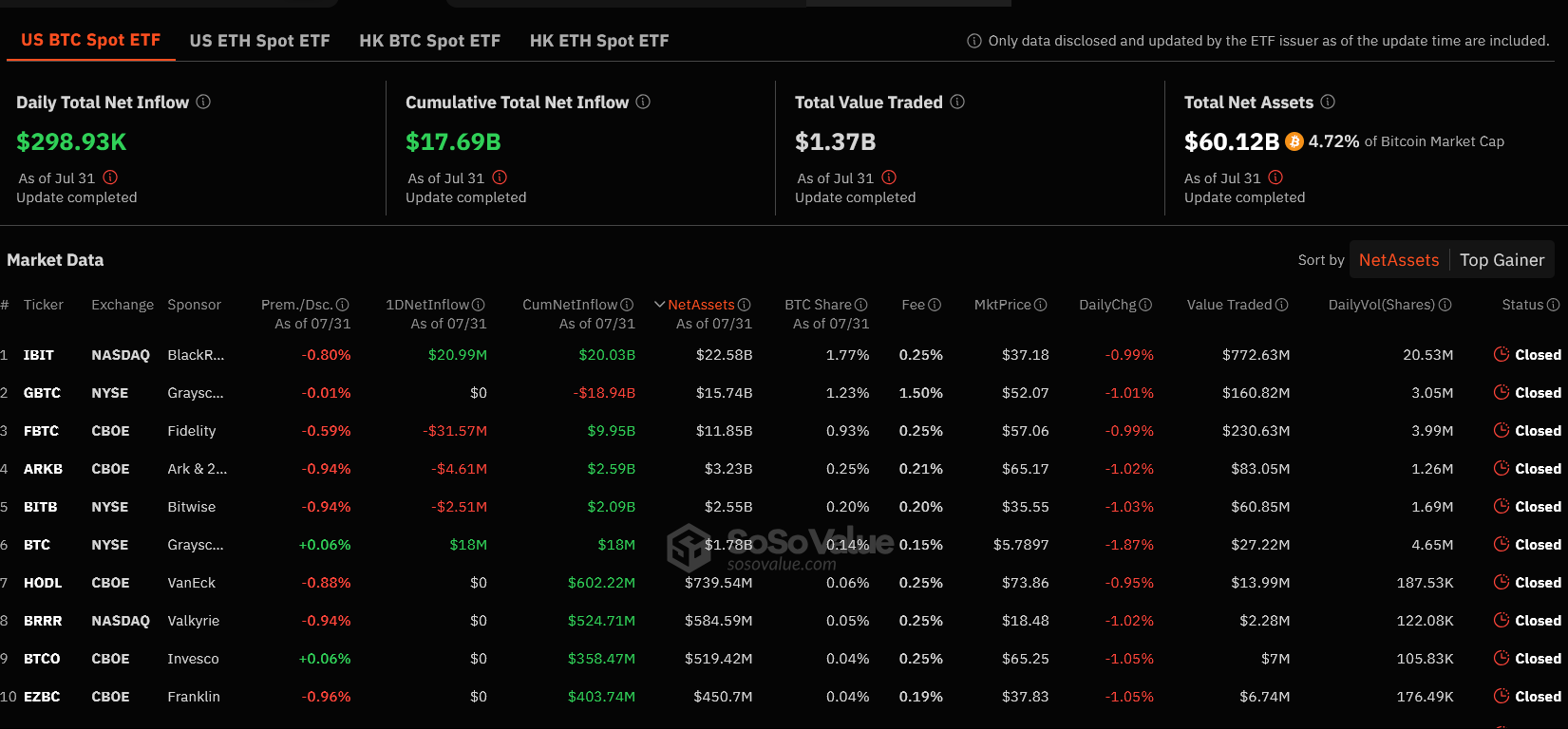

Among spot Bitcoin ETFs, only BlackRock’s IBIT fund and the newly traded Grayscale Bitcoin Mini Trust experienced positive net inflows. BlackRock IBIT secured an inflow of $20.99 million, while Grayscale Bitcoin Mini Trust attracted $18 million.

However, Fidelity’s FBTC saw a significant net outflow of $31.57 million. Ark and 21Shares’ ARKB also experienced net outflows of $4.61 million each. Bitwise’s BITB faced an outflow of $2.51 million. No flows were recorded in other spot Bitcoin ETFs. Despite these developments, the total trading volume remained steady at $1.37 billion.

Outflows in Ethereum ETFs

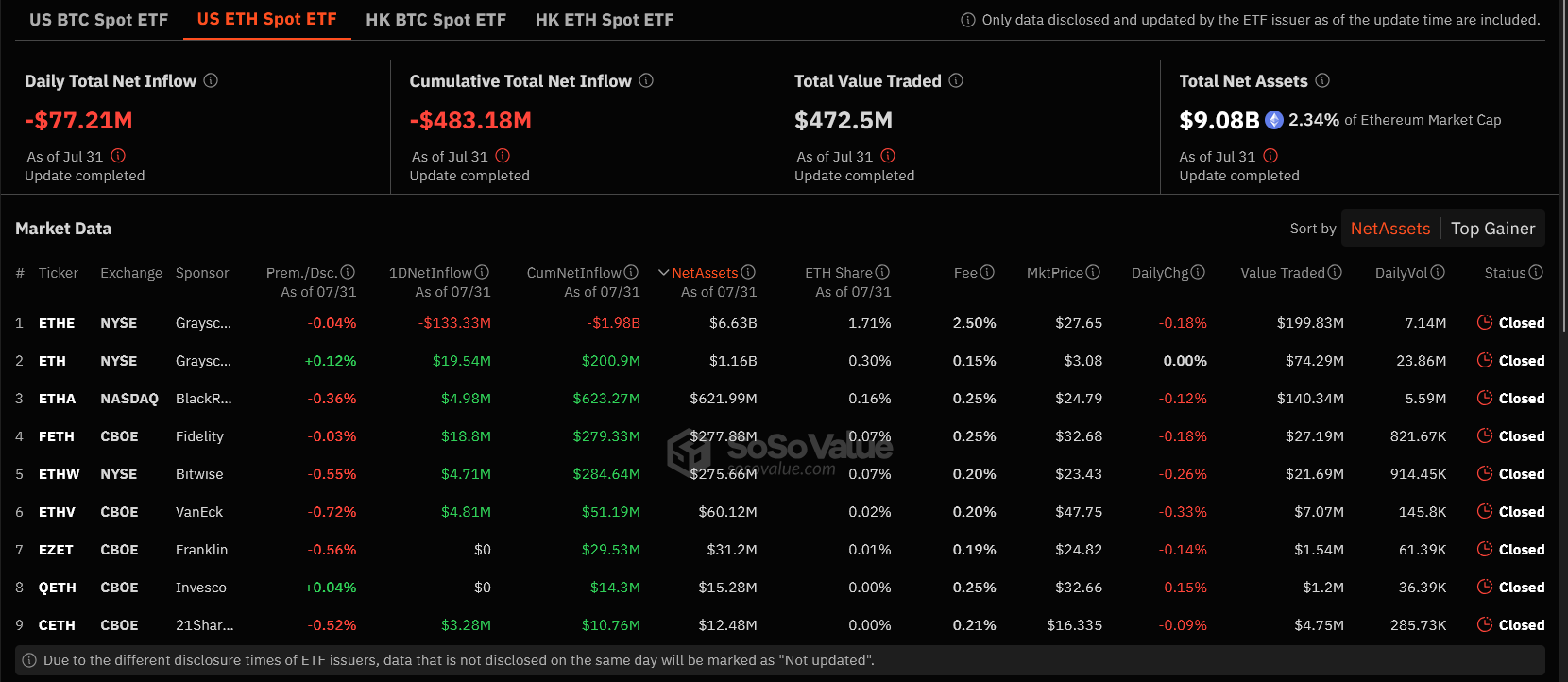

The situation was quite different for spot Ethereum ETFs. Grayscale Ethereum Trust (ETHE) experienced a substantial net outflow of $133.33 million daily since its first outflow on July 23. This Trust was the only spot Ethereum fund to see an outflow that day. However, some spot Ethereum ETFs managed to attract net inflows.

Grayscale Ethereum Mini Trust secured a net inflow of $19.54 million, Fidelity’s FETH $18.8 million, BlackRock ETHA $4.98 million, and VanEck ETHV $4.81 million. Additionally, Bitwise’s ETHW and 21Shares’ CETH recorded net inflows of $4.71 million and $3.28 million, respectively. Two other spot Ethereum ETFs saw no flows.

Market Reflections

On Wednesday, the trading volume of nine spot Ethereum ETFs fell from $563.22 million on Tuesday to $472.5 million. This indicates that significant net outflows have a noticeable impact on Ethereum ETFs. The sharp trend differences between Bitcoin and Ethereum ETFs clearly reveal the changing sentiment and market dynamics among cryptocurrency investors.

Bitcoin ETFs indicate moderate investor interest, while Ethereum ETFs reflect potential shifts in market strategy through large outflows. Trading volumes and net flows provide crucial insights into the current state of cryptocurrency ETF investments and broader market trends affecting these cryptocurrencies.