The recent wave of sell-offs in the cryptocurrency market has led to significant liquidations in decentralized finance (DeFi) protocols. The substantial drops in market value have caused major ripples not only in the crypto derivatives markets but also in the DeFi space. According to Parsec Finance, a total of $350 million worth of positions were liquidated in DeFi protocols.

Aave Earns $6 Million

On the other hand, the leading DeFi protocol Aave (AAVE) has gained significant revenue from the market turmoil. Stani Kulechov, the founder of the DeFi protocol, announced that Aave earned $6 million during today’s wave of sell-offs.

Currently, Aave hosts $21 billion worth of assets across 14 active markets operating on different Blockchain layers (Layer 1 and Layer 2).

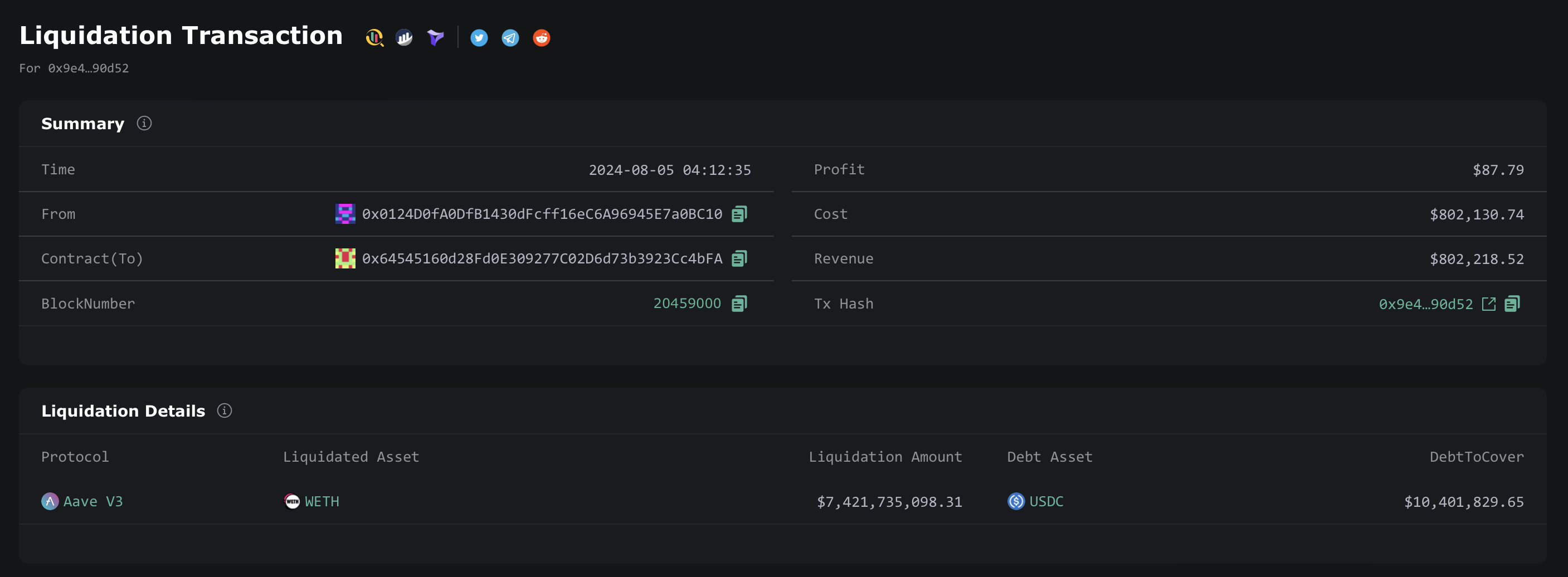

One particularly notable liquidation during this period was the $7.4 million wrapped Ethereum (WETH) position. This liquidation brought Aave $802,000 in revenue. Aave played a crucial role in ensuring market security with this on-chain liquidation revenue.

Crypto Market Downturn Hits DeFi Protocols

The Bank of Japan’s decision to raise interest rates and last week’s unemployment data from the US triggered a massive sell-off in the cryptocurrency market. The altcoin king Ethereum (ETH) lost more than 20% of its value in the last 24 hours, while Aave’s (AAVE) market value dropped by 23.7%. The market downturn has been a significant test not only for Aave but for all DeFi protocols.

Additionally, the total value locked (TVL) in DeFi protocols has dropped from $100 billion at the beginning of the month to $71 billion now. This decline shows how vulnerable DeFi protocols can be to market fluctuations. According to DefiLlama, this drop in TVL indicates shaken investor confidence and the severity of market stress.

Türkçe

Türkçe Español

Español