Worldcoin price managed to recover less than 10% after a 46% drop. Some see this as a sign of decline, but rising investor expectations suggest it may just be a delayed start. Worldcoin’s price has faced notable misfortune in the past two months, invalidating the altcoin‘s 66% rise since mid-July.

What’s Happening with Worldcoin?

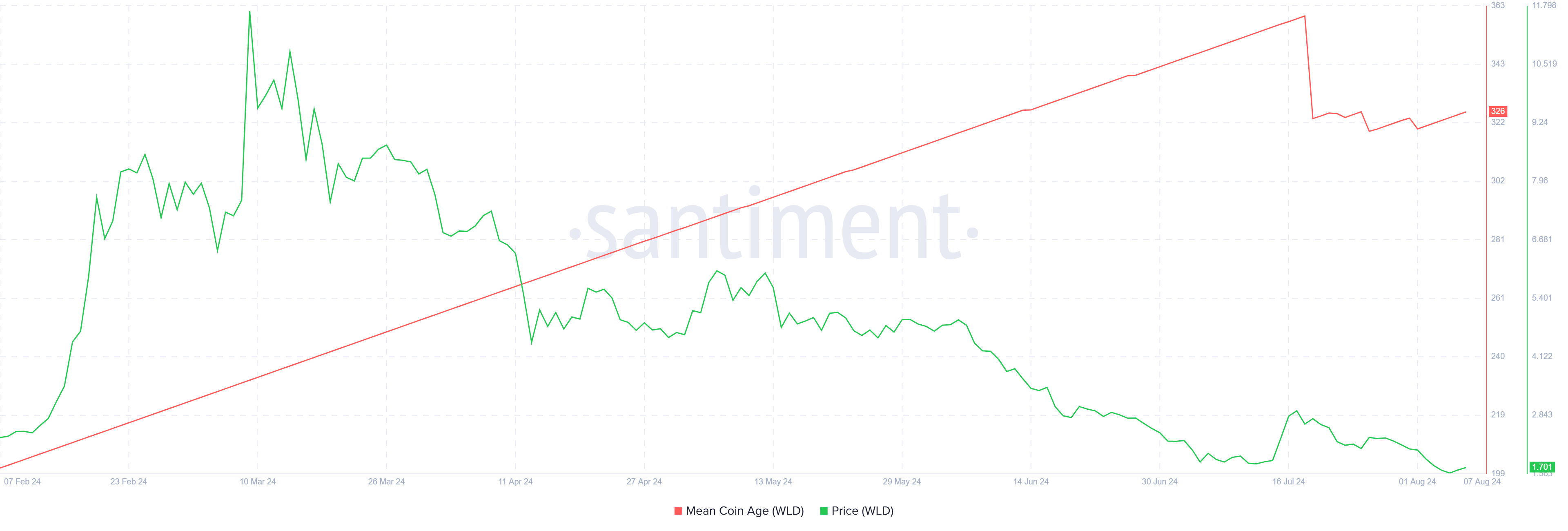

Currently at its lowest levels since November 2023, the altcoin likely has nowhere to go but up. This is slightly reflected by investors shedding their pessimism, as seen in the Mean Coin Age (MCA). MCA represents the average time assets are held in a wallet before being spent or transferred, providing insight into the longevity of circulating coins and indicating market sentiment and stability.

Generally, an increase indicates a rise in consistent investors, while a decrease signals increased supply movement among addresses. After a tough few days in late July, the indicator started to rise again. This suggests that confidence among WLD holders improved as the price drop halted. Additionally, some investors might take advantage of low prices to add WLD to their holdings. The Market Value to Realized Value (MVRV) Ratio confirms this possibility.

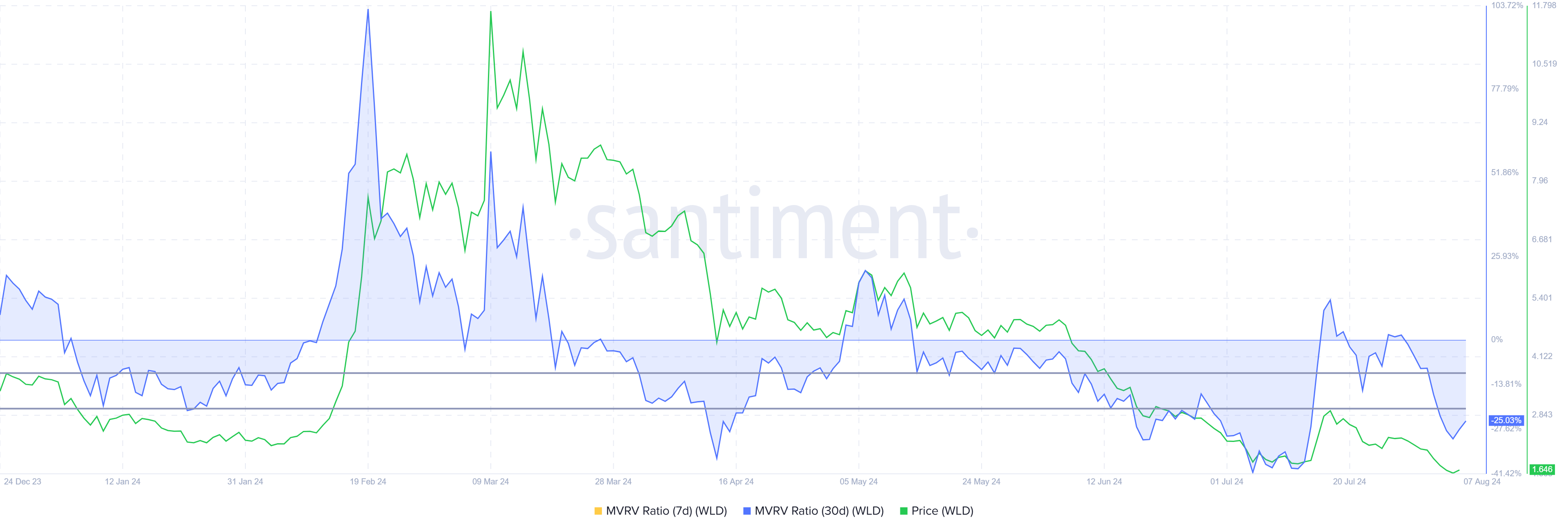

The MVRV ratio assesses investor profit and loss. Currently, Worldcoin’s 30-day MVRV data is at -25%, indicating losses and potential buying pressure. Historically, WLD MVRV between -10% and -21% typically marks the start of recoveries and uptrends, indicating an accumulation opportunity zone. Therefore, if investors continue their bullish stance and move towards accumulation, Worldcoin’s price could recover much faster.

WLD Chart Analysis

After recording a 63% drop throughout June and half of July, Worldcoin’s price tried to recover its losses. When WLD rose by 66%, the market turned bearish, and the altcoin dropped by 46% within three weeks. This decline brought the trading price to $1.70 at the time of writing, erasing all gains from the 66% rise. WLD still has a chance to profit, but for that, the altcoin needs to turn $3.00 into support. This requires surpassing the $2.00 resistance level and turning it into a support base.

If Worldcoin’s price doesn’t exceed $3.00, it may consolidate. The same happened in July, resulting in WLD forming limits at $1.76 and $3.00. Prolonged consolidation could suspend investors’ profit opportunities, invalidating the bullish thesis.