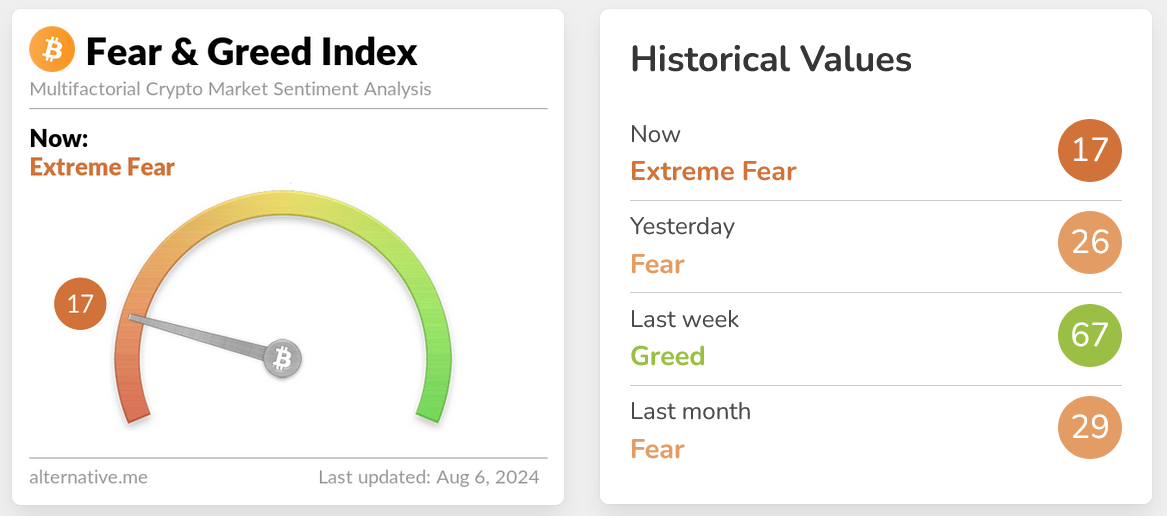

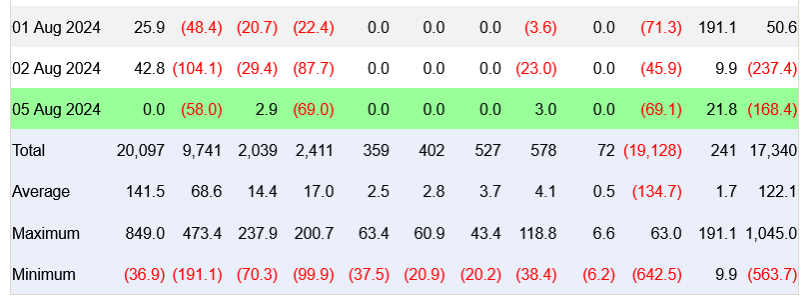

Crypto Fear and Greed Index dropped to its lowest level since July 2022, scoring 17 on August 5. This development coincided with a reported $168.4 million outflow from US spot Bitcoin exchange-traded funds (ETFs).

Current Status of Crypto Fear and Greed Index and US Spot ETFs

The index measures investor sentiment in the Bitcoin and cryptocurrency markets. On August 5, the index entered the “Extreme Fear” zone at 17, its lowest since July 12, 2022. Last week, on July 29, the index was at 67, marking one of the largest weekly drops recorded in years.

On August 5, spot Bitcoin ETFs saw $168 million in outflows. Most of these outflows came from the Grayscale Bitcoin Trust and ARK 21Shares Bitcoin ETF, recording $69.1 million and $69 million, respectively. In contrast, the Grayscale Bitcoin Mini Trust, VanEck Bitcoin ETF, and Bitwise Bitcoin ETF recorded inflows of $21.8 million, $3 million, and $2.9 million, respectively. BlackRock’s iShares Bitcoin Trust reported zero inflows.

Spot Ethereum ETFs saw $48.8 million in inflows on the same day. Most of these inflows came from the iShares Ethereum Trust, recording $47.1 million. VanEck and Fidelity’s spot Ethereum ETF products also recorded inflows of $16.6 million and $16.2 million, respectively.

Investors Shaken by Bitcoin and Altcoin Crash

Bitcoin and Ethereum saw market sentiment drop as they fell 10% and 18% respectively in two hours on August 5. During this period, over $600 million in leveraged long positions were liquidated, and many altcoins were hit harder than Bitcoin and Ethereum. On the same day, trillions of dollars were wiped from the US stock market.

The market crash was triggered by weak employment data, slow growth in major technology stocks, and renewed recession fears. Independent investor Bob Loukas described the last three days as a once-in-7-to-10-year event, noting a loss of over $500 billion in crypto market value.

Bitcoin analyst Tuur Demeester expressed his belief that Bitcoin would bottom out between $40,000 and $45,000, cautioning against making such bets, stating, “You shouldn’t bet on declines in a Bitcoin bull market because prices can suddenly rise again.”

Bitcoin, after bottoming out at $48,800 on August 5, rebounded by 11.85% to $55,680 earlier today. According to CoinGecko’s data, this rebound suggests that investor confidence in the market might be reviving.