Solana-based memecoin project Dogwifhat (WIF) saw a 13% increase in one day, reaching a peak of $1.77 on August 6. This comes as part of a recovery following a 63% drop from its peak of $2.89 two weeks ago. Data from TradingView shows that WIF rose from $1.07 on August 6 to a daily peak of $1.77 on August 7, marking a 66% increase.

What is Happening with WIF?

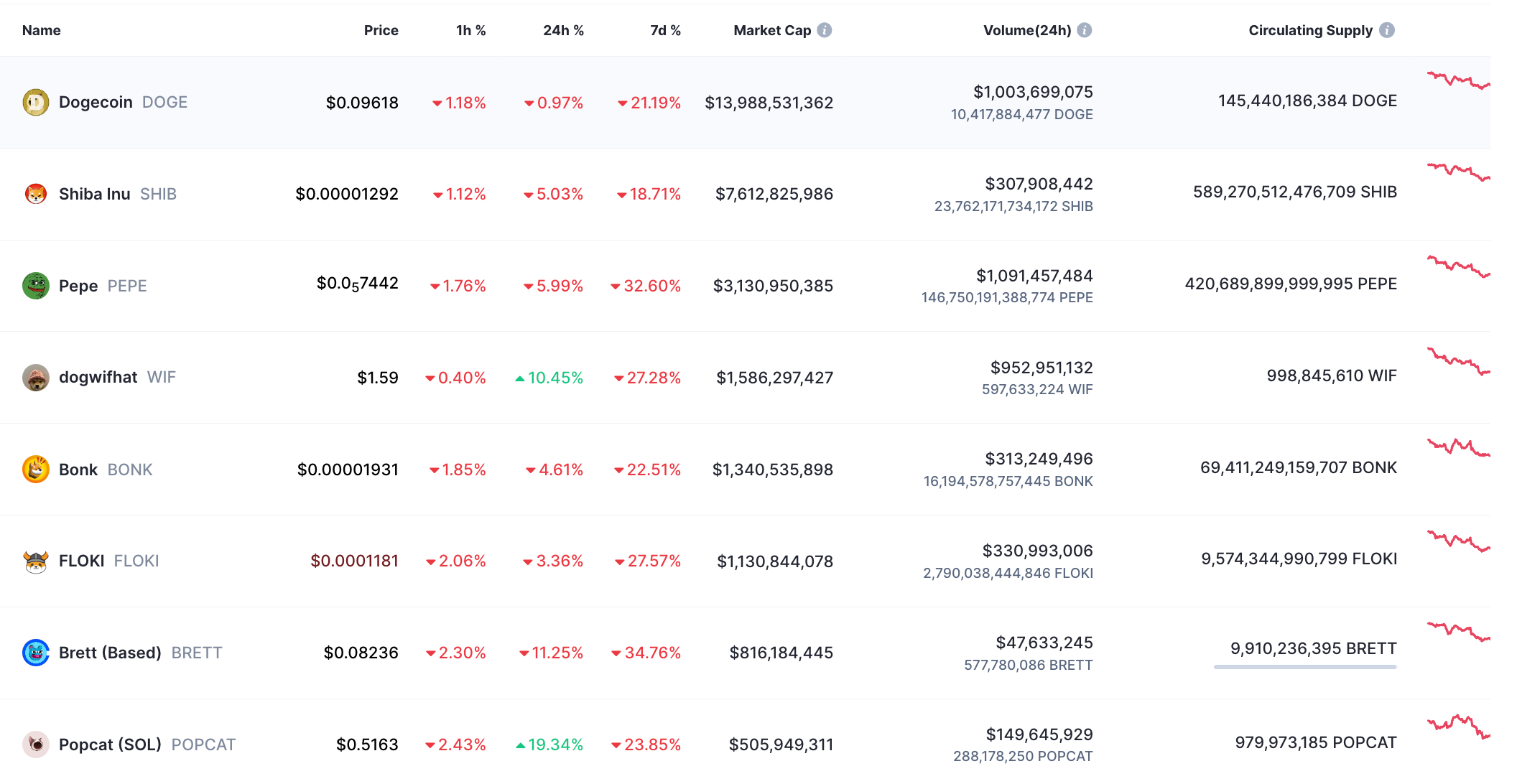

In comparison, data from CoinMarketCap shows that most of the largest cryptocurrencies by market cap were losing value on August 7, while the total market cap of the memecoin increased by 5.3%.

Dogwifhat remains the fourth largest memecoin by market cap, ranking below Pepe. Pepe has a market cap of $3.13 billion, nearly double that of Dogwifhat. Meanwhile, analyst Kyledoops noted that WIF was trading at $1.74 and, despite facing strong resistance on its recovery path, remains the best altcoin choice within the Solana ecosystem:

“Although a slight pullback is possible with the EMA Ribbon at the top, WIF remains the best choice on Solana.”

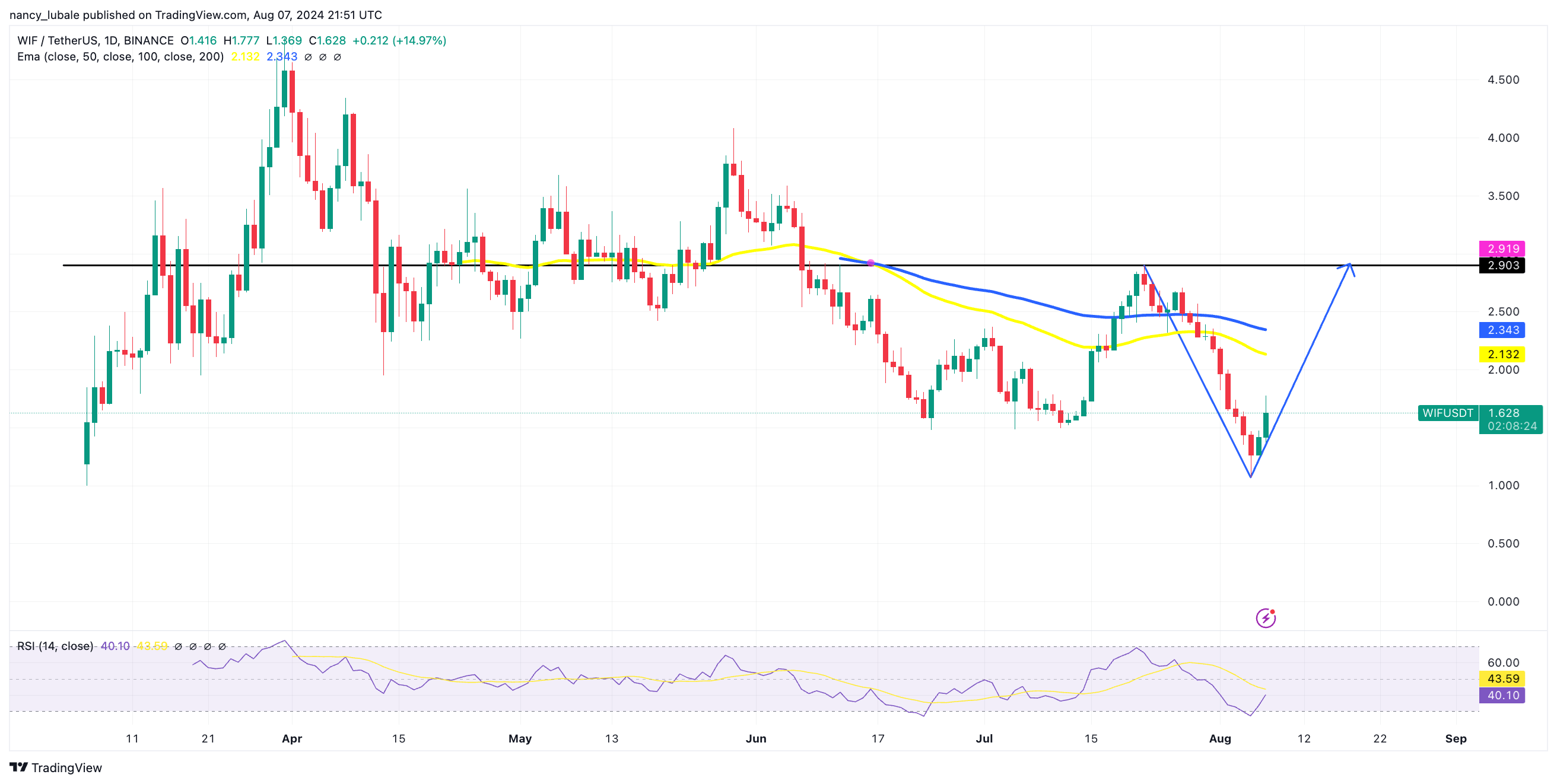

From a technical perspective, the price of Bitcoin is feeding a V-shaped recovery pattern on the daily chart as shown below. The appearance of two green engulfing candles on the daily chart indicates that the bulls have taken control of the price. The $1.50 level serves as immediate support for the memecoin. The relative strength index rose from 27 to 38 between August 5 and August 8, indicating that buyers are returning to the scene.

Therefore, increased buying from current levels could cause the price to encounter resistance at the 50-day exponential moving average (EMA) of $2.13 and the 100-day EMA of $2.34. At a higher level, the price of WIF could reach the neckline of the dominant chart pattern at $2.90, representing an 80% gain from the current price.

Details on the Subject

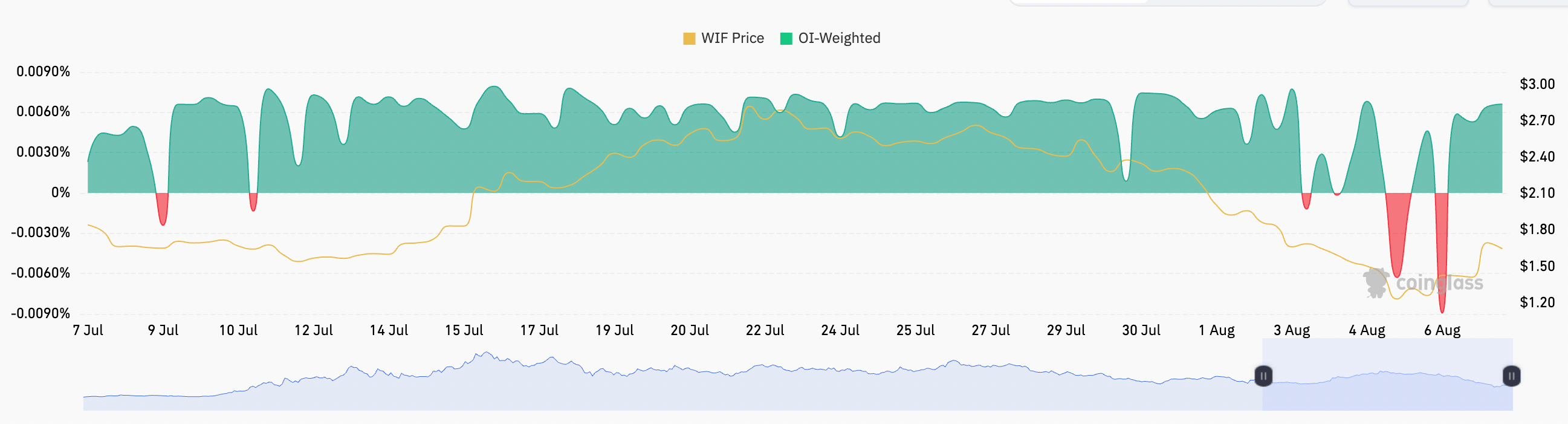

Meanwhile, demand for long positions on the WIF front has increased in recent days, as shown by the perpetual funding rate. Data from Coinglass reveals that WIF’s perpetual funding rate turned positive after falling into negative territory following the market-wide sell-off on August 5. A positive funding rate indicates that buyers are seeking more leverage, while the opposite scenario occurs when sellers demand additional leverage, leading to a negative funding rate.

It is worth noting that the current eight-hour rate of 0.0066% corresponds to a cost of 0.13% over a seven-day period, which is not significant for investors creating futures positions. When there is an imbalance due to excessive optimism, the rate can easily exceed 1% per week in the coming days.

Türkçe

Türkçe Español

Español