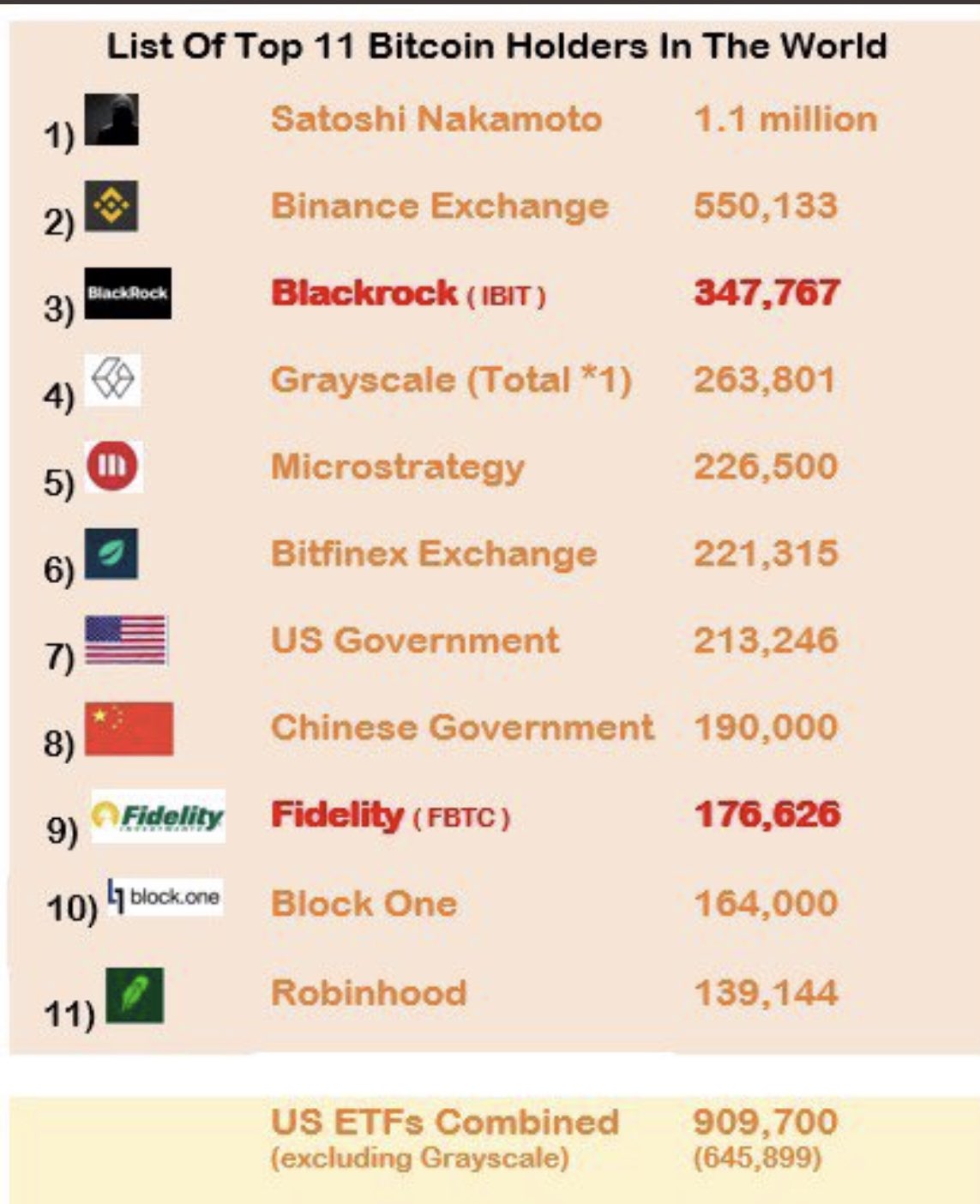

The world’s largest asset management company, BlackRock, achieved significant success with its spot Bitcoin ETF, IBIT, launched this year, and currently holds the largest Bitcoin fund in the market. If this accumulation continues at the same pace, BlackRock’s IBIT fund could surpass the amount of BTC owned by Bitcoin’s mysterious founder, Satoshi Nakamoto, within a year.

ETFs Could Surpass Satoshi Nakamoto Soon

Bloomberg ETF strategist Eric Balchunas shared a list ranking the top ten institutions holding the most Bitcoin worldwide. According to this list, BlackRock’s spot Bitcoin ETF, IBIT, currently ranks third with 347,767 BTC. Ahead of IBIT is the Binance exchange with 550,133 BTC, and in the first place is Satoshi Nakamoto with 1.1 million BTC.

According to Balchunas, if IBIT continues at its current pace, it could become the world’s largest Bitcoin fund by the end of next year. Besides IBIT, other spot Bitcoin ETFs in the US also hold significant accumulations. For example, Fidelity‘s FBTC and Grayscale‘s two funds (BTC and GBTC) are among the institutions holding the most Bitcoin. Balchunas noted that if these funds combine, they could surpass Satoshi Nakamoto’s total BTC holdings by October this year.

Interest in spot Bitcoin ETFs has been fluctuating, with large outflows last week, but this week ETFs recorded over $27 million in inflows on Monday, making a good start. Ark Invest‘s ARKB led with $35.4 million in inflows, while BlackRock’s IBIT followed with $13.4 million. On the other hand, Bitwise‘s BITB experienced a $17.1 million outflow, and Grayscale’s GBTC fund recorded an $11.8 million outflow.

Bitcoin Price Rises Ahead of US Inflation Data

Bitcoin’s price rose by 1.5% to $60,000 ahead of the release of the US Consumer Price Index (CPI) data. July’s inflation data could influence the Fed‘s decision on rate cuts in September. The market is divided on whether there will be a 25 basis points or 50 basis points rate cut in September.

Despite all these fluctuations, crypto funds attracted $176 million in inflows last week, with spot Ethereum ETFs being the main driver of this increase.