Bitcoin (BTC) recorded a strong recovery, rising about 12% to $60,720 after Monday’s market crash. This recovery marked the biggest gain since November 2022, supporting the total value of the cryptocurrency market, which rose 12% to $2.12 trillion. According to top cryptocurrency analyst Lark Davis, there are convincing reasons for investors to remain optimistic despite recent fluctuations.

Reasons Keeping the Cryptocurrency Market Alive

One of the most important factors fueling this optimism is the fear of recession. Despite high concerns about economic downturns, Davis believes these fears may be exaggerated. Recent economic indicators such as a strong US job market, decreasing bankruptcies, and increasing rail traffic indicate a more robust economy than many expected. This economic strength can help stabilize markets, including cryptocurrencies.

Another positive signal comes from the expected interest rate cuts by major central banks, especially the US Federal Reserve. Speculations are rising that the US interest rate could be lowered as early as September. Such cuts could increase market liquidity, creating a favorable environment for risky assets like cryptocurrencies. Additionally, the Japanese market’s recent stabilization following the Bank of Japan’s decision not to raise interest rates has contributed to global financial stability.

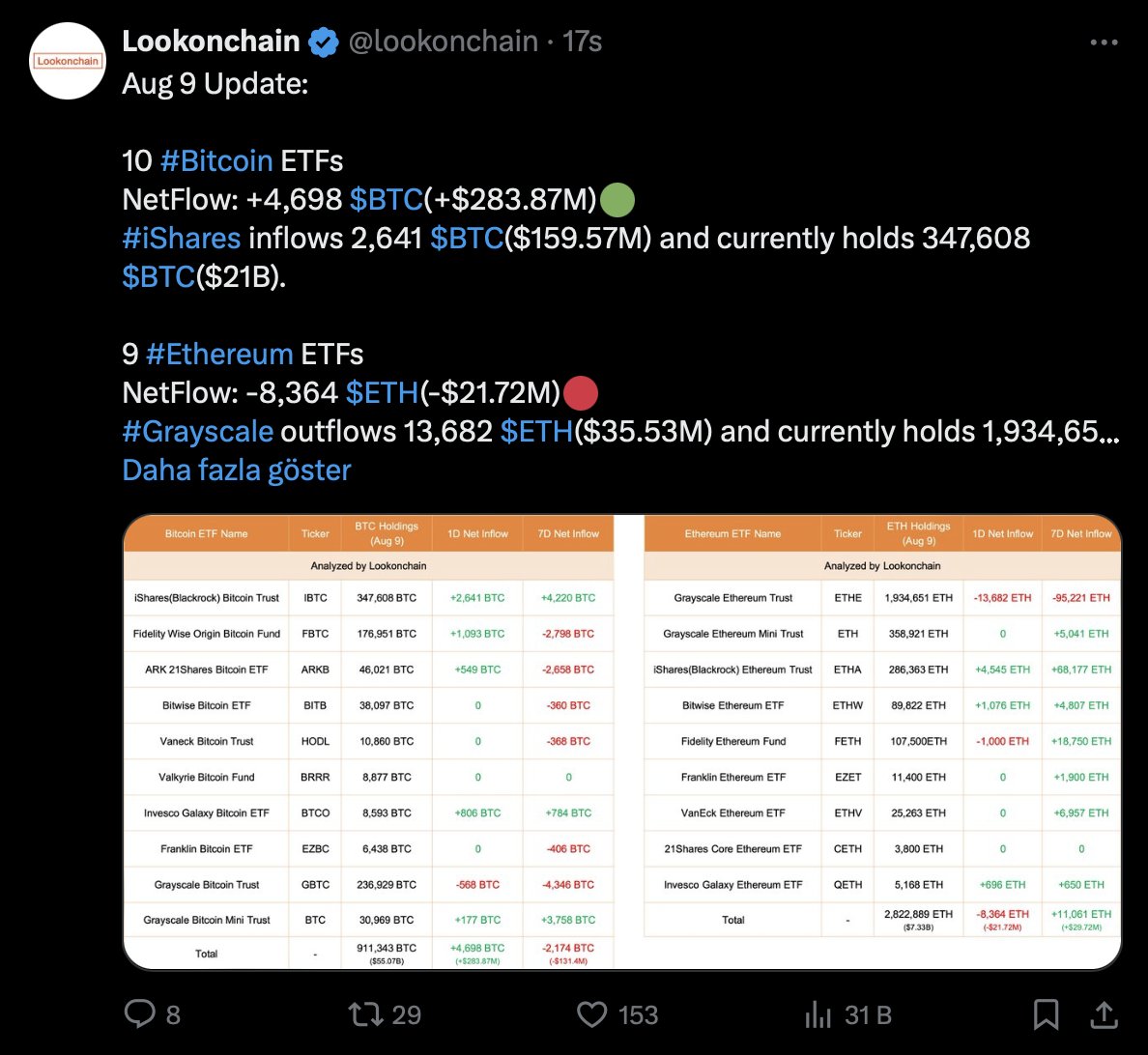

The Middle East, a region usually associated with geopolitical risks, has also been maintaining its stability recently. This stability reduces the likelihood of major disruptions in global oil supply and inflation, providing further support to the market. Moreover, spot Bitcoin ETFs have shown significant growth, with daily purchases now exceeding the amount of new BTC produced. This trend indicates sustained demand for Bitcoin and the potential for its price to rise.

Other Reasons

Additionally, the new management of FTX plans to return $12.7 million in cryptocurrency to pre-bankruptcy users, which stands out as another positive development. The massive return by FTX is expected to add liquidity to the market, potentially boosting sentiment and prices. Furthermore, the Pi Cycle indicator, known for its accuracy in predicting Bitcoin’s price peaks, suggests that the market has not yet reached its peak and that more gains could be on the horizon.

Finally, the increase in global liquidity due to central bank actions and rising money supply supports higher asset prices, including cryptocurrencies. The continued rise in global liquidity is expected to provide more fuel for the rally seen in Bitcoin and altcoins. Additionally, the upcoming US elections could lead to stabilizing measures and crypto-friendly policies, adding another layer of optimism for investors.

Türkçe

Türkçe Español

Español