Bitcoin, if it turns $62,000 into support, can overcome the approaching dead cross, and the latest analysis suggests this. On August 9, popular investor Benjamin Cowen used history to suggest how bulls could avoid a new Bitcoin price drop. The recent Bitcoin price movement has brought the BTC/USD pair to the brink of another moving average crossover, classically known as a dead cross.

Dead Cross Concerns on the Bitcoin Front

This process involves the downward-sloping 50-day simple moving average (SMA) crossing below its 200-day equivalent. According to data from TradingView, the 50-day and 200-day SMA averages currently stand at 61,998 and 91,882, respectively. The dead cross gets its name from the assumption that once the crossover is complete, it serves as a pre-warning for a downward movement in Bitcoin’s price. However, as Cowen pointed out, the results are often mixed, and the last daily dead cross in 2023 actually interrupted a gain process:

“In 2023, Bitcoin started to rise immediately after the dead cross. It then rose above the 50-day SMA average and held it as support before going higher.”

In contrast, brief touches to the dead cross process in 2019, 2021, and 2022 ultimately led to the expected outcome and losses:

“The durability of this move will likely depend on Bitcoin first rising above the 50-day SMA average of $62,000 and then holding it as support as it did in 2023.”

He added that if this fails, the downward movement could return until macroeconomic conditions change significantly. Specifically, the US Federal Reserve must make a sufficient pivot in interest rates to boost crypto and risk assets.

Details on the Subject

BTC/USD pair continued to recover during the day and reached $62,775 at the previous daily close before consolidating at a slightly lower level at the time of writing.

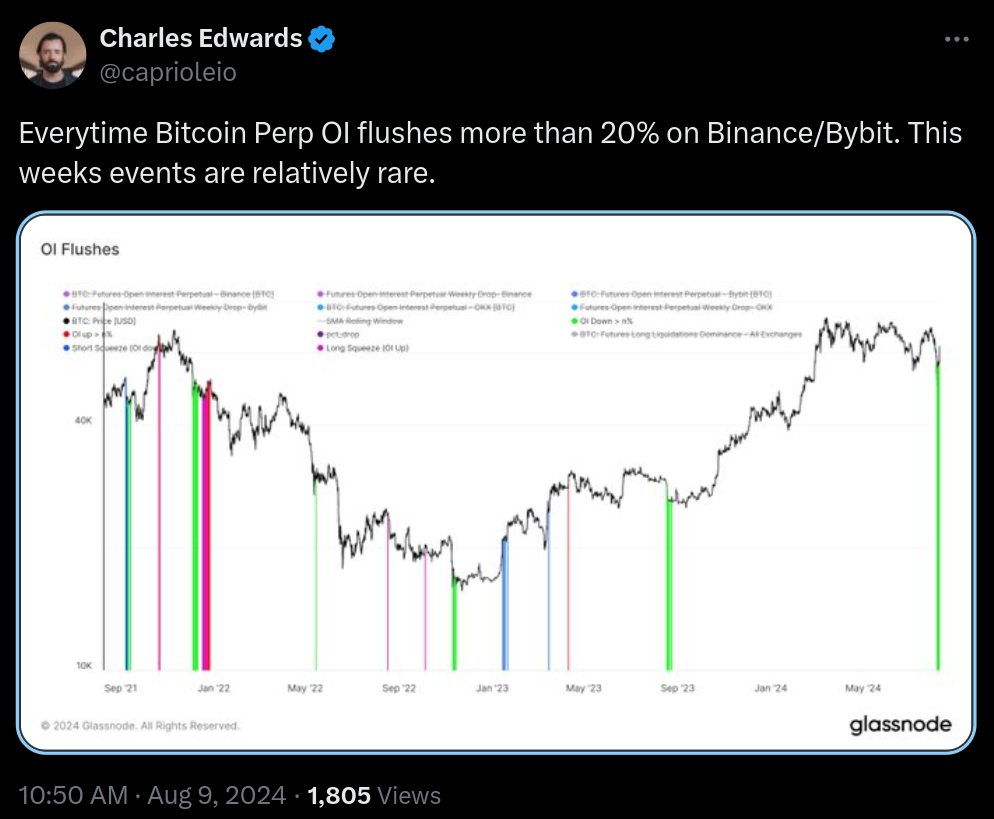

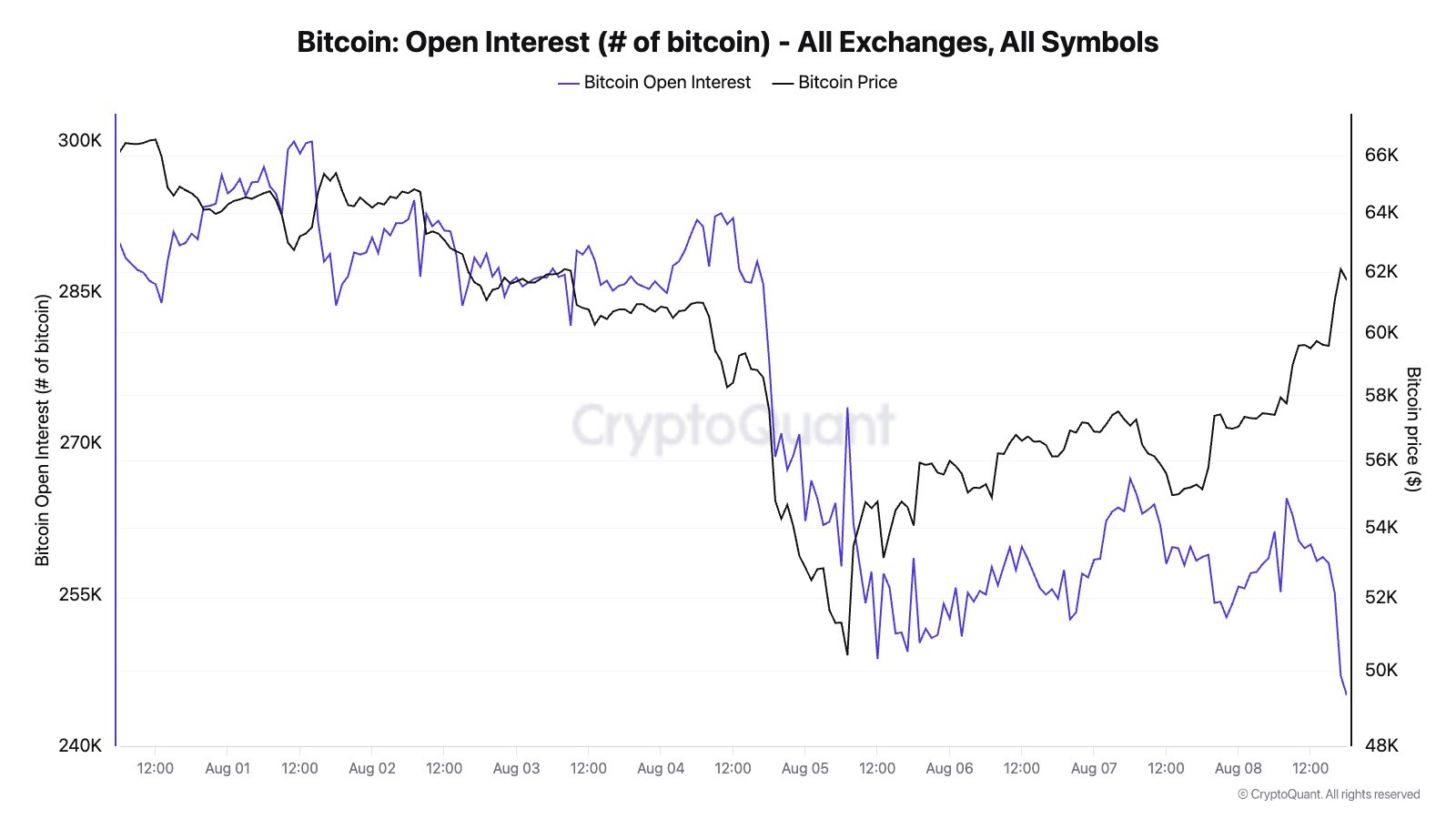

Market observers noted a lack of recovery in open interest in the futures market despite higher prices in these days following a massive rally rarely seen in Bitcoin’s history in terms of scale. Julio Moreno, a contributor to the on-chain data analysis platform CryptoQuant, commented on the subject:

“This Bitcoin rally was mostly short positions closing in the futures market.”

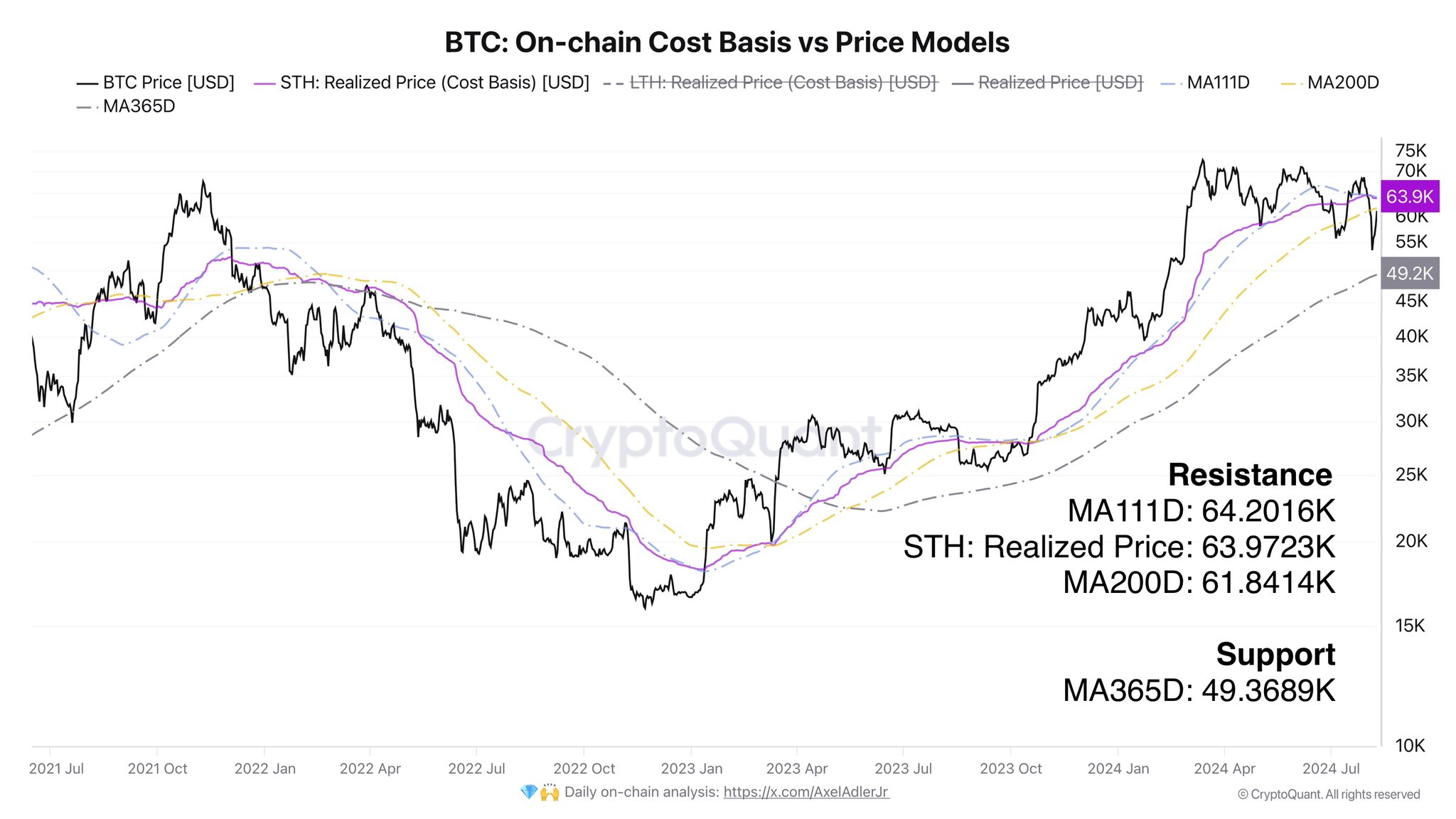

Meanwhile, another participant, Axel Adler Jr, marked the area above $62,000 as significant resistance, with major support still below this week’s six-month low of $50,000.

Türkçe

Türkçe Español

Español